PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642120

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642120

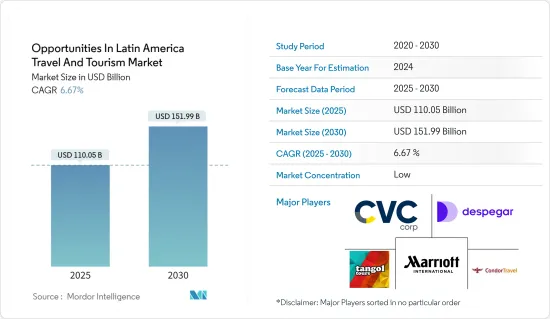

Opportunities In Latin America Travel And Tourism - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Opportunities In Latin America Travel And Tourism Market size is estimated at USD 110.05 billion in 2025, and is expected to reach USD 151.99 billion by 2030, at a CAGR of 6.67% during the forecast period (2025-2030).

Latin America's travel and tourism market is characterized by its diverse landscapes, rich cultural heritage, and vibrant cities. This market spans Central America, South America, and the Caribbean, with each country offering its own unique attractions and experiences. The nations in Latin America draw visitors not only to their natural wonders like the Amazon rainforest, Iguazu Falls, Machu Picchu, and Patagonia but also to their historical sites, lively festivals, and stunning beaches.

As internet access expands and economic conditions improve across the region, more individuals are finding both the means and opportunities to travel, both domestically and internationally. Outbound travel has emerged as a significant driver for the industry's expansion. Furthermore, rising disposable incomes and a burgeoning middle class have buoyed the tourism sector, allowing it to thrive even amidst economic slowdowns.

Latin America Travel & Tourism Market Trends

Increasing International Tourism Fueling the Market

- The growth of international airlines and increased flight routes connecting Latin American countries to various regions has made traveling to Latin America easier and more convenient for international tourists. This has led to a significant increase in the number of visitors from different parts of the globe.

- Latin America is a popular destination for ecotourism and adventure travel enthusiasts. The availability of various outdoor activities like hiking, trekking, wildlife safaris, and water sports further contributes to the growth of the travel market.

- The rise of social media, travel blogs, and online travel platforms has significantly increased travel awareness and inspiration. Latin America has gained popularity through online platforms, where travelers share their experiences, post captivating photos, and recommend destinations. Such digital exposure has contributed to the growing interest in visiting the region.

Growing Travel Market in Mexico

- Renowned for its vibrant cultural heritage, stunning landscapes, and welcoming hospitality, Mexico has consistently attracted tourists from different parts of the world. Mexico has experienced steady growth in its travel market over the years, with a significant increase in international tourists visiting the country.

- Mexico has seen significant improvements in transportation networks, including expanded airport capacity and enhanced road connectivity. This has made it easier for travelers to access different regions of Mexico and explore its various destinations.

- Currency exchange rates can significantly impact tourism. In the past, Mexico has benefited from favorable exchange rates, making it an affordable destination for international travelers. This has made Mexico an attractive option for tourists from countries with stronger currencies.

- The country has been featured in numerous travel media outlets, highlighting its unique attractions and experiences. Positive word-of-mouth and the influence of social media have also contributed to the increasing popularity of Mexico as a travel destination.

Latin America Travel And Tourism Industry Overview

The Latin American travel and tourism market is fragmented. The unsteady financial and political circumstances in Latin American and Caribbean nations, despite their allure as travel destinations, are impacting the region's tourism industry. The travel and tourism market in the region includes dynamic players from foreign markets like North America and Australia competing with domestic players. A few of the prominent players in this market are Latin American Escapes Inc., Tangol SRL, Central America Journeys, Latin America Travel, and Cox & Kings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Market

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMERY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Disposable Income

- 4.2.2 Increasing Social Media Influence

- 4.3 Market Restraints

- 4.3.1 Outbreaks of Contagious Diseases

- 4.4 Market Opportunities

- 4.4.1 Personalized Travel Experiences

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights into Technological Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 International Tourism

- 5.1.2 Domestic Tourism

- 5.2 By Purpose

- 5.2.1 Adventure Tourism

- 5.2.2 Business Travel

- 5.2.3 Conference or Seminar Travel

- 5.2.4 Family and Friends Visit

- 5.3 By Country

- 5.3.1 Brazil

- 5.3.2 Mexico

- 5.3.3 Colombia

- 5.3.4 Chile

- 5.3.5 Argentina

- 5.3.6 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Tangol SRL

- 6.2.2 Condor Travel

- 6.2.3 Despegar.com

- 6.2.4 CVC Corp

- 6.2.5 Mariott International

- 6.2.6 Cox & Kings Travel

- 6.2.7 South America Odyssey

- 6.2.8 Hilton Worldwide

- 6.2.9 Inter Continental Hotels

- 6.2.10 Hoteis Angola

- 6.2.11 Eco Hotels & Resorts

- 6.2.12 Mobibrasil*

7 FUTURE MARKET TRENDS

8 DISCLAIMER AND ABOUT US