PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637758

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637758

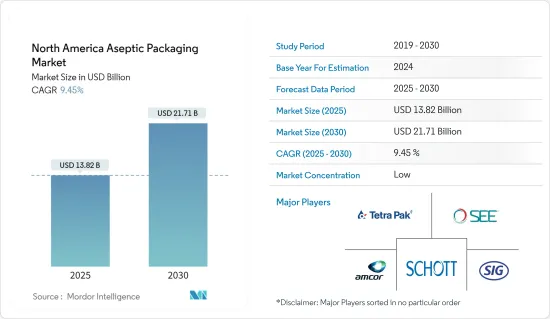

North America Aseptic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America Aseptic Packaging Market size is estimated at USD 13.82 billion in 2025, and is expected to reach USD 21.71 billion by 2030, at a CAGR of 9.45% during the forecast period (2025-2030).

The market is witnessing significant growth, driven by the rising need for extended shelf life and the preservation of food and beverages without refrigeration. Furthermore, technological advancements in packaging that bolster product safety and quality play a pivotal role in propelling the market forward.

Key Highlights

- As demand for long-distance transportation surges, extending shelf life has become paramount. Packaging must enhance its durability and protective features with growing distances between manufacturing sites and end users. North America's penchant for packaged and ready-to-eat meals is driving the adoption of aseptic packaging.

- The end-user industries, such as food and beverage, prioritize sustainable packaging and extended shelf life. Many regional food and beverage vendors are leaning towards aseptic packaging, weighing both cost and environmental benefits, particularly for ambient shipping and storage. Furthermore, aseptic packaging utilizes recyclable cartons and eco-friendly pouches. These options often appeal to consumers favoring smaller quantities and more frequent purchases, driving significant demand for such products in the region.

- Consumer health and wellness consciousness is on the rise. They are willing to invest more in products that align with this wellness trend, from morning juices to energy drinks. Therefore, there's a surging demand for cost-effective packaging solutions in the beverage packaging segment. Furthermore, the growing preference for aseptic cartons, especially from the milk and dairy beverage sectors, is set to invigorate the market. These cartons facilitate easy stacking and extend the product's shelf life.

- As per the Beverage Report by the Association for Packaging and Processing Technologies (PMMI), North America's beverage industry is projected to expand by approximately 4.5% by 2028. This burgeoning beverage market is poised to propel the growth of the studied market. In the region's pharmaceutical sector, particularly in the United States, there's been a significant surge in demand for aseptic packaging. This uptick is primarily driven by the increasing availability and consumption of biotechnology-based drugs and various liquid pharmaceuticals' aseptic filling needs.

- In response to rising customer demands and the imperative to control storage and distribution costs, companies are leveraging connected technologies like sensors, RFID, and NFC and channeling investments into advanced technologies. These investments aim to substantially cut down or eliminate costs associated with managing products from manufacturers to retailers.

- However, several challenges loom over the aseptic packaging market, potentially hindering its revenue growth. The initial capital outlay for aseptic packaging can be two to three times higher than that of conventional fresh production methods. Furthermore, involving research teams from the beginning is crucial, enabling formula tweaks specific to aseptic processing. Yet, this necessity can significantly escalate the costs of aseptic packaging when posed with traditional methods.

North America Aseptic Packaging Market Trends

Beverages Segment is Expected to Hold a Significant Market Share

- As consumers increasingly prioritize health and wellness, the demand for fruit-based ready-to-drink beverages is surging, especially with a focus on cost-effective packaging. This trend is expected to intensify over the forecast period. Aseptic packaging not only extends the shelf life of these beverages but also introduces innovations like shelf-stable fruit juices.

- Convenience is emerging as a dominant trend in ready-to-drink beverages and health-focused categories across North America. Given the extensive preparation required for homemade beverages, consumers gravitate towards ready-to-drink cocktails. This shift highlights a significant trend: consumers are drawn to the unique flavors of these cocktails and value the ease of enjoying them outside the home.

- Global trends in the dairy industry reveal a push towards product differentiation through innovative packaging. Today's dairy product packaging often boasts eye-catching designs and advanced aseptic features. This emphasis on packaging innovation is a response to fierce competition in key North American markets.

- Aseptic milk, treated with ultra-high-temperature pasteurization, effectively eliminates harmful bacteria. The dairy category is diverse, encompassing not just white milk and its byproducts like ghee, buttermilk, and yogurt-based beverages but also the promising realm of flavored milk. Aseptic processing and packaging, free from preservatives, significantly enhance shelf life and freshness-vital attributes for perishable items like milk.

- The dairy industry's growing appetite for aseptic packaging signals a broader trend. With rising milk production, new global market opportunities are on the horizon. For context, the USDA projects U.S. cow milk production to increase from 217,600 million pounds in 2018 to approximately 228,200 million in 2024. Additionally, a notable consumer shift has been the surging demand for UHT milk, prized for its extended shelf life, allowing consumers to reduce store visits. Furthermore, with the effect pandemic, there was a marked preference for the sterile packaging of UHT milk over traditional packaged fresh and bulk milk, underscoring a significant evolution in dairy consumption patterns.

Canada is Expected to Witness Growth in the Market

- Investments continue to flow into the Canadian dairy sector, bolstering the nation's economy. Responding to regional demands, the Canadian government is championing the adoption of advanced packaging technologies, particularly aseptic packaging. Health-conscious millennials and the younger generation in Canada increasingly gravitate towards milk, juices, and energy drinks, driven by a heightened awareness of the risks of excessive sweets, carbonated sodas, and artificial sugars.

- In Canada, consumers are increasingly opting for milk cartons over glass bottles and plastic alternatives, driven by eco-friendly concerns and the cost-effectiveness of cartons. A report from StatCan in May 2024 highlighted that Canada's production of standard 3.25% milk rose from about 438.38 thousand kiloliters in 2020 to 468.07 thousand kiloliters in 2023. Aseptic liquid packaging is preferred for perishable items in the dairy-based beverages sector. Given the nature of dairy products, the quality of packaging is paramount for these highly perishable liquid foods and beverages.

- Aseptic solution providers are addressing challenges in the dairy packaging arena. Nearly 60% of products using aseptic packaging are dairy items, including spoonable yogurt, cheese, cream, and ice cream. Dairy consumption spans natural, powdered, and processed cheese, but perishability remains a pressing concern. Aseptic packaging can extend cheese's shelf life by an impressive 60 days.

- Consequently, end users are channeling substantial investments into packaging. Given dairy's vulnerability to fragrance transfer and decomposition from oxygen exposure, packaging must boast superior barrier qualities. Data from StatCan reveals a notable uptick in Canada's dairy product sales: from January to May 2024, monthly manufacturer sales surged from CAD 1.39 billion (USD 1.03 billion) to CAD 1.67 billion (USD 1.24 billion).

- Further, aseptic pharmaceutical manufacturing, often termed fill-finish manufacturing, is crucial in producing vaccines, biologics, injectable drugs, cancer treatments, and various forms of ear, nasal, and eye drops. This method significantly reduces the risk of contaminating medications with germs or other harmful substances. In Canada, the pharmaceutical sector stands out as one of the nation's most innovative industries. It encompasses companies developing and producing creative and generic medicines alongside over-the-counter drug products.

North America Aseptic Packaging Industry Overview

Aseptic packaging utilizes cartons and eco-friendly pouches and caters to consumers who favor smaller, more frequent purchases, driving demand. Furthermore, as consumers increasingly seek organic products without preservatives, manufacturers are responding by investing in premium packaging solutions that preserve freshness and extend shelf life.

The North America Aseptic Packaging Market is competitive owing to the presence of multiple vendors in the market supplying their products in domestic and international markets. The market appears fragmented, with major players adopting various strategies to expand their reach and stay competitive. Some of the major players in the market are Amcor Group, DS Smith Plc, Schott AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness- Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand to Reduce the Cost of Cold Chain Logistics

- 5.1.2 Increasing Demand for the Longer Shelf Life of Products

- 5.2 Market Restraint

- 5.2.1 Manufacturing Complications and Lower Return on Investments

6 MARKET SEGMENTATION

- 6.1 Product Type

- 6.1.1 Plastic Bottles

- 6.1.2 Prefillabe Syringes

- 6.1.3 Vials and Ampoules

- 6.1.4 Bags and Pouches

- 6.1.5 Cartons

- 6.1.6 Cups

- 6.1.7 Glass Bottles

- 6.2 End- User Type

- 6.2.1 Pharmaceutical

- 6.2.2 Beverage

- 6.2.2.1 Fruit-based

- 6.2.2.2 Milk and Other Dairy Beverages

- 6.2.2.3 Ready-to-Drink

- 6.2.2.4 Other Beverage Industry Types

- 6.2.3 Food

- 6.2.3.1 Fruit-based

- 6.2.3.2 Dairy Food

- 6.2.3.3 Processed Foods

- 6.2.3.4 Baby Foods

- 6.2.3.5 Soups and Broths

- 6.2.3.6 Other Food Industry Types

- 6.3 Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tetra Pak International S.A.

- 7.1.2 Amcor Group

- 7.1.3 Sealed Air Corporation

- 7.1.4 SIG Combibloc Group

- 7.1.5 WestRock Company

- 7.1.6 Schott AG

- 7.1.7 Scholle IPN

- 7.1.8 DS Smith PLC

- 7.1.9 Elopak AS

- 7.1.10 Mondi PLC

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS