PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690883

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690883

Zero-emission Aircraft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

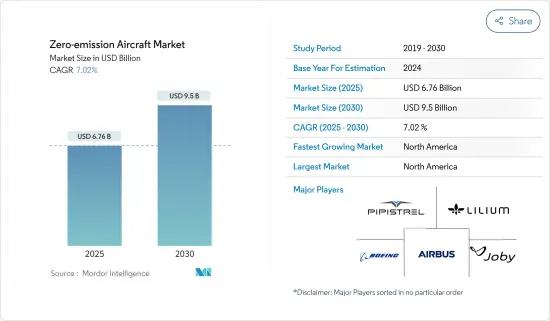

The Zero-emission Aircraft Market size is estimated at USD 6.76 billion in 2025, and is expected to reach USD 9.50 billion by 2030, at a CAGR of 7.02% during the forecast period (2025-2030).

The outbreak of the COVID-19 pandemic disrupted the commercial and general aviation market due to travel restrictions. It also had an impact on the economy and resulted in several aerospace companies to pause funds towards innovative projects. Such decisions have temporarily impacted the growth of the zero-emission aircraft market. However, as aircraft operators looking to reduce their operational costs and carbon emission, there will be significant growth in investment, testing, and adoption of all-electric aircraft during the forecast period.

Increasing stringency on the emission regulations has made manufacturers shift towards zero-emission concept. Engine manufacturers will play a vital role for the aviation industry to move towards the new concept. Sustainable aviation fuel (SAF) is also an important part of the aviation roadmap to reduce the industry's CO2 emissions as companies like Airbus and Boeing are targeting flights on 100% SAF.

Beyond technology challenges, the aviation industry's transition will require the regulatory and infrastructure ecosystems to change. Cross-industry collaboration will be required to drive down infrastructure and production costs, which will be mutually beneficial and help speed up development of the zero-emission aircraft.

Electric aircraft has penetrated the general aviation market. However, its adoption in long-haul commercial aviation is still far away from becoming reality soon with major developments expected in the later half of the forecast period.

Zero-Emission Aircraft Market Trends

Evolving Emissions Regulations Driving the Pace of Development

In 2015, the US Environmental Protection Agency (EPA) found that the greenhouse gas emissions from certain classes of engines used in aircraft contribute to air pollution and endanger public health and welfare. In 2016, the ICAO finalized a global emissions-reduction scheme applicable to passenger and cargo flights in the member countries of the UN. It was decided that the global aviation emission in 2020 will be used as a benchmark, and around 80% of the emission levels in 2020 will be offset by the airlines until 2035.

Such a landmark decision paved the way for the development of electric aircraft as manufacturers sought to resort to sustainable ways of reducing carbon footprint. The market players started investing in electric aircraft technologies and have already been successful in the form of successful prototypes and commercialization of light aircraft.

With new technology coming into the foray, regulations are being framed to improve their commercial feasibility. Regulations, such as CS-23, reestablish the objectives and design independent requirements of an aircraft. This has opened various avenues of opportunities in the development of all-electric and hybrid propulsion. The focus has shifted from fulfilling design requirements to improving consumer safety and automation in aircraft. This has enabled the designers to focus on redesigning the total aircraft from scratch and make necessary modifications that were otherwise impossible due to design restrictions.

North America and Europe will Dominate the Market During the Forecast Period

North America and Europe have a matured aviation market. Several aerospace companies are in these regions due to their proximity to major aircraft OEMs. The presence of aerospace giants like NASA, Airbus, Boeing, and Rolls Royce among others will support the growth of the zero-emission aircraft market. Over 90% of the companies currently working on the zero-emission concept are based in the US and Europe. In September 2020, Airbus revealed three concepts for zero-emission commercial aircraft which could enter service by 2035. All of these concepts rely on hydrogen as a primary power source. Rolls-Royce recently announced its plan to invest £80 million in energy storage systems over the next decade. The company is developing energy storage systems (ESS) that will enable aircraft to undertake zero-emission flights of over 100 miles on a single charge. Aerospace-certified ESS solutions from Rolls-Royce will power electric and hybrid-electric propulsion systems for eVTOLs (electric vertical takeoff and landing) in the urban air mobility market and fixed-wing aircraft, with up to 19 seats, in the commuter market. Earlier in December 2020, Hydrogen-electric aircraft developer ZeroAvia secured USD 21.4 million of backing from a raft of major investors, including Amazon and Shell, as the company completed its first fundraising round in support of plans to run its first commercial zero emission planes from 2023. The company has also partnered with British Airways to explore the development of zero emission aircraft for use in the airline's fleet. It also received approval of USD 16.3 million of U.K. government funding via the Aerospace Technology Institute (ARI). Such developments are anticipated to drive the market growth in the North America and Europe region during the forecast period.

Zero-Emission Aircraft Industry Overview

The market is rapidly becoming fragmented as several new companies are venturing into this market. Start-ups are designing prototypes and are at various stages of aircraft development. These companies are dependent on series funding from major aerospace companies and investment firms. Several new collaborations have been observed in the recent past as companies look to expand capabilities, efficiency, and propel the development cycle. For instance, Rolls Royce has recently partnered with aerospace manufacturer Tecnam and Scandinavia's largest regional airline, Wideroe, to produce a new battery-powered aircraft. The partners aim to launch an all-electric passenger aircraft for commuters in Norway by 2026, building on previous work by Rolls Royce and Tecnam on an all-electric aircraft called the P-Volt. This partnership demonstrates Rolls-Royce's ambitions to be the leading supplier of all-electric and hybrid-electric propulsion and power systems across multiple aviation markets. Several other aerospace manufacturers have plans for battery-powered aircraft, including Airbus with the CityAirbus and Boeing's eVTOL. Most are short-range aircraft designed to ferry people between cities or from airports to city centers. Some of the other prominent players in the market are PIPISTREL d.o.o., Bye Aerospace, Aurora Flight Sciences, Eviation, Joby Aviation, NASA, Lilium GmbH, and ZeroAvia, Inc. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 Application

- 5.1.1 Commercial and General Aviation

- 5.1.2 Military Aviation

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Bye Aerospace

- 6.1.2 Ampaire Inc.

- 6.1.3 PIPISTREL d.o.o.

- 6.1.4 Airbus SE

- 6.1.5 Eviation

- 6.1.6 ZeroAvia, Inc.

- 6.1.7 Heart Aerospace

- 6.1.8 Lilium GmbH

- 6.1.9 Aurora Flight Sciences (The Boeing Company)

- 6.1.10 Wright Electric

- 6.1.11 Joby Aero, Inc.

- 6.1.12 NASA

- 6.1.13 Rolls-Royce plc

- 6.1.14 Avinor AS

- 6.1.15 Equator Aircraft AS

- 6.1.16 BETA Technologies, Inc.

- 6.1.17 Evektor, spol. s r. o.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS