PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435802

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435802

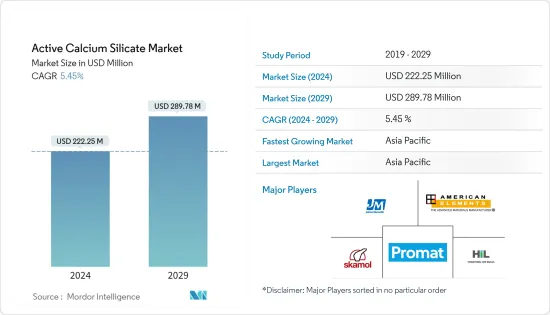

Active Calcium Silicate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Active Calcium Silicate Market size is estimated at USD 222.25 million in 2024, and is expected to reach USD 289.78 million by 2029, growing at a CAGR of 5.45% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- Major factors driving the market studied are growing demand from the construction industry in Asia-Pacific and increasing usage in the ceramic industry.

- On the flip side, stringent regulations about the permissible exposure limit of the product are the major restraints hindering the market's growth.

- Growing demand for sound adsorption and high temperature-resistance applications is expected to offer various lucrative opportunities for market growth.

- By application, the fire protection segment is expected to grow significantly during the forecast period owing to stringent regulations proposed by various governments to use fire protection materials in commercial, residential, and industrial buildings.

- Asia-Pacific dominated the global market with the largest consumption from the countries such as China, India, and ASEAN Countries.

Active Calcium Silicate Market Trends

Growing Demand from Insulation and Fire Protection Segment

- Active calcium silicate is widely used in the building and construction segment owing to its properties which leads the product to be used for adhesion, insulation, intumescence, and fire resistance applications. Growing construction spending to upgrade the quality of residential, commercial, and industrial projects is boosting the demand for the market studied in the sector.

- Active calcium silicate is non-combustible and retains its excellent dimensional stability even in damp and humid conditions. The increasing usage of active calcium silicate in producing wallboard and acoustic tiles can offer excellent sound adsorption properties.

- The government has been emphasizing stringent environmental regulations to prevent fire and reduce the harm caused by fire hazards, improving emergency rescue, safeguarding personal safety and security of property, as well as maintaining public security.

- Building Regulations apply to the construction of new buildings and extensions and material alterations to the buildings. These safety laws on building construction have been followed rapidly in the interior surfaces for protection against fire hazards, leading to enhanced demand for fire protection products such as active calcium silicate.

- According to Global Construction Perspectives and Oxford Economics, the volume of construction output is expected to reach USD 15.5 trillion worldwide by 2030, with three countries - China, the United States, and India leading the way and accounting for 57% of all global growth.

- According to the Mortgage Bankers Association (MBA) forecasts, single-family housing is expected to be 1.210 million in the United States in 2023.

- The United States boasts a colossal construction sector with over 7.6 million employees. According to U.S. Census Bureau, in 2022, the value of construction was USD 1,792.9 billion, a 10.2% increase over the USD 1,626.4 billion spent in 2021.

- Owing to all the factors mentioned above for active calcium silicate, its market is expected to grow rapidly over the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for active calcium silicate during the forecast period. In countries like China and India, owing to the increase in the demand for active calcium silicates from various applications in building & construction, fire protection, cement, and ceramics, the demand for active calcium silicate has been increasing in the region.

- Enactment of rules and regulations about product standards and quality is expected to drive regional growth. Demand for fireproofing cladding products such as active calcium silicate for prevention against smoke, flames, and fire spread should boost market demand.

- The construction sector of Asia-Pacific has been witnessing steady growth, in the recent past, owing to the presence of fast-growing economies, rapid urbanization, and rising infrastructure spending. The increasing presence of foreign companies in the Asia-Pacific region has also created the demand for the construction of new offices, buildings, production houses, etc., thereby driving the growth of the construction sector in the region and consequently stimulating the active calcium silicate market in the region.

- China has already established a set of fire safety regulations, from policy-based regulations about fire prevention and reduction to specific standards related to the requirements for fire safety facilities and monitoring processes. The updated law relating to fire safety is the Code for Fire Protection Design of Buildings (GB50016-2014), which combines the original specification and the Code of Fire Protection Design of tall buildings to increase consistency and compatibility with other standard protocols. Such regulations boost the uptake of active calcium silicate in the region.

- According to the Indian Brand Equity Foundation (IBEF), the Indian real estate industry will likely reach USD 1 trillion by 2030 and contribute approximately 13% to the country's GDP by 2025. This will likely increase the demand for active calcium silicate and propel its market in the region.

- The construction sector in the country is expected to expand at a moderate pace over the next five years, owing to the increasing investments in public and private infrastructure and commercial projects. The GDP shares in 2023 and 2024 are expected to enhance, reaching USD 221.75 billion and USD 225.20 billion, respectively.

- Regarding infrastructure investment in Southeast Asia, Japan remains the undisputed leader, not only to counter Beijing's growing influence in the region but also to serve as an important economic and foreign policy goal. Tokyo is the largest investor in this rapidly developing region, and Japanese financiers are now involved in infrastructure projects.

- Some major companies operating in the Asia-Pacific region are - Promat, 2K Technologies, HIL Limited, and MLA Group of Industries.

- The abovementioned factors and government support contribute to the increasing demand for active calcium silicate during the forecast period.

Active Calcium Silicate Industry Overview

The global active calcium silicate market is fragmented with a few major players dominating a significant portion. Some of the major companies are Promat International (Etex), Skamol Group, American Elements, HIL Limited, and Johns Manville (not in any particular).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Construction Industry in Asia-Pacific

- 4.1.2 Increasing Usage in the Ceramic Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulations Pertaining to Permissible Exposure Limit of the Product

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Insulation

- 5.1.2 Fire Protection

- 5.1.3 Paints & Coatings

- 5.1.4 Ceramics

- 5.1.5 Cement

- 5.1.6 Others

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Elements

- 6.4.2 HIL Limited

- 6.4.3 Johns Manville

- 6.4.4 MLA Group of Industries

- 6.4.5 Promat International (Etex)

- 6.4.6 Ramco Industries Limited

- 6.4.7 Sibelco

- 6.4.8 Skamol Group

- 6.4.9 Weifang Hongyuan Chemical Co., Ltd.

- 6.4.10 Xella Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Sound Adsorption and High Temperature-Resistance Applications

- 7.2 Other Opportunities