PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910937

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910937

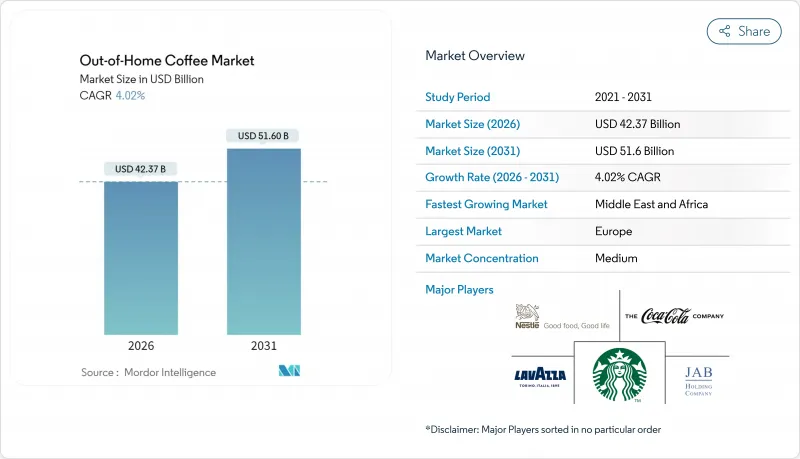

Out-of-Home Coffee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Out-of-Home Coffee market size in 2026 is estimated at USD 42.37 billion, growing from 2025 value of USD 40.73 billion with 2031 projections showing USD 51.6 billion, growing at 4.02% CAGR over 2026-2031.

Younger consumers are increasingly driving demand for specialty coffees, as they seek unique flavors and high-quality offerings. The market continues to experience premiumization, fueled by the rising popularity of single-origin beans, which appeal to consumers looking for authenticity and traceability in their coffee choices. Additionally, there is a growing preference for functional ready-to-drink (RTD) coffee options, which cater to the demand for convenience and health-focused beverages. Operators are actively expanding their presence by establishing suburban drive-thru locations to cater to on-the-go consumers. Europe maintains profitability by combining its deeply ingrained cafe culture with the implementation of strict sustainability regulations, which align with evolving consumer expectations for environmentally responsible practices. In contrast, the Middle East and Africa are experiencing the fastest outlet growth, driven by the resurgence of large-format mall openings, which attract significant foot traffic, and a revival in tourism activities that boost demand for out-of-home coffee experiences.

Global Out-of-Home Coffee Market Trends and Insights

Rising specialty-coffee demand among Millennials and Gen Z

Millennials and Gen Z drive the surging demand for specialty coffee, significantly influencing the Out-of-Home Coffee Market. These demographics prioritize premium coffee experiences, often seeking unique flavors, high-quality beans, and sustainable sourcing. Their preference for artisanal and specialty coffee options has led to increased visits to coffee shops, cafes, and other out-of-home coffee establishments. This trend is further fueled by their willingness to spend on premium beverages, making them a key consumer group driving growth in this market. According to Convenience Org, Gen Z coffee drinkers are just as likely to start with iced coffee as hot coffee, and about 85% of them add creamer, compared to 70% of coffee drinkers overall . This highlights their distinct preferences, which are shaping product offerings and marketing strategies in the out-of-home coffee segment. Additionally, according to the National Coffee Association of the USA, 46% of American adults consumed specialty coffee in 2024 . This statistic underscores the growing popularity of specialty coffee among a broader consumer base, further driving the expansion of the Out-of-Home Coffee Market.

Convenience-led uptake of RTD and cold-brew formats

Health-conscious consumers, especially younger demographics, are increasingly opting for functional ready-to-drink (RTD) products that offer wellness benefits. These consumers prioritize on-the-go convenience without sacrificing quality. Cold-brewed options are emerging as premium alternatives to traditional iced coffee. In response, brands are innovating with sugar-free and organic variants to appeal to health-focused segments. An expanded distribution network, spanning supermarkets, convenience stores, and online platforms, is enhancing product accessibility. Notably, Asia-Pacific markets are witnessing significant growth, driven by evolving dietary preferences and increasing disposable incomes. This shift towards premium RTD products underscores a broader consumer trend: a willingness to pay a premium for convenience and perceived health benefits. This trend presents operators with opportunities to broaden their brand presence beyond just physical locations.

Increased preference for at-home coffee due to cost

Rising costs drive a growing preference for at-home coffee, which acts as a significant restraint on the Out-of-Home Coffee Market. Consumers are increasingly opting to brew coffee at home to save money, especially as economic pressures and inflation impact disposable incomes. This shift in consumer behavior reduces the frequency of visits to coffee shops and other out-of-home coffee establishments, directly affecting market growth. Additionally, advancements in home coffee-making equipment and the availability of premium coffee products for home use further encourage this trend, intensifying the challenge for the Out-of-Home Coffee Market. The affordability and convenience of at-home coffee preparation have become key factors influencing this shift. Many consumers perceive at-home coffee as a cost-effective alternative to the often higher-priced beverages offered by coffee shops. Furthermore, the growing availability of subscription services for coffee beans and pods, along with the increasing popularity of do-it-yourself coffee recipes shared through social media platforms, has made at-home coffee preparation more appealing.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of cafe chains and social cafe culture

- Premiumization with specialty blends and artisanal methods

- Price sensitivity and coffee price inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Regular coffee continues to hold a dominant position in the Out-of-Home Coffee Market, accounting for a substantial 72.68% share in 2025. This strong market presence is largely attributed to entrenched consumer habits that favor traditional coffee choices. The segment benefits from its broad price accessibility, making it a preferred option for a wide range of consumers, particularly in the context of ongoing inflationary pressures. Regular coffee's affordability and familiarity ensure steady demand across diverse demographic groups and geographic regions. Many consumers continue to prioritize value and consistency when selecting their coffee beverages, reinforcing the segment's leadership. Additionally, regular coffee remains a staple offering in many coffee shops, quick-service restaurants, and convenience outlets, further anchoring its market share.

In contrast, gourmet and specialty coffee represents the fastest-growing segment within the market, projected to achieve a CAGR of 4.58% between 2026 and 2031. This growth is primarily driven by younger consumers, including Millennials and Generation Z, who place a strong emphasis on quality, origin transparency, and ethical sourcing practices. These consumer groups are less sensitive to price and more willing to pay a premium for coffee that aligns with their values and lifestyle preferences. The demand for artisanal, single-origin, and sustainably produced coffee has sparked innovation and diversification within this segment. Specialty coffee also benefits from a growing culture of coffee connoisseurship, with consumers seeking unique flavors and brewing techniques.

The Out-Of-Home Coffee Market Report is Segmented by Category (Regular Coffee, Gourmet/Specialty Coffee), Beverage Format (Hot Brewed, Iced/Cold Brew, Ready-To-Drink), Distribution Channel (Coffee-Shop and Cafe Chains, Quick-Service and Fast-Casual Restaurants, and Others), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe continues to maintain its position as the market leader in the market, commanding a substantial 36.88% share in 2025. The region's leadership is deeply rooted in its sophisticated and well-established coffee culture, which has been cultivated over centuries and is integral to daily life across many European countries. European markets benefit from stringent regulatory frameworks that emphasize sustainability and high-quality standards, fostering consumer trust and promoting ethical sourcing practices. These regulations encourage coffee operators to innovate responsibly, focusing on environmentally friendly practices and premium product offerings. Furthermore, the dense network of coffee shops and cafe chains in Europe reinforces consumer loyalty and consistently drives demand in the out-of-home segment.

In contrast, the Middle East and Africa represent the fastest-growing region in the Out-of-Home Coffee Market, with a projected CAGR of 5.12% from 2026 to 2031. This dynamic growth is propelled by rising urban populations, changing lifestyle preferences, and increasing disposable incomes that fuel demand for fashionable and premium coffee experiences. Investments in coffee retail infrastructure and the introduction of international coffee chains are significantly expanding access and awareness in these regions. Moreover, cultural openness toward new lifestyle trends and a youthful demographic are supporting the shift toward coffee consumption outside the home. The growth in this region also reflects a broader economic diversification strategy and increased tourism, further expanding the consumer base for out-of-home coffee products.

Meanwhile, the Asia-Pacific region exhibits the most dynamic and complex growth patterns in the out-of-home coffee space. Countries such as China, Japan, and South Korea are witnessing burgeoning coffee scenes, characterized by a mix of modern cafe formats and traditional beverage variations. North America also remains a significant player, with a strong coffee culture that continues to evolve through innovation in ready-to-drink (RTD) beverages and specialty coffee formats. The competitive but mature North American market is driven by both established chains and artisanal coffee shops innovating to cater to increasingly sophisticated consumer palates.

- Starbucks Corporation

- JAB Holding Company Sarl

- Nestle S.A.

- The Coca-Cola Company (Costa Coffee)

- Luigi Lavazza S.p.A.

- The Kraft Heinz Company

- The J.M. Smucker Company

- Dunkin' Brands

- Tchibo GmbH

- Gruppo illy SpA

- Tim Hortons (RBI)

- Peet's Coffee

- Dutch Bros Coffee

- Caribou Coffee Company

- 7 Brew Coffee

- Pret A Manger

- Luckin Coffee

- Blue Tokai Coffee Roasters

- Baronet Coffee Inc.

- Compass Group (OCS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising specialty-coffee demand among Millennials and Gen Z

- 4.2.2 Convenience-led uptake of RTD and cold-brew formats

- 4.2.3 Expansion of cafe chains and social cafe culture

- 4.2.4 AI-driven beverage personalisation lifting average ticket size

- 4.2.5 Premiumization with specialty blends and artisanal methods

- 4.2.6 Drive-thru micro-formats boosting suburban throughput

- 4.3 Market Restraints

- 4.3.1 Increased preference for at-home coffee due to cost

- 4.3.2 Price sensitivity and coffee price inflation

- 4.3.3 Supply chain disruptions affecting quality and availability

- 4.3.4 Rising operational and labor costs for cafes

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Category

- 5.1.1 Regular Coffee

- 5.1.2 Gourmet / Specialty Coffee

- 5.2 By Beverage Format

- 5.2.1 Hot Brewed

- 5.2.2 Iced / Cold Brew

- 5.2.3 Ready-to-Drink (RTD)

- 5.3 By Distribution Channel

- 5.3.1 Coffee-shop and Cafe Chains

- 5.3.2 Quick-Service and Fast-Casual Restaurants

- 5.3.3 Hotels, Restaurants and Catering

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Russia

- 5.4.2.8 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Turkey

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Starbucks Corporation

- 6.4.2 JAB Holding Company Sarl

- 6.4.3 Nestle S.A.

- 6.4.4 The Coca-Cola Company (Costa Coffee)

- 6.4.5 Luigi Lavazza S.p.A.

- 6.4.6 The Kraft Heinz Company

- 6.4.7 The J.M. Smucker Company

- 6.4.8 Dunkin' Brands

- 6.4.9 Tchibo GmbH

- 6.4.10 Gruppo illy SpA

- 6.4.11 Tim Hortons (RBI)

- 6.4.12 Peet's Coffee

- 6.4.13 Dutch Bros Coffee

- 6.4.14 Caribou Coffee Company

- 6.4.15 7 Brew Coffee

- 6.4.16 Pret A Manger

- 6.4.17 Luckin Coffee

- 6.4.18 Blue Tokai Coffee Roasters

- 6.4.19 Baronet Coffee Inc.

- 6.4.20 Compass Group (OCS)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK