PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1439816

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1439816

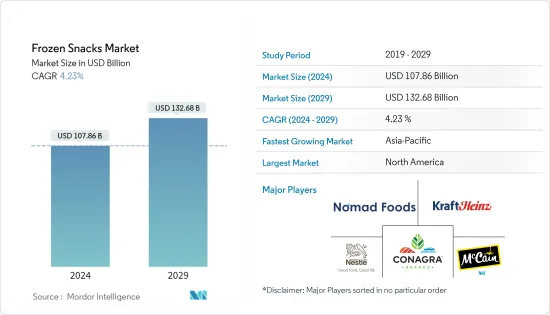

Frozen Snacks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Frozen Snacks Market size is estimated at USD 107.86 billion in 2024, and is expected to reach USD 132.68 billion by 2029, growing at a CAGR of 4.23% during the forecast period (2024-2029).

During the COVID-19 pandemic, the frozen snacks market experienced a sudden increase in sales due to the availability of products in e-commerce stores and various supermarkets and hypermarkets offering home delivery to customers. With the rapid spread of the virus, consumers' awareness and hygiene practices increased, creating an enormous opportunity for e-commerce stores to offer contactless delivery of fully sanitized packaged food items in various countries worldwide. However, continuous innovation in the sector to provide appropriate packaging aids the overall growth of the market.

Key players are introducing new types of ingredients and products to cater to the tastes of consumers on a regional basis. The rising preference of consumers toward convenience products fuels the growing demand for frozen products due to their effortlessness and time-saving benefits as compared to cooking from scratch. The frozen snacks market is expanding rapidly due to the increasing number of working populations and their hectic lifestyles, which is expected to boost the frozen snacks market significantly.

Italian cuisine is gaining traction in the global market, and the trend of deep-frozen pizza is capturing majorities of the Asian, European, and North American markets. The manufacturers are coming up with innovative techniques to meet consumer demands and boost the growth of the market. The intake of animal protein is associated with high cholesterol levels, fat intake, and calorie intake, which increase the risk of cardiac diseases, high blood sugar levels, and obesity. Hence, consumers are showing an inclination toward vegan sources of protein, which, in turn, has created a good platform for the players offering plant-based or vegan frozen products.

Frozen Snacks Market Trends

Rising Consumer Expenditure on Convenience Food Products

The market is primarily driven by rising expenditure on food and beverages, introducing products with longer shelf lives, increasing impulse purchasing, and growing demand for convenience foods that can be prepared quickly and are fresh to eat, such as fries, frozen pizza, and other products. For instance, in February 2021, the American Frozen Food Institute (AFFI) reported that the sales of frozen meals, such as seafood and poultry, were 21.0% higher than in the year 2019, with double-digit sales of all types of frozen and chilled meals. The main advantage of these products is their comforting familiarity as snack foods among consumers, especially for families, where stressed parents turn to frozen pizza as something that appeals to even the pickiest eaters. Due to fast-paced lifestyles and the need for a quick snack among adults, there has been a growing demand for healthy and convenient foods that can be consumed instantly. These products are considered beneficial as most of them can be cooked within a short period of time for consumption. These factors have been propelling the market's growth. Moreover, manufacturers have provided consumers with more foods, for which much of the preparation work has been done outside the home. This development has been facilitated by technological innovations in preservation, packaging, freezing, artificial flavorings and ingredients, and by using microwaves.

North America Holds Major Share

Keeping up with the changing consumer demand, restaurants are providing food items in line with the need and convenience of consumers. Moreover, other lifestyle changes among North American consumers are expected to propel the growth of the frozen snack market. According to the US Department of Agriculture, 72% of Americans purchased frozen food due to their busy schedules during the previous year. Moreover, the growing preference for healthier food options, concerns over environmental sustainability, increased competition from grocery stores, heightened consumer expectations, and rapidly advancing technology is reinventing the traditional dining experience and forcing changes in the way restaurants and cafes operate. However, restaurant operators in North America are optimistic about their businesses, where the competition is more in product offerings and dining experiences, which are expected to drive positive sales in line with the time spent at the restaurants. Further, the demand for frozen pizza, fries, nuggets, wedges, rolls, baguettes, fish fingers, fish sticks, pretzels, croissants, fish cakes, squid rings, frozen momos, frozen burgers, sausages, cutlets, chicken fingers, dippers, and many more is booming in the region. Several restaurants offer the convenience of take-out and delivery options. Therefore, to meet the increased demand, restaurants keep larger stocks of frozen snack products to facilitate growth in their sales.

Frozen Snacks Industry Overview

The market for frozen snacks is highly fragmented due to the presence of many global and local companies. Some of the key companies in the market include Nomad Foods Limited, Conagra Brands Inc., McCain Foods Limited, Kraft Heinz Co., and Nestle SA. Manufacturers operating in the market are entering into agreements with downstream companies to increase their operational reach. The giant manufacturers have intensified their R&D efforts to develop niche and innovative products based on the end-user industry's requirements. Manufacturers are concentrating on enhancing their product quality to obtain a competitive edge over other players in the market. The major players are also practicing geographical expansion and mergers and acquisitions to pump up their revenues. For instance, in December 2021, Strong Roots, a leading plant-based frozen food company, and McCain Foods, the family-owned world leader in frozen potato specialties and appetizers, announced a strategic partnership, with McCain Foods investing USD 55 million in Strong Roots to take a minority stake in the business.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Potato Fries

- 5.1.2 Pizzas

- 5.1.3 Other Frozen Snacks

- 5.2 Distribution Channel

- 5.2.1 Retail

- 5.2.1.1 Supermarkets/Hypermarkets

- 5.2.1.2 Convenience Stores

- 5.2.1.3 Online Retail Stores

- 5.2.1.4 Other Distribution Channels

- 5.2.2 Food service

- 5.2.1 Retail

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Nestle SA

- 6.3.2 McCain Foods Limited

- 6.3.3 Conagra Brands Inc.

- 6.3.4 Tyson Foods Inc.

- 6.3.5 BRF SA

- 6.3.6 Ajinomoto Co. Inc.

- 6.3.7 General Mills Inc.

- 6.3.8 Sudzucker AG

- 6.3.9 Nomad Foods

- 6.3.10 The Kraft Heinz Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS