PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687220

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687220

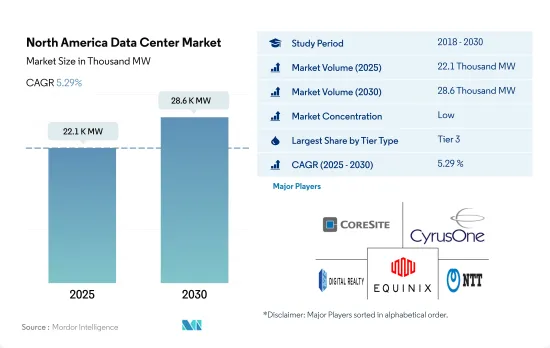

North America Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America Data Center Market size is estimated at 22.1 thousand MW in 2025, and is expected to reach 28.6 thousand MW by 2030, growing at a CAGR of 5.29%. Further, the market is expected to generate colocation revenue of USD 25,932.6 Million in 2025 and is projected to reach USD 42,227.7 Million by 2030, growing at a CAGR of 10.24% during the forecast period (2025-2030).

Tier 3 data centers accounted for majority share in terms of volume in 2023; Tier 4 is the fastest-growing segment

- The tier 4 data center reached 5881.0 MW in 2023 and is further projected to exhibit a CAGR of 13.46%, surpassing 12547.2 MW by 2029.

- Over the coming years, demand for facilities in tiers 1 and 2 will steadily decrease, but growth will continue due to protracted and unpredictable outages. While there is already an adequate supply of retail colocation in these tier 1 and tier 2 locations, large-scale projects are also driving demand to fulfill growing hyperscale cloud requirements as the demand for lower latency and greater efficiency develops.

- The majority of clients will eventually move to tier 3 and tier 4 facilities due to the increasing demand for data processing, storage, and analysis. The tier 3 type held the majority of the market in 2022 due to the significant benefits of its features. Most tier 3 data centers in the area are located in North America, providing numerous channels for power and cooling as well as a high level of redundancy. These data centers have an uptime of about 99.982%, which equals 1.6 hours of downtime annually. Additionally, it is anticipated that the expansion in tier 3 data centers will continue to increase with the increased usage of edge and cloud connectivity.

- The tier 4 type is anticipated to increase at a CAGR of 15.51%. To benefit from total fault tolerance and component redundancy, several industrialized nations are working on adopting the Tier 4 certification. In 2022, there were 81 tier 4 data centers in North America. Tier 4 data centers will grow dramatically in the coming years as more companies are offering cloud-based services, which has prompted other companies to build facilities to offer colocation space with the greatest technology.

The United States holds the majority share of the regional market, with its dominance expected to continue during the forecast period

- Over the past few years, there has been a sharp increase in the demand for data centers in the region due to growing cloud adoption and rising data generation. The major drivers of the expansion of the data center market in North America have been the rising popularity of IoT, the increased development of 5G networks, the COVID-19 pandemic, and the increasing demand for high-speed streaming of online entertainment content.

- The total IT load capacity of hyper-scale colocation data centers in North America is 4,481.2 megawatts (MW), and by 2029, it is expected to reach 1,2047.5 MW after registering a CAGR of 14.63%. By 2023, more than 13,000 MW of capacity were to be under development, and by 2029, this is expected to increase to more than 25,000 MW. More than half this new capacity is being added in the United States by mega data centers, followed by massive-size data centers. The size and quantity of user requirements for data centers kept expanding.

- Several sizable businesses have inked leases totaling more than 60 MW, some even over 100 MW. Most big hyperscalers are responsible for a net absorption percentage of more than 70%, which is to rise by more than 5% by 2029. The hyperscale data center market in the United States is predicted to grow the fastest in North America over the coming years. Recent economic incentives and tax benefits have been key factors in constructing the US data center market.

- Canada is a growing nation in the data center market. A supportive regulatory environment and cool climate support the data center market and are ideal for operations. The Internet of Things (IoT), cloud computing, and big data drive Canada's demand for data storage and processing capabilities. As a result, new facilities are being built, and old ones are being expanded.

North America Data Center Market Trends

The expansion of network coverage and the continued high adoption of 4G and 5G expansion may drive market growth

- The unlimited data rates, enhanced 5G network coverage, and increased network capacity drew more and more new 5G subscribers in 2021. With the adoption of gaming, XR, and video-based apps anticipated to rise, the amount of data created per minute of use was expected to increase considerably. To satisfy users, these experiences required greater video resolutions, more uplink traffic, and data from devices offloaded to cloud computing resources. North America was projected to have the highest 5G subscription penetration, reaching 90%, by 2028 compared to all other areas.

- Popular cities with early 5G rollouts set the pace for traffic growth during the forecast period in 2021. 5G was expected to account for more than 10% of mobile data traffic in the upcoming years. The expansion of coverage and the continued high adoption of 4G, which was related to an increase in smartphone subscriptions and average data usage per smartphone, were driving traffic growth. For instance, as of 2021, there were about 328 million smartphone owners in the United States, and by 2027, there will be 358 million smartphone subscriptions in North America.

- The use of high bandwidth services was made possible by the expansion of LTE availability. About 75% of people who used mobile services visited the internet on a weekly basis, with more than half of them doing so from their mobile devices. The second-largest category was social networking, with more than 60% of mobile users visiting a social networking site at least once each week. The usage equated to 15 to 30 minutes of daily video streaming in 2021. Increased traffic was also expected to result from social networking and other apps. In 2021, monthly mobile data traffic was anticipated to reach 6 GB and increase to more than 30 GB by 2029.

5G network expansion and increased sales of 5G smartphones will boost the market's growth

- Smartphone adoption has some room to expand. By the end of 2021, smartphones accounted for 83% of mobile connections in North America. With 30 million additional smartphone connections anticipated by 2025, the migration away from legacy networks (2G and 3G) will continue to support smartphone adoption in the coming years. The expansion of mobile data traffic in North America, which was anticipated to more than triple by 2027, will continue to depend heavily on rising smartphone penetration. Since Apple unveiled the first iPhone in 2007, the popularity of smartphones has skyrocketed. By 2016, it was expected that 43.5% of all Americans would own an iPhone.

- In the United States, where 5G made up approximately one out of every four mobile connections in 2021, 5G was starting to become widely used. The economic recovery following the pandemic, increased sales of 5G smartphones, and general marketing initiatives have all helped increase momentum. Consumer interest in upgrading to 5G was increasing, and current 5G customers were showing an increased interest in expanding their 5G plans to include content and services like streaming video, music, gaming, live sports, and cloud storage. This was expected to encourage more people to purchase smartphones, increasing the number of smartphone users.

- Almost 90% of people in North America use the internet. In the United States and Canada, Facebook had a combined 266 million monthly active users (MAU). This demonstrated the widespread use of smartphones in the region, which essentially necessitates the use of data centers for storage since they demand real-time processing of sizable data chunks. A rise in data centers was expected to be seen in the region during the anticipated period as a result of good smartphone growth.

North America Data Center Industry Overview

The North America Data Center Market is fragmented, with the top five companies occupying 19.67%. The major players in this market are CoreSite (America Tower Corporation), CyrusOne Inc., Digital Realty Trust Inc., Equinix Inc. and NTT Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Canada

- 5.6.2 Mexico

- 5.6.3 United States

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Data Center Size

- 6.1.1 Large

- 6.1.2 Massive

- 6.1.3 Medium

- 6.1.4 Mega

- 6.1.5 Small

- 6.2 Tier Type

- 6.2.1 Tier 1 and 2

- 6.2.2 Tier 3

- 6.2.3 Tier 4

- 6.3 Absorption

- 6.3.1 Non-Utilized

- 6.3.2 Utilized

- 6.3.2.1 By Colocation Type

- 6.3.2.1.1 Hyperscale

- 6.3.2.1.2 Retail

- 6.3.2.1.3 Wholesale

- 6.3.2.2 By End User

- 6.3.2.2.1 BFSI

- 6.3.2.2.2 Cloud

- 6.3.2.2.3 E-Commerce

- 6.3.2.2.4 Government

- 6.3.2.2.5 Manufacturing

- 6.3.2.2.6 Media & Entertainment

- 6.3.2.2.7 Telecom

- 6.3.2.2.8 Other End User

- 6.4 Country

- 6.4.1 Canada

- 6.4.2 Mexico

- 6.4.3 United States

- 6.4.4 Rest of North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 Cologix Inc.

- 7.3.2 CoreSite (America Tower Corporation)

- 7.3.3 CyrusOne Inc.

- 7.3.4 Cyxtera Technologies

- 7.3.5 Digital Realty Trust Inc.

- 7.3.6 Edgecore (Partners Group)

- 7.3.7 Equinix Inc.

- 7.3.8 Flexential Corp.

- 7.3.9 NTT Ltd

- 7.3.10 Quality Technology Services

- 7.3.11 Switch

- 7.3.12 Vantage Data Centers LLC

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms