PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1439806

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1439806

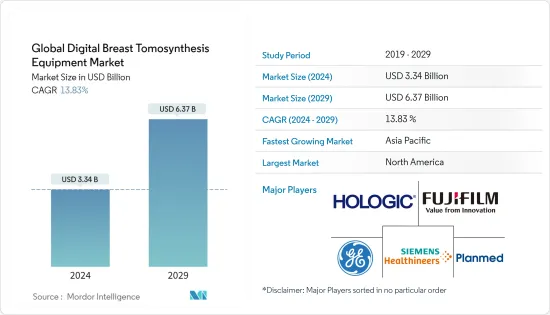

Global Digital Breast Tomosynthesis Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Global Digital Breast Tomosynthesis Equipment Market size is estimated at USD 3.34 billion in 2024, and is expected to reach USD 6.37 billion by 2029, growing at a CAGR of 13.83% during the forecast period (2024-2029).

COVID-19 outbreak has significantly impacted the Digital Breast Tomosynthesis Equipment Market during the pandemic period. The pandemic resulted in substantial reductions in breast cancer screening, cancer management visits, and cancer procedures across the globe. For instance, a study published in the Journal of the American College of Radiology in June 2022 stated that cancer diagnoses dropped by nearly 50% in the peak-pandemic period and have not entirely rebounded to the pre-COVID rate. The strict lockdown and the policies led to the relocation of medical healthcare providers and material resources, which led the healthcare providers to focus primarily on this abrupt pandemic emergency, thereby postponing other non-emergency medical services such as digital breast tomosynthesis. However, the relaxation of the lockdown restrictions and the resumption of cancer diagnostics during the post-pandemic period are expected to contribute to the market's growth.

The growth factors expected to drive the market are the increasing prevalence of breast cancer worldwide, technological advancements in the field of breast imaging, and rising awareness about the use of digital breast tomosynthesis (DBT). The increasing prevalence of breast cancer cases is expected to drive the demand for advanced diagnosis, fueling the studied market. For instance, the article published in MDPI in July 2022 mentioned that 45.4% of breast cancer cases were diagnosed in Asia in 2021. Additionally, the Breast Cancer Organization data published in August 2022 mentioned that breast cancer is the most common cancer globally, accounting for 12.5% of cancer cases annually. The report also mentioned that it is estimated that about 30% of all diagnosed cancer in women might be breast cancer in 2022. The rising prevalence of breast cancer is expected to drive the demand for digital breast tomosynthesis equipment owing to the advanced diagnosis, thereby contributing to the market's growth.

On the other hand, the increasing product launches by various key market players is also expected to contribute to the market's growth over the forecast period. For instance, in August 2021, FUJIFILM Medical Systems launched its ASPIRE Cristalle mammography system with Digital Breast Tomosynthesis (DBT) that offers ScreenPoint Medical's new, US FDA-cleared Transpara powered by Fusion Artificial Intelligence (AI) for 2D and 3D mammography in the United States. Moreover, rising awareness campaigns by various organizations working towards spreading awareness about breast cancer are expected to play a vital role in the market's growth. For instance, in October 2021, the Pink Bot breast cancer awareness campaign was initiated with a chat module integrated to answer queries on breast cancer, the latest initiative from Dr. P Guhan and his team to raise awareness of it. Similarly, in May 2022, Mount Sinai Health System initiated Mammogram May to empower women to take charge of their breast health by scheduling an annual mammogram. The goals of the campaign are to raise awareness of the importance of mammography in early breast cancer detection and treatment and to address a decline in breast screenings worsened by the pandemic.

Thus, due to the aforesaid mentioned reasons, the market is expected to show significant growth over a forecast period. However, the high costs of the systems and side effects associated with radiation exposure may slow down its growth over the forecast period.

Digital Breast Tomosynthesis Equipment Market Trends

2D/3D Combination Mammography Systems Segment is Expected to Witness a Significant Growth Over the Forecast Period

2D/3D combination mammography systems segment is expected to drive market growth as 3D mammography combined with 2D mammography or synthetic 2D mammography can detect more cases of breast cancer as compared to 2D mammography alone. 2D/3D mammography systems require less follow-up imaging, detect more cancers than standard mammography alone, and improve breast cancer detection in dense breast tissues. The high detection rate, rising awareness among people about 2D/3D combination mammography systems, and increasing prevalence of breast cancer are the key factors driving this segment. For instance, in April 2022, an article published in the Journal of Oncology and Radiology reported that 2D-3D mammograms had better sensitivity for non-palpable malignancies than 2D mammograms alone.

An article published in the Egyptian Journal of Radiology and Nuclear Medicine in January 2022, reported that the combination of digital breast tomosynthesis (DBT) with digital mammography(DM) led to higher diagnostic accuracy, sensitivity, and positive predictive value (PPV). The same source also reported that a total of 313 masses were picked up on 2D mammography alone while 2D and 3D mammography combined picked up 361 lesions thus showing that the combination of 2D/3D mammography improves lesion visualization. Such higher efficiency of the 2D/3D mammography systems in the diagnosis of breast cancer is expected to drive the growth of the studied segment.

Additionally, the launch of technologically advanced products is also expected to drive the growth of the segment. For instance, in April 2021, Fujifilm launched the "Harmony" version of its AMULET immorality mammography system. This offers a synthetic 2D image that combines 3D power and 2D reading speed, ultimately offering advanced tomosynthesis of breast mammography.

Thus, the high efficacy of these systems and increasing innovative product launches are expected to drive the growth of the studied segment in the forecast period.

North America is Expected to Witness a Significant Growth Over the Forecast Period.

North America is expected to hold a major market share in the global digital breast tomosynthesis (DBT) equipment market due to the high demand for advanced diagnostic products, and increasing demand for early and effective diagnosis. The growing prevalence of breast cancer, significant R&D in breast cancer therapies, and advancements in breast imaging modalities are the primary drivers of the market in this region. For instance, in January 2022, the American Cancer Society reported that breast cancer is the most common cancer in women in the United States, with about 1 in every 3 women being diagnosed with breast cancer. American Cancer Society has also estimated about 2,87,850 new cases of invasive breast cancer to be reported in women in the United States in 2022. Additionally, the Canadian Cancer Society data published in May 2022, reported that an estimated 28,600 Canadian women are diagnosed with breast cancer. Such a high burden of breast cancer in North American Countries is also expected to drive the demand for digital breast tomosynthesis equipment, thereby boosting the growth of the market.

Furthermore, technological advancements, research and development, and new product launches by key market players, in the region are projected to boost the market region. For instance, in May 2022, iCAD, Inc. launched its new research supporting ProFound AI for Digital Breast Tomosynthesis (DBT), the company will be showcasing its complete suite of deep-learning breast cancer detection, density assessment, and risk evaluation solutions at the Society of Breast Imaging (SBI/ACR) Breast Imaging Symposium.

Thus, due to the aforesaid mentioned factors such as rising breast cancer cases, and rising product launches, the market is expected to show significant growth over the forecast period in the region.

Digital Breast Tomosynthesis Equipment Industry Overview

The digital breast tomosynthesis equipment market is moderately consolidated and consists of a few major players. Some of the prominent players operating in the digital breast tomosynthesis (DBT) Equipment market are Hologic, Inc, GE Healthcare, Fujifilm Holdings Corporation, Siemens Healthineers, General Medical Merate SpA (IMS GIOTTO SPA), Analogic Corporation, Trivitron Healthcare, Metaltronica Spa, Varex Imaging Corporation, PerkinElmer Inc. (Dexela Ltd.), and Planmed OY.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Breast Cancer Worldwide

- 4.2.2 Technological Advancements in the Field of Breast Imaging

- 4.2.3 Rising Awareness About the Use of Digital Breast Tomosynthesis (DBT)

- 4.3 Market Restraints

- 4.3.1 High Costs of the Systems

- 4.3.2 Side Effects Associated with Radiation Exposure

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 2D/3D Combination Mammography Systems

- 5.1.2 Standalone 3D Mammography Systems

- 5.2 By End-User

- 5.2.1 Hospitals

- 5.2.2 Diagnostic Centers

- 5.2.3 Other End-Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Hologic, Inc

- 6.1.2 GE Healthcare

- 6.1.3 Fujifilm Holdings Corporation

- 6.1.4 Siemens Healthineers

- 6.1.5 General Medical Merate SpA (IMS GIOTTO SPA)

- 6.1.6 Varex Imaging Corporation

- 6.1.7 Trivitron Healthcare

- 6.1.8 Metaltronica Spa

- 6.1.9 Analogic Corporation

- 6.1.10 PerkinElmer Inc. (Dexela Ltd.)

- 6.1.11 Planmed OY

- 6.1.12 Internazionale Medico Scientifica S.r.l

7 MARKET OPPORTUNITIES AND FUTURE TRENDS