PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1273349

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1273349

Herpes Zoster Infection Treatment Market - Growth, Trends, and Forecasts (2023 - 2028)

During the time frame of the forecast, the herpes zoster infection treatment market is expected to register a CAGR of 4.1%.

COVID-19 had a significant impact on the growth of the market. Herpes zoster infection is caused by the reactivation of the varicella-zoster virus, which can occur in patients who have immunosuppressive diseases or whose cell-mediated immunity declines with age. Coronavirus infection has also been linked to T-cell immunological dysfunction and can result in Herpes zoster reactivation.For instance, as per the study published by PubMed in July 2022 on COVID-19 individuals, varicella-zoster virus reactivation could occur as a result of T-cell malfunction, such as lymphopenia and lymphocyte depletion. Patients with COVID-19 were more likely to reactivate herpes zoster due to the tendency of COVID-19 to establish an immunosuppressive state, related to the functional impairment and the concurrent quantitative drop in T lymphocytes, especially cd4+ T cells, cd8+ T cells, and natural killer cells. Additionally, the COVID-19 pandemic also disrupted the supply chain of antiviral drugs, which had a negative impact on the studied market. For instance, according to an article published by PubMed in May 2022, antiviral drug purchases significantly decreased in developed countries during the early pandemic. Therefore, the COVID-19 pandemic had a pronounced impact on the growth of the market. However, as the pandemic has currently subsided, the studied market is expected to have stable growth during the forecast period of the study.

The key market drivers for the growth of the herpes zoster infection treatment market include the rising geriatric population coupled with the rising incidence of herpes zoster, growing awareness regarding the use of the varicella vaccine, and an increase in immunization programs across the world. Herpes zoster (HZ) has a cumulative incidence rate of 2.9-19.5 cases per 1,000 population and an incidence rate of 5.23-10.9 cases per 1,000 person-years, according to a study published in PubMed in March 2021.Females had higher cumulative incidence and incidence rates than males. Because of weak immune systems, elderly people are more susceptible to herpes zoster. The geriatric population is expected to have a significant impact on the market studied as people over 65 are more susceptible to chronic diseases. For instance, according to the study updated by the NCBI in September 2022, herpes zoster occurs at a rate of 1.2 to 3.4 per 1000 people per year in younger, healthy people, but at a rate of 3.9 to 11.8 per 1000 people per year in patients over 65. Hence, herpes zoster is more prevalent in the aging population.

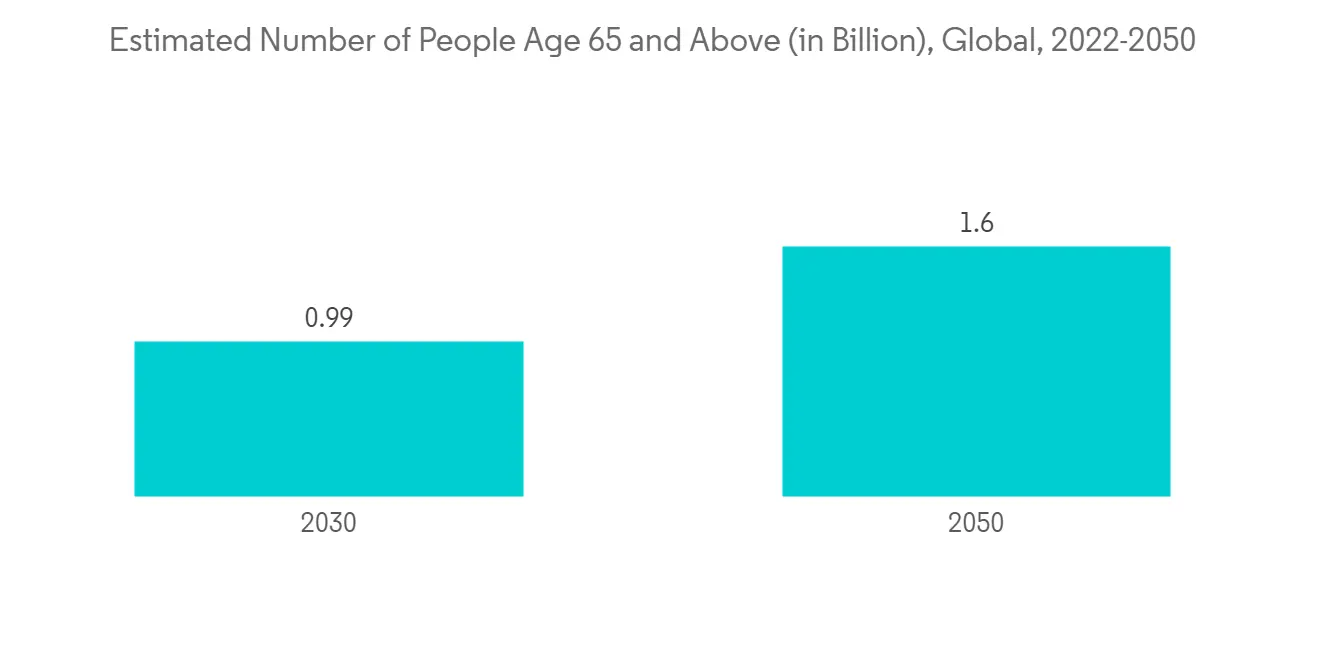

Moreover, the growing geriatric population is expected to positively impact market growth. For instance, according to the World Population Prospect 2022, the global population of people aged 65 and older is estimated at 77 million in 2022 and is expected to reach 1.6 billion by 2050. As the geriatric population is more susceptible to herpes zoster, the increasing number of cases is expected to boost market growth over the forecast period.

Additionally, the increasing coverage of the herpes zoster vaccine, or shingles vaccine, is also expected to boost market growth. For example, according to data updated by the United Kingdom Government in November 2022, 31.2% of patients aged 70 in the United Kingdom received the shingles vaccine during 2021-2022, while 74.9% of patients aged 76 received the vaccine during the same time period.

Additionally, the market is also driven by increasing awareness about the use of varicella vaccinations and market players adopting various strategies such as product launches, mergers and acquisitions, and fundraising for research and development activity. For instance, in February 2021, Dr. Florian Full of the Institute of Clinical and Molecular Virology at Universitatsklinkum Erlangen at Friedrich-Alexander-Universitat (FAU) received EUR 2.34 million in funding from the Federal Ministry of Education and Research (BMBF) for the development of a new herpes virus medication. Such instances may positively impact market growth over the forecast period.

Thus, owing to the aforementioned factors such as the high prevalence of herpes zoster, the growing geriatric population, increasing awareness about the use of varicella vaccinations, and market players adopting various strategies such as product launches, mergers and acquisitions, and fundraising for research and development activity, the market is expected to project growth over the forecast period. However, the high cost of the vaccine is likely to hinder market growth over the coming years.

Herpes Zoster Infection Treatment Market Trends

Antiviral Drug Segment is Expected to Hold Significant Market Share Over the Forecast Period

The antiviral drug segment holds a significant market share in the herpes zoster infection treatment market and is anticipated to show a similar trend over the forecast period as it reduces viral shedding and accelerates the resolution of symptoms such as reducing pain and developing fast healing. The segment is driven by things like the fact that there are many antiviral drugs for treating herpes zoster infections and that market players keep putting out new products.

According to the study published by UpToDate in August 2022, the effectiveness of topical and systemic antivirals in the prevention of oral herpes discovered that both oral acyclovir (800 to 1600 mg daily) and valacyclovir (500 mg daily) were beneficial in reducing the risk of oral herpes. Because antivirals work well, people will be more likely to use low-concentration acyclovir drugs to make sure they are safe. This will lead to more people using this segment, which will keep growing throughout the time frame of the projection.

As a result of its cost-effectiveness, many companies are engaged in drug development, and the use of acyclovir in herpes zoster is predicted to be significant. For instance, in September 2021, the Indian Patent Office issued a patent to Aurobindo Pharma for its technology for producing valacyclovir, an antiviral medicine sold under the brand name Valtrex in the United States and other countries. Aurobindo's invention is for a better method of preparing medication or pharmaceutically suitable salts. In humans, valacyclovir hydrochloride is used to treat viral diseases such as herpes zoster and genital herpes. Thus, all the aforementioned factors are expected to boost segment growth over the forecast period.

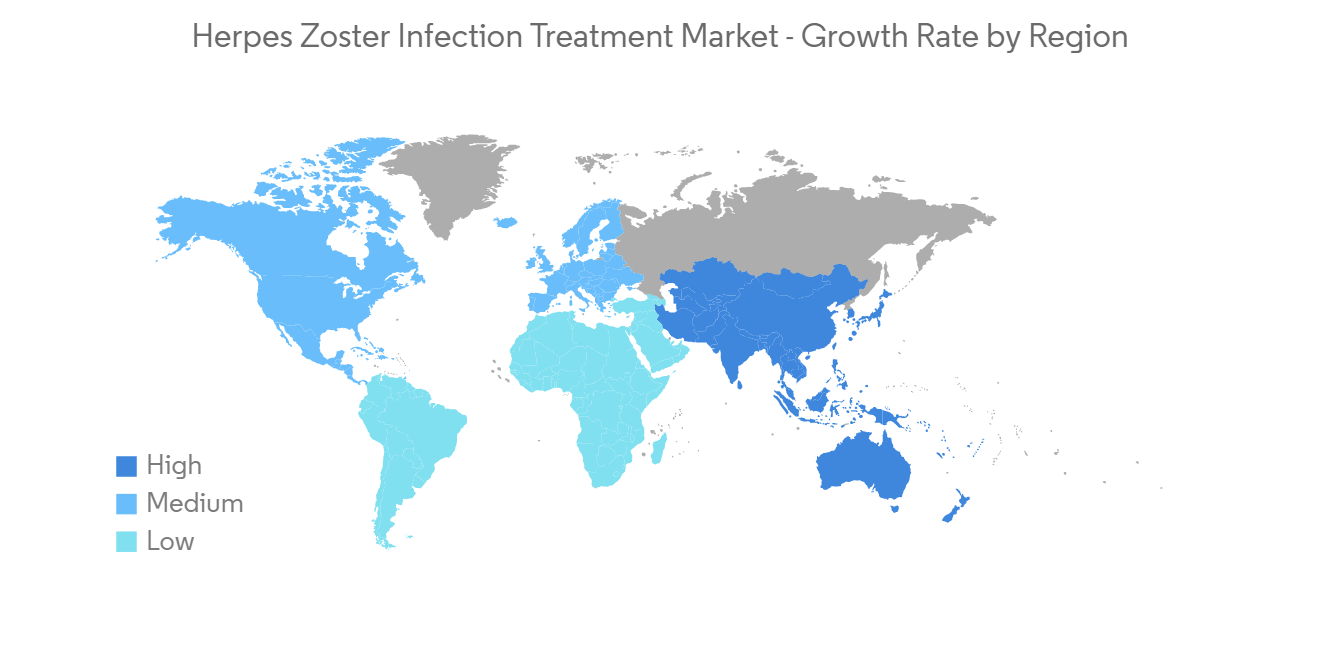

North America is Expected to Hold a Significant Share of the Market Over the Forecast Period

The North American region is expected to hold a major market share of the global herpes infection treatment market, due to the high incidence rate of herpes zoster in North America and readily available medications. The presence of major players involved in the commercialization and development of herpes zoster interventions is a primary factor for the growth of this market in this region.

Major companies are focusing on developing and marketing safe and effective vaccines to treat herpes zoster infection by conducting various clinical trials. For instance, in August 2022, Nobel Pharma started a clinical trial to study the effect of NPC-06 in patients with pain associated with acute herpes Zoster. The study is under Phase 3 of the clinical trial and is expected to be completed by July 2023.

Furthermore, product launches and approval by regulatory bodies support market growth. For instance, in July 2021, GlaxoSmithKline plc reported that the United States Food and Drug Administration (FDA) approved Shingrix (Zoster Vaccine Recombinant, Adjuvanted), to prevent herpes zoster in adults aged 18 and above who are at higher risk of developing the disorder due to immunodeficiency.

Hence, the rising burden of infections due to the herpes zoster virus, coupled with the rising awareness and new product launches, is expected to boost market growth over the forecast period.

Herpes Zoster Infection Treatment Industry Overview

The herpes zoster market is moderately fragmented. Some of the companies that are currently dominating the market are GlaxoSmithKline PLC, Merck & Co. Inc., Pfizer Inc., Apotex Inc., and Viatris Inc., among others. Major players in the market are focused on expanding their businesses in developed and fast-growing markets by launching their products to meet the demand for herpes zoster interventions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Geriatric Population Coupled with Rising incidence of Herpes Zoster

- 4.2.2 Growing Awareness Regarding the Use of Varicella Vaccine and Increase in Immunization Programs Across the World

- 4.3 Market Restraints

- 4.3.1 High Cost of the Vaccine

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Type

- 5.1.1 Drug Therapy

- 5.1.1.1 Antivirals

- 5.1.1.2 Analgesic

- 5.1.1.3 Nonsteroidal Anti-inflammatory Drugs

- 5.1.1.4 Other Types

- 5.1.2 Vaccination

- 5.1.2.1 Monovalent Vaccine

- 5.1.2.2 Combination Vaccine

- 5.1.1 Drug Therapy

- 5.2 By End User

- 5.2.1 Hospitals and Clinics

- 5.2.2 Diagnostic Centers

- 5.2.3 Other End-Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 GlaxoSmithKline PLC

- 6.1.2 Merck & Co. Inc.

- 6.1.3 Apotex Inc.

- 6.1.4 Pfizer Inc.

- 6.1.5 Viatris Inc.

- 6.1.6 Takeda Pharmaceutical Company Limited

- 6.1.7 Novartis AG

- 6.1.8 Hetero Drug (Camber Pharmaceuticals, Inc.)

- 6.1.9 Cipla Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS