Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639535

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639535

France Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

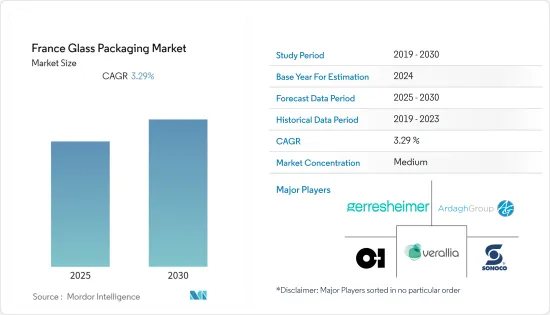

The France Glass Packaging Market is expected to register a CAGR of 3.29% during the forecast period.

Key Highlights

- France is a dominant beverage producer in the European Union, with an extensively cultivated environment aiding the development of different indigenous alcohol forms and their appropriate premium packaging solutions, primarily champagne and cognac.

- The French glass industry labored through increasing mechanization, particularly in the cold operations section, where sorting, loading, and unloading are mechanized. Several operations have been outsourced. Remnant areas only include the most technical additions, such as glass forming and molding. France benefits from many recognized glass artists present throughout the country.

- However, Germany and France cannot keep glass packaging materials, like bottles and jars, in circulation. Over the last 40 years, it lost most of its glass deposit systems. It led to an overuse of plastics in various end-user industries. The French Government recently proposed a deposit system to recycle plastic instead of reusing it. According to experts, this is a flawed policy, as the global recycling of plastics stalled at 25%. The government needs a comprehensive plan to replace the plastics lost in recycling over time.

- It, however, is expected to create opportunities for enhanced use of glass bottles for daily-use products, such as milk and other food items. Bruni Glass France is offering lighter glass bottles to gin manufacturers and heavier and thick-bottomed glass bottles for cognac.

France Glass Packaging Market Trends

Beverages Segment is Expected to Hold a Significant Market Share

- The trend of using glass bottles for wine packaging remained the dominant choice amongst wine lovers in France. The rise of new formats poses a little challenge for traditional glass packaging. The data is substantiated by a recent survey made between April and May 2021 by the Federation of Glass Industries and France's glass association, with the participation of 1,000 wine lovers across the country.

- The French Glass Industry Federation also engaged in several campaigns, like the #MyUniverre ('verre' meaning 'glass' in French) campaign launched on social networks in May 2021. Such campaigns directly support the studied market growth in the county.

- Further, according to the OIV (The International Organization of Vine and Wine (OIV)), Italy is the leading producer of wine than any country, and France comes in the second spot. As the properties of glass are well suited to the nature of wine, unmatched by plastic or even metals, the market reflects a potential growth.

- Further, iced tea is another popular beverage that is witnessing demand from specific regions in the market. For instance, Coke-owned Fuze Tea supports its product development for the French market and export markets, such as the Netherlands, Belgium, Norway, Sweden, and Germany. CCEP invested in a new glass bottle production line at its Socx plant.

Personal Care Segment Expected to Witness Significant Growth

- France is also among the leading countries in terms of the size of the cosmetics industry. Glass is one of the most used materials in cosmetics packaging, as the material guarantees optimum product preservation and is also recyclable.

- Additionally, Glass is preferred for cosmetics packaging because it's a cold material and appeals to pure nature. The sensation of heaviness drives a feeling of quality which often act as a differentiating factor in the cosmetics industry.

- The country is home to some of the globally recognized fashion, cosmetics, and personal care brands which is driving the demand for glass packaging in the country. For instance, according to data provided by ITA, there are approximately 430 cosmetics companies in France with 55,000 employees. Marionnaud, L'Oreal, Sephora, Douglas, and Nocibe are vital players in the cosmetic industry's distribution network. The mass distribution sectors, such as pharmacies and department stores, also play a significant role.

France Glass Packaging Industry Overview

The French glass packaging market is moderately competitive, with many regional and global players. However, the properties of glass and its benefits to beverages, cosmetics, and other sectors are leading to the increased adoption of glass bottles, containers, vials, and ampoules. Players adopt strategies, such as product innovation, partnerships, mergers, and acquisitions, to increase their market shares and further drive the market.

- March 2022 - Coca-Cola Europacific Partnersexpanded the returnable glass bottle program for French hotels, restaurants, and cafes. The glass bottles are refillable up to 25 times, according to CCEP. With CCEP stating that the new refillable bottle includes three times fewer greenhouse gas (GHG) emissions, it is estimated that this will prevent the production of more than 15 million single-use glass bottles in 2022.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 51095

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Higher Disposable Income and Integration in Premium Packaging

- 5.1.2 Improved Technology Offering Better Solutions

- 5.2 Market Challenges

- 5.2.1 High Competition from Substitute Packaging Solutions

- 5.2.2 Operation and Logistical Concerns

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Bottles and Containers

- 6.1.2 Jars

- 6.1.3 Vials

- 6.1.4 Syringes

- 6.1.5 Ampoules

- 6.1.6 Other Products

- 6.2 By End-user Vertical

- 6.2.1 Beverage

- 6.2.2 Food

- 6.2.3 Cosmetics

- 6.2.4 Pharmaceuticals

- 6.2.5 Other End-user Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ardagh Packaging Group PLC

- 7.1.2 Owens-illinois Inc.

- 7.1.3 Sonoco Products Company

- 7.1.4 Verallia Packaging SAS

- 7.1.5 Gerresheimer AG

- 7.1.6 APG Europe

- 7.1.7 Bormioli Pharma SpA

- 7.1.8 Saver Glass Inc.

- 7.1.9 Stolzle Glass Group (CAG Holding GmbH)

- 7.1.10 Quadpack Industries SA

- 7.1.11 SGD Pharma

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.