PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640334

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640334

North America Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

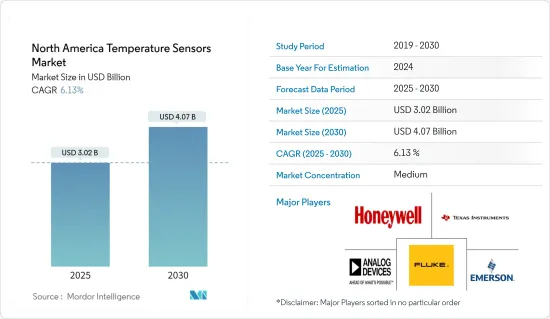

The North America Temperature Sensors Market size is estimated at USD 3.02 billion in 2025, and is expected to reach USD 4.07 billion by 2030, at a CAGR of 6.13% during the forecast period (2025-2030).

The temperature sensor measures the temperature of its environment and converts the input data into electronic data to record monitor or signal temperature changes. Adopting such process and monitoring automation in industrial and defense operations is the major driver augmenting the demand for wireless sensors in asset monitoring, security, and quality assurance.

Key Highlights

- Industries, such as aerospace, oil and gas, and mining, among others, are characterized by the harsh and complex operating environment and the adoption of a suitable sensor to withstand such external environment extremities and performing at the desired accuracy, reliability, precision, and repeatability are of crucial importance for these end-users.

- Rapid technological advancements in temperature monitoring have played a crucial role in the growth of wireless temperature sensors in the past few years. Multiple large-scale manufacturers have been focusing on implementing advanced concepts such as IR sensors and heat sensors. The usage of advanced concepts is further expected to open up significant potential for the market's growth in the coming years.

- With the increase in defense expenditure, wireless type sensors have been an emerging technology area with multiple applications within the defense industry. Applications such as integrated vehicle health monitoring (IVHM) of the defense and aerospace vehicles are primarily needed to ensure the crew's safety and the vehicle.

- At their essence, the sensor networks have been monitoring the physical characteristics of an environment and then translating those physical measurements to electrical impulses. The sensor networks primarily measure characteristics such as temperature, among others. In various cases, the network has been designed to not only sense the environment but also act on the physical environment based on the sensed data.

- Temperature sensors are employing IoT connectivity to speed COVID-19 screening. The market demand for screening process equipment has enabled the demand for temperature sensors where various firms' collaboration to invent new temperature sensor devices has raised significantly. For instance, Polysense Technologies and Semtech have joined forces in developing a series of human body temperature monitoring devices based on Semtech's Long Range (LoRa) Low-Power Wide-Area Network (LPWAN). The sensors offer real-time data to frontline healthcare workers and quickly screen individuals with high temperatures, one of the most common symptoms of COVID-19.

North America Temperature Sensors Market Trends

Infrared Temperature Sensors to Drive the Market Growth

- IR temperature sensor applications are found in various defense applications such as optical target sighting and variable emissivity measurements that are often helpful in tracking activities. However, all these applications are very advanced and have a continuous demand due to the globally increasing military spending.

- In recent years, even the top snack manufacturers like Frito-Lay North America, Inc, a popular division of Pepsi Co, have started a new range of products rather baked than fried. Such trends, coupled with stringent food safety regulations worldwide, are expected soon to create substantial market opportunities for IR temperature sensors.

- Forward-Looking Infrared (FLIR) has been a prominent vendor for such technology. FLIR technology has been used in ports and borders and airports, and other places to look for elevated body temperatures. The company has witnessed a significant increase in those orders in the past month.

- The list of countries using FLIR products for temperature screening continues to grow. It now includes China, Thailand, Taiwan, the Philippines, Singapore, Malaysia, South Korea, Italy, and the U.S. The company stated that its supply chain is continuing to keep up with demand.

- Predictive maintenance is one of the functional uses of Infrared (IR) temperature sensors in the market; enterprises are increasingly focusing on predictive maintenance, automation, and IoT.

United States Holds Significant Market Share

- The United States holds a significant market share due to advancements across various industries in the country. With the R & D of multiple types of temperature sensors being integrated into different products, the market for temperature sensors is set to grow at a healthy rate.

- For instance, automakers, such as General Motors, have planned to launch 20 new all-electric vehicles by 2023. The Tesla Company also changed the face of the EV market segment in the country by introducing reliable and efficient electric vehicles.

- The United States's automotive industry, directly and indirectly, employs hundreds of thousands of Americans and invest billions of dollars. It was estimated that the automotive industry annually spends nearly USD 105 billion on R&D worldwide, USD 18 billion of which is spent in the United States to incorporate newer and more advanced sensors into automobiles.

- With the US Department of the Interior planning to allow offshore exploratory drilling in about 90% of the Outer Continental Shelf (OCS) acreage, under the National Outer Continental Shelf Oil and Gas Leasing Program (National OCS Program) for 2019-2024, the oil and gas sector in the region is expected to open up new opportunities to the market.

- In the COVID-19 pandemic, the market is witnessing growing demand for temperature sensors at the workplace for temperature screening. For instance, the CDC (Centers for Disease Control and Prevention) in the United States and WHO (World Health Organization) recommended temperature checking at the workplace.

North America Temperature Sensors Industry Overview

The North America temperature sensor market is moderately fragmented due to many players operating in the market, such as Honeywell, Analog Devices Inc, and Texas Instruments, among other regional and local manufacturers. Continuous product up-gradation and industry convergence are driving the market towards highly differentiated offerings. Further, players adopt strategic initiatives such as mergers and acquisitions, partnerships, etc., to strengthen their market presence. Some of the recent developments in the market are:

- July 2020 - Maxim Integrated Products Inc. and Analog Devices Inc. announced that they entered into a definitive agreement. Analog Devices Inc. will acquire Maxim in an all-stock transaction that values the combined enterprise at over USD 68 billion. The transaction is expected to close in the summer of 2021. This transaction would strengthen Analog Devices Inc. and increase its reach and scale across multiple markets.

- May 2021 - Honeywell installed advanced skin temperature screening systems (Honeywell Thermo Rebellion) in Terminal One of New York's John F. Kennedy International Airport for passengers and employees

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth in Industry 4.0 & Rapid Factory Automation

- 4.3.2 Increasing Adoption of Wireless Technologies, especially in Harsh Environments

- 4.4 Market Restraints

- 4.4.1 Higher Security Needs and Infrastructure Updating Costs

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 ELECTRIC VEHICLE SENSOR MARKET

- 5.1 Market Estimation for xEV Sensors

- 5.2 Trends and Dynamics Impacting the Adoption of Sensors in EV

- 5.3 Breakdown of the Market Estimates by Two Broader Classes of EV

- 5.4 Major Sensor Categories used in EV with Key Applications

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By Technology

- 6.2.1 Infrared

- 6.2.2 Thermocouple

- 6.2.3 Resistance Temperature Detector

- 6.2.4 Thermistor

- 6.2.5 Temperature Transmitter

- 6.2.6 Fiber Optic

- 6.2.7 Others

- 6.3 By End-user Industry

- 6.3.1 Chemical & Petrochemical

- 6.3.2 Oil and Gas

- 6.3.3 Metal and Mining

- 6.3.4 Power Generation

- 6.3.5 Food and Beverage

- 6.3.6 Automotive

- 6.3.7 Medical

- 6.3.8 Aerospace and Military

- 6.3.9 Consumer Electronics

- 6.3.10 Other End-user Industries

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Texas Instruments Incorporated

- 7.1.3 Honeywell International Inc.

- 7.1.4 Analog Devices Inc.

- 7.1.5 Fluke Process Instruments

- 7.1.6 Emerson Electric Company

- 7.1.7 Microchip Technology Incorporated

- 7.1.8 Sensata Technologies

- 7.1.9 FLIR Systems

- 7.1.10 Maxim Integrated Products

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET