Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437245

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437245

North America Automotive Engine Oils - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2021 - 2026)

PUBLISHED:

PAGES: 80 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

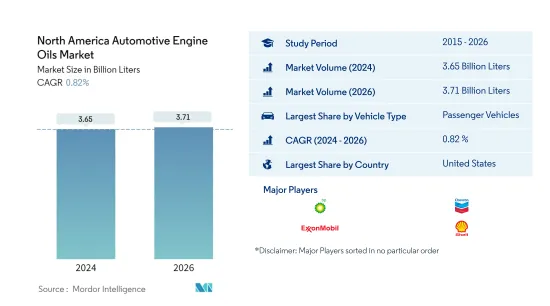

The North America Automotive Engine Oils Market size is estimated at 3.65 Billion Liters in 2024, and is expected to reach 3.71 Billion Liters by 2026, growing at a CAGR of 0.82% during the forecast period (2024-2026).

Key Highlights

- Largest Segment by Vehicle Type - Passenger Vehicles : The large proportion of the passenger vehicle population in North America is attributed to the highest engine oil consumption in the passenger vehicle sector in the region.

- Fastest Segment by Vehicle Type - Passenger Vehicles : As the social distancing measures are slowly being relaxed, the usage of cars, along with their preventive maintenance requirements, is likely to grow significantly.

- Largest Country Market - United States : The United States is one of the largest automotive markets in the world and a leading automotive engine oil consumer in North America, owing to the highest vehicle population.

- Fastest Growing Country Market - United States : The recovering usage of large vehicle fleets and the growing production output for the domestic and export markets are anticipated to boost lubricant consumption.

North America Automotive Engine Oils Market Trends

Largest Segment By Vehicle Type : Passenger Vehicles

- During 2015-2020, North America recorded a fluctuating trend in the consumption of engine oils, thus registering a negative CAGR of 3.65%.

- A majority of engine oils used in the region meet the latest standards set by the International Lubricant Specification Advisory Committee (ILSAC) and the American Petroleum Institute (API). Although these synthetic grades have higher profit margins per gallon, they also support higher drain intervals. Hence, the higher penetration of synthetic engine oils restrained the product's volume growth during 2015-2020.

- Post the COVID-19 outbreak, the engine oil change requirements of vehicles further declined. As the usage of the existing automotive fleet is gradually rising, the engine oil volume consumption is likely to recover at a rate of 2.19% during the forecast period.

Largest Country : United States

- During 2015-2020, North America recorded a fluctuating trend in the consumption of engine oils, thus registering a negative CAGR of 3.65%.

- A majority of engine oils used in the region meet the latest standards set by the International Lubricant Specification Advisory Committee (ILSAC) and the American Petroleum Institute (API). Although these synthetic grades have higher profit margins per gallon, they also support higher drain intervals. Hence, the higher penetration of synthetic engine oils restrained engine oils' volume growth during 2015-2020.

- Post the COVID-19 outbreak, the engine oil change requirements of vehicles further declined. As the usage of the existing automotive fleet is gradually rising, engine oil consumption volume is likely to recover at a rate of 2.19% during the forecast period.

North America Automotive Engine Oils Industry Overview

The North America Automotive Engine Oils Market is fairly consolidated, with the top five companies occupying 67.64%. The major players in this market are BP PLC (Castrol), Chevron Corporation, ExxonMobil Corporation, Royal Dutch Shell Plc and Valvoline Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90006

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 Key Industry Trends

- 3.1 Automotive Industry Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 Market Segmentation

- 4.1 By Vehicle Type

- 4.1.1 Commercial Vehicles

- 4.1.2 Motorcycles

- 4.1.3 Passenger Vehicles

- 4.2 By Product Grade

- 4.3 By Country

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.3.4 Rest of North America

5 Competitive Landscape

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Profiles

- 5.3.1 AMSOIL Inc.

- 5.3.2 BP PLC (Castrol)

- 5.3.3 Chevron Corporation

- 5.3.4 ExxonMobil Corporation

- 5.3.5 HollyFrontier (PetroCanada lubricants)

- 5.3.6 Motul

- 5.3.7 Phillips 66 Lubricants

- 5.3.8 Royal Dutch Shell Plc

- 5.3.9 TotalEnergies

- 5.3.10 Valvoline Inc.

6 Appendix

- 6.1 Appendix-1 References

- 6.2 Appendix-2 List of Tables & Figures

7 Key Strategic Questions for Lubricants CEOs

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.