PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1432967

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1432967

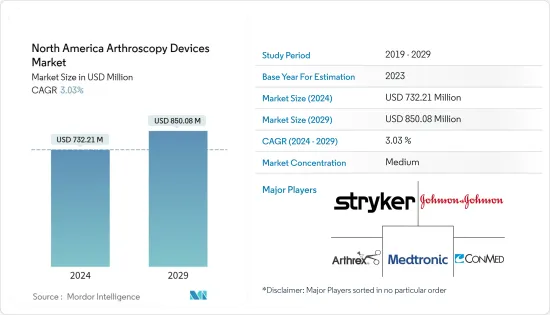

North America Arthroscopy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The North America Arthroscopy Devices Market size is estimated at USD 732.21 million in 2024, and is expected to reach USD 850.08 million by 2029, growing at a CAGR of 3.03% during the forecast period (2024-2029).

The COVID-19 pandemic had a significant impact on the arthroscopy devices market. Diagnostic and treatment procedures were postponed at the beginning of the pandemic as hospitals and surgeons were advised to postpone or cancel elective courses. According to an article published by Springer Nature in November 2022, the COVID-19 pandemic strained the United States healthcare system, and associated policies resulted in the postponement or cancellation of many elective surgeries. While most orthopedic surgeons were aware of how the pandemic affected their patients' care, broader national trends in the operative treatment of orthopedic knee pathology were poorly characterized. The greatest decrease in knee procedures occurred early in the pandemic. This further impacted the growth of the arthroscopy device market during the pandemic. However, the sector has been recovering well since restrictions were lifted. An increase in orthopedic surgeries and a rise in marketing strategies to sell arthroscopy devices have led to the market's recovery over the last two years.

The other major factors driving the growth of the market include increasing incidences of sports injuries, a rising geriatric population, and technological advancements in arthroscopic implants. For instance, according to a National Safety Council update for 2021, the number of injuries in the United States in 2021 was 409,224; the age group with the highest injury rate is 15- to 24-year-olds; nearly twice as many males as females were injured (4,148,404 males vs. 2,158,887 females); and 91% of injury victims were treated in emergency departments and released.

Additionally, various initiatives taken by key market players, such as product launches, mergers, acquisitions, and partnerships, are expected to boost the market's growth during the forecast period. For instance, in January 2021, Smith+Nephew acquired Extremity Orthopedics for a deal amount of USD 240 million and expanded and strengthened its portfolio. Extremity Orthopedics is a company operating in the medical technology and arthroscopy devices and equipment market-based in the United States.

While the above-mentioned factors are expected to drive the market's growth across North America, the lack of skilled surgeons, stringent regulatory requirements, and the high cost of arthroscopy devices are expected to hamper its growth during the forecast period.

North America Arthroscopy Devices Market Trends

Arthroscope is Expected to Hold Significant Market Share over the Forecast Period

An arthroscope is a small tube that is inserted into the body. It contains a system of lenses, a small video camera, and a light for viewing. The arthroscope segment is expected to show a significant market share owing to the high prevalence of orthopedic conditions coupled with the adoption of advanced treatment procedures. For instance, according to the CDC's update in October 2021, about 1 in 4 United States adults (23.7%), or about 58.5 million people, had doctor-diagnosed arthritis. Such a huge prevalence of this disease will lead to increased adoption of orthopedic procedures such as arthroscopy, driving segmental growth.

Moreover, market players in North America focus on growth strategies such as new product launches, partnerships, mergers, and acquisitions, which are driving the growth of the segment over the forecast period. For instance, in November 2022, Integrated Endoscopy launched its second generation NUVIS single-use Arthroscope, a first-of-its-kind 4K endoscope designed for use in arthroscopic surgical procedures.

United States is Expected to Garner a Significant Share of the Market Over the Forecast Period

The major factors boosting the market growth in the United States are the increasing number of orthopedic conditions, well-established healthcare infrastructure, and the presence of several market players. For instance, according to statistics from the Arthritis Foundation 2022, osteoarthritis is the most common form of arthritis, affecting more than 32.5 million people in the US, and about half of the knees with anterior cruciate ligament (ACL) injuries will develop osteoarthritis within 5 to 15 years. By 2040, 78 million Americans are projected to have osteoarthritis. Such an increase in orthopedic conditions is expected to drive the growth of the market in the United States over the forecast period.

Moreover, market players in the United States focus on growth strategies such as new product launches, partnerships, mergers, and acquisitions. For instance, in August 2021, Smith+Nephew showcased its sports medicine innovations for joint repair and arthroscopic enabling technologies during the American Academy of Orthopaedic Surgeons' 2021 Annual Meeting held in San Diego, CA. The latest technologies include INTELLIO Connected Tower, WEREWOLF FASTSEAL 6.0 Hemostasis Wand, and the Regeneten Bioinductive Implant.

North America Arthroscopy Devices Industry Overview

The North America arthroscopy devices market is moderately concentrated due to the presence of companies operating globally and regionally. The competitive landscape includes an analysis of companies including Arthrex Inc., Conmed Corporation, Johnson & Johnson (DePuy Synthes), Karl Storz GmbH & Co. KG, Medtronic PLC, Richard Wolf GmbH, Smith & Nephew PLC, and Stryker Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidences of Sports Injuries

- 4.2.2 Rising Geriatric Population

- 4.2.3 Technological Advancements in Arthroscopic Implants

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Surgeons

- 4.3.2 Stringent Regulatory Requirements

- 4.3.3 High Cost of Arthroscopy Devices

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size - Value in USD million)

- 5.1 By Application

- 5.1.1 Knee Arthroscopy

- 5.1.2 Hip Arthroscopy

- 5.1.3 Spine Arthroscopy

- 5.1.4 Shoulder and Elbow Arthroscopy

- 5.1.5 Other Arthroscopy Applications

- 5.2 By Product

- 5.2.1 Arthroscope

- 5.2.2 Arthroscopic Implant

- 5.2.3 Fluid Management System

- 5.2.4 Radiofrequency (RF) System

- 5.2.5 Visualization System

- 5.2.6 Other Products

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Arthrex Inc.

- 6.1.2 Conmed Corporation

- 6.1.3 Johnson & Johnson

- 6.1.4 Stryker Corporation

- 6.1.5 Medtronic PLC

- 6.1.6 Karl Storz GmbH & Co. KG

- 6.1.7 Richard Wolf GmbH

- 6.1.8 Smith & Nephew PLC

- 6.1.9 Zimmer Biomet Holdings Inc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS