PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644453

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644453

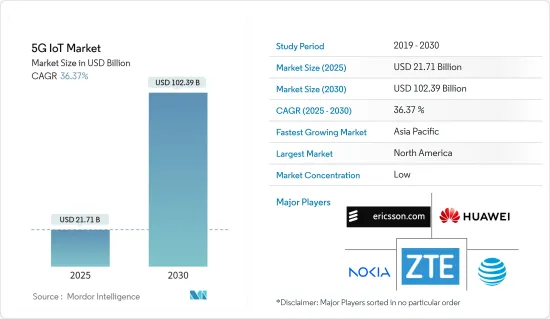

5G IoT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The 5G IoT Market size is estimated at USD 21.71 billion in 2025, and is expected to reach USD 102.39 billion by 2030, at a CAGR of 36.37% during the forecast period (2025-2030).

The 5G IoT market is poised to revolutionize how connected devices interact across various industries, leveraging the high-speed, low-latency capabilities of 5G networks. This technology enables a new level of connectivity for the Internet of Things (IoT), facilitating seamless communication between millions of devices. The integration of 5G into IoT networks is driving significant advancements in industries such as manufacturing, healthcare, and smart cities, where real-time data exchange and ultra-reliable communications are crucial.

Key Highlights

- With 5G IoT technology, industries are witnessing an evolution in how data is collected, analyzed, and utilized, leading to enhanced operational efficiencies and the creation of innovative solutions. The market's growth is underpinned by the advantages 5G offers over existing LTE networks, including reduced latency, higher data throughput, and the capacity to connect a vast number of IoT devices simultaneously. However, the transition to 5G also comes with challenges, particularly the need for substantial infrastructure upgrades and the ongoing relevance of 4G LTE for certain IoT use cases.

Enhanced Connectivity: A Game-Changer for IoT Networks

Key Highlights

- Unprecedented Device Handling Capabilities: The ability of 5G IoT technology to support a massive number of IoT devices is one of its most significant strengths. In industries like smart cities and manufacturing, the sheer volume of connected devices necessitates a network that can manage and maintain reliable connections across all devices. 5G IoT networks excel in this aspect, enabling real-time data exchange that is essential for automated processes, smart infrastructure, and large-scale IoT ecosystems. This capability significantly enhances industry operations, driving greater efficiency and opening new avenues for IoT applications that were previously unattainable with older network technologies.

- Low Latency and Critical Application Support: The low latency provided by 5G IoT networks is pivotal for applications requiring instantaneous data transmission. In healthcare, for example, 5G IoT devices facilitate real-time monitoring and remote surgeries, where any delay could be critical. Similarly, in the automotive industry, 5G supports the development of autonomous vehicles, where split-second decisions are necessary for safety. These critical applications highlight the transformative impact of 5G IoT solutions, as they enable new use cases that demand ultra-reliable and low-latency communication, which 4G LTE cannot adequately support.

Infrastructure Challenges: Balancing Cost and Innovation

Key Highlights

- Existing 4G LTE Sufficiency for Certain Use Cases: While 5G IoT technology offers significant benefits, there are scenarios where existing 4G LTE networks are still sufficient, particularly for less demanding IoT applications. Some industries may find that the current 4G infrastructure meets their needs without requiring the expensive transition to 5G. This is especially true for use cases where low bandwidth and lower device density are acceptable, such as in basic monitoring systems or non-critical data collection scenarios. The sufficiency of 4G LTE in these contexts can slow the adoption of 5G, as companies weigh the costs and benefits of upgrading.

- High Costs of Infrastructure Upgrades: The transition from LTE to 5G involves considerable investment, particularly in upgrading the existing infrastructure. The costs associated with deploying 5G networks, including the installation of new antennas, network configurations, and the procurement of 5G-enabled devices, are substantial. This financial burden can be a significant barrier for industries looking to adopt 5G IoT solutions, especially in regions where 4G infrastructure is still relatively new. Companies must balance the long-term benefits of 5G IoT adoption with the immediate financial outlay, which may delay widespread implementation.

The 5G IoT market is at a critical juncture where the potential for groundbreaking advancements is tempered by the practical challenges of infrastructure development and cost considerations. As industries continue to explore the full capabilities of 5G IoT networks, the balance between innovation and cost will play a crucial role in shaping the market's future trajectory.

5G Internet of Things (IoT) Market Trends

Automotive Industry is Expected to Witness Significant Growth Rate

- Rapid Evolution of Connected Vehicles: The automotive industry is undergoing a major transformation, driven by the integration of 5G IoT technology. With ultra-low latency and high-speed data transfer, 5G IoT is crucial for enabling advanced features like vehicle-to-everything (V2X) communication, autonomous driving, and real-time data processing. This technological shift is expected to significantly boost market growth as automakers leverage 5G IoT networks to enhance vehicle safety, efficiency, and overall user experience.

- Expansion of the 5G IoT Ecosystem: The 5G IoT ecosystem within the automotive sector is rapidly expanding, with new use cases such as remote diagnostics, predictive maintenance, and enhanced in-car entertainment systems. These innovations not only improve driving experiences but also offer new revenue streams for manufacturers and service providers. As connected vehicles become more prevalent, the automotive industry is set to be a key driver of growth within the 5G IoT market, significantly contributing to its overall market size.

- Investment Surge in 5G IoT Infrastructure: Major players in the automotive industry are making significant investments in 5G IoT infrastructure to capitalize on emerging opportunities. These investments are aimed at supporting the development of autonomous vehicles, which require reliable, real-time communication with other connected devices. As a result, the automotive segment is expected to experience a compound annual growth rate (CAGR) that outpaces other sectors within the 5G IoT market, further fueled by smart city initiatives and the growing demand for connected vehicle solutions.

- Autonomous Driving and Market Predictions: The ongoing advancements in autonomous driving technology, supported by 5G IoT, are expected to reshape the automotive landscape. Industry reports indicate that the automotive segment will witness robust growth, driven by the integration of 5G IoT solutions in smart cities. Connected vehicles will interact with smart infrastructure to optimize traffic flow, reduce emissions, and enhance public safety, positioning the automotive industry as a major contributor to the overall growth of the 5G IoT market.

North America is Expected to Hold Significant Market Share

- Early Adoption and Market Leadership: North America is poised to maintain its dominant position in the global 5G IoT market, thanks to its early adoption of 5G technology and substantial investments in IoT infrastructure. The region's strong technological foundation and presence of leading market players have established it as a critical player in the global 5G IoT ecosystem. This leadership is expected to continue, supported by favorable regulatory environments and ongoing advancements in 5G IoT solutions.

- Widespread Implementation Across Industries: The rapid deployment of 5G IoT applications across various sectors, including healthcare, manufacturing, and logistics, is a key factor driving North America's market dominance. These industries are utilizing 5G IoT technology to enhance operational efficiency, reduce costs, and improve service delivery. For example, in healthcare, 5G IoT enables remote patient monitoring, telemedicine, and smart medical devices, which are essential for improving patient outcomes and easing the burden on healthcare systems.

- Focus on Cybersecurity and Data Privacy: North America's strong emphasis on cybersecurity and data privacy is driving the adoption of secure 5G IoT networks. Ensuring the protection of connected devices and networks from potential threats is crucial for building consumer and business trust in 5G IoT technology. This focus on security is a key factor in sustaining North America's leadership in the global market, as the region continues to expand its 5G IoT ecosystem while prioritizing data protection.

- Continuous Growth and Innovation: Market forecast data suggests that North America's 5G IoT market will continue to grow, driven by technological advancements and increasing investments in research and development. The region's commitment to innovation is evident in various industry research initiatives and partnerships aimed at exploring new 5G IoT use cases. As a result, North America's market outlook remains positive, with the region expected to maintain a substantial share of the global 5G IoT industry in the coming years, further solidifying its position as a market leader.

5G Internet of Things (IoT) Industry Overview

Highly Fragmented Market: The 5G IoT market is characterized by a high level of fragmentation, with a diverse array of global and regional players competing for market share. The market is driven by both large conglomerates and specialized companies, each bringing unique strengths and technologies to the table. This fragmentation suggests a competitive environment where no single company dominates, allowing multiple players to coexist and innovate across different sectors. The 5G IoT market's fragmented nature fosters a dynamic ecosystem, with opportunities for both established and emerging companies to succeed.

Major Players Include Global Telecom Giants: In the 5G IoT market, leading companies include Nokia Corporation, AT&T Inc., Huawei Technologies Co Ltd, Telefonaktiebolaget LM Ericsson, and ZTE Corporation. These companies are recognized for their extensive experience in telecommunications and their ability to leverage existing infrastructure to support 5G IoT applications. Their global reach, technological expertise, and strong financial backing provide them with significant advantages in the market. These companies are often involved in strategic partnerships, mergers, and acquisitions to expand their market presence and enhance their IoT solutions.

Key Factors for Future Success: For companies in the 5G IoT market, success will depend on their ability to innovate, form strategic alliances, and maintain strong network infrastructure. The rapid evolution of 5G technology and IoT applications requires companies to continuously adapt and improve their offerings. Factors such as network security, scalability, and interoperability will be critical in differentiating successful players from their competitors. Additionally, companies that can offer integrated solutions and services across various industries, such as healthcare, automotive, and smart cities, will be well-positioned for long-term success.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Ability of 5G Technology to Handle Millions of IoT Connected Devices

- 5.1.2 Advantages of 5G over LTE for Low Latency and Critical Applications

- 5.2 Market Restraints

- 5.2.1 Existing 4G LTE Technology is Sufficient for Certain IoT Use Cases

- 5.2.2 Costs Involved in the up-gradation of the Infrastructure from LTE to 5G

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Ultra-Reliable Low-Latency Communications (URLLC)

- 6.1.2 Low-Power Wide-Area Network (LPWAN)

- 6.2 By End-User Industry

- 6.2.1 Manufacturing

- 6.2.2 Supply Chain

- 6.2.3 Healthcare

- 6.2.4 Retail

- 6.2.5 Smart Cities

- 6.2.6 Automotive

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Russia

- 6.3.2.5 Spain

- 6.3.3 Asia

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 South America

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.6 Middle East and Africa

- 6.3.6.1 United Arab Emirates

- 6.3.6.2 Saudi Arabia

- 6.3.6.3 Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 AT&T Inc.

- 7.1.3 Huawei Technologies Co Ltd

- 7.1.4 Telefonaktiebolaget LM Ericsson

- 7.1.5 ZTE Corporation

- 7.1.6 Cisco Systems Inc

- 7.1.7 Deutsche Telekom AG (T-Mobile)

- 7.1.8 Verizon Communication Inc

- 7.1.9 Sprint Corp

- 7.1.10 Vodafone Group PLC

8 MARKET OPPORTUNITIES AND FUTURE TRENDS