PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1436043

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1436043

Latin America Washing Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

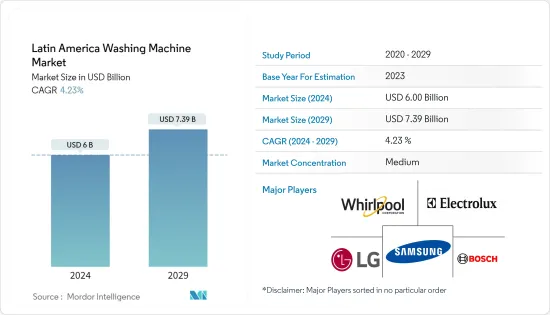

The Latin America Washing Machine Market size is estimated at USD 6 billion in 2024, and is expected to reach USD 7.39 billion by 2029, growing at a CAGR of 4.23% during the forecast period (2024-2029).

The lockdown made the economy handicapped with the shutters closed and affected many's livelihoods. The manufacturing units had already suffered a huge loss. With it, the livelihood of those associated with the industry was also at stake. COVID-19 disrupted the global supply chain of the major brands of the washing machine market. China is one of the largest consumers and producers of washing machine products. It also caters to a wide range of countries by exporting several input supplies to produce finished goods. Production shutdown in China forced other washing machine manufacturers based in the Americas to temporarily hold the production of the finished goods. It leads to an increase in the supply and demand gap and the product market.

Despite being dominated by large countries such as Brazil, the Latin American region includes countries with significant differences. Growth in the washing machine market is driven by the increased disposable household income, with demand clustered on washing machines. The growth in Latin America's middle-class population will further drive growth and bring home appliance market opportunities. However, the low saving ratio in the country may bring some challenges to the market's growth. Home appliance consumption in Argentina is affected by economic situations. Before the covid pandemic, the peso was devalued, increasing prices in the country. To overcome this effect, the government launched a program for its citizens to purchase goods on credit cards with drop-in interest rates by 20 basis points.

Latin America Washing Machine Market Trends

Increasing Online sales for Washing Machines

Departmental Stores dominate large appliance sales in the market. E-commerce channels are leading market sales. Consumers are growing in preference for online channels and are interestingly using credit cards, debit cards, and internet banking to shop for laundry appliances. Players are developing virtual wallets so consumers can pay and put the amount in the safe and secure environment of the company's wallet. Smartphones are becoming an increasing choice for consumers. 58% of consumers are choosing online sales due to security in the purchase process, 54% because of diversity in payment methods, and 35% due to logistic speed. Due to reduced costs, online sales channels for laundry appliances are also getting consumers to buy through them. Mercado Libre is one of the most preferred online shopping channels for buying appliances in Latin America as it offers more security to consumers.

Brazil Signifying the Strongest Washing Machine Market in Latin America Region

Growth in Brazil's economy spurred the demand in the market. Cutting off credit rates led to higher appliance sales, including laundry appliances. Automatic Washing Machines are gaining traction in Brazil's laundry appliance market. Due to space constraints in major cities and hectic lifestyles, consumers in the market are seeking more convenient products that save time. Smaller-sized automatic washing machines are the preferred choice for consumers in the market. Due to the dense population, consumers also prefer large-capacity washing machines in the market.

Latin America Washing Machine Industry Overview

The report covers major international players operating in the Latin America Washing Machine Market. In terms of market share, few of the major players currently dominate the market. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping into new markets. The leading brands are opening exclusive stores for special products. The companies are also promoting, differentiating, and selling limited editions to increase their visibility and brand awareness in the market. Whirlpool Corporation, Electrolux, Samsung, Bosch, and LG are the key major players in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Insights on Various Regulatory Trends Shaping the Market

- 4.5 Insights on impact of technology in the Market

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Front Load

- 5.1.2 Top Load

- 5.2 By Technology

- 5.2.1 Fully Automatic

- 5.2.2 Semi-Automatic

- 5.3 By Distribution Channel

- 5.3.1 Multi-brand Stores

- 5.3.2 Specialty Stores

- 5.3.3 Online

- 5.3.4 Other Distribution Channels

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Columbia

- 5.4.4 Rest of Latine America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.2 Bosch

- 6.2.3 Electrolux AB

- 6.2.4 LG Electronics

- 6.2.5 Samsung Electronics

- 6.2.6 Miele

- 6.2.7 AEG

- 6.2.8 Group SEB

- 6.2.9 Mabe

- 6.2.10 Panasonic Corporation*

7 MARKET OPPORTUNTIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US