PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644423

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644423

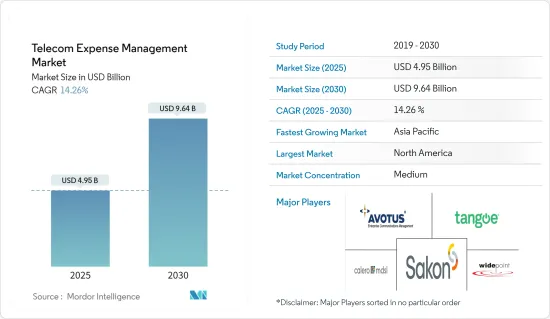

Telecom Expense Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Telecom Expense Management Market size is estimated at USD 4.95 billion in 2025, and is expected to reach USD 9.64 billion by 2030, at a CAGR of 14.26% during the forecast period (2025-2030).

Telecom Expense Management has become an essential practice for enterprises operating across any business domain/industry, irrespective of their size. The increased requirement for efficient telecom expense management practices is one of the transforming trends in the market, coupled with the expansion that has been observed in the business telecom infrastructures in the past few years.

Key Highlights

- The increasing demand for mobile applications, the growing adoption of portable equipment in multiple enterprises, and the technological advancements in telecom expense management solutions are driving the growth of the telecom expense management market. Furthermore, increased adoption of mobile devices, visibility into expense management, and the growing popularity of cloud-based services are also aiding market growth.

- The ongoing trend of integrating individual mobile devices, such as smartphones, laptops, and tablets, under mobility policies such as the choose-your-own-device (CYD), and bring-your-own-devices for one, has been transforming the market over the past few years. Also, the augmented integration of mobile devices in the inner telecom networks has highlighted the requirement for a holistic system for managing and monitoring costs and using telecom resources.

- Further, due to the growing startup culture across developed and developing economies, the increasing number of small and medium-sized enterprises has led companies willing to adopt the BYOD culture to eliminate or restrict the initial infrastructure expenses, which may limit their early growth. Such trends are expected to create several opportunities for telecom expense management solutions.

- The ease of adoption of cloud-based technologies has boosted the adoption of video conferencing among businesses, driving the adoption of cloud services for various business needs. These are overwhelming the current networks and increasing the requirement for advanced network solutions, proliferating enterprises to invest in telecom expense management solutions.

- Thus, globally, telecom operators align themselves in the cloud value chain by managing cloud connectivity and leveraging network assets to enhance and optimize cloud-based solutions and services. Moreover, the growing need for easily maintained network systems that can enable effective communications across multiple end-user industries, including healthcare, retail, and manufacturing, is evident. For instance, the advent of cost-effective cloud-based solutions has seen increased adoption by healthcare providers, which are often categorized as having minimum IT budgets.

- With the outbreak of COVID-19, the telecom industry witnessed a significant increase in demand for internet services due to a major chunk of the population staying at home due to remote working conditions. The increase in people working from home led to an increase in demand for downloading, online video viewing, and communication through video conferencing, all of which are leading to increased network traffic and data usage.

Telecom Expense Management Market Trends

BFSI Segment is Expected to Gain Significant Traction

- There has been a growing competition among the service providers to improve telecom expense management services available for the BFSI sector, thereby helping them to gain a competitive edge over other end-users. With these solutions, financial institutions and the insurance sector can avail of maximum savings and keep their telecom bills under control. For instance, Cass Information Systems Inc. is helping finance, banking, and insurance enterprises to fully manage their telecoms, including mobility services and BYOD management.

- In addition, the growing mobile and online banking users are boosting the demand for telecom expense management in the Banking Sector. For instance, according to data from a report of Bank of America published in August 2022, Customers of Bank of America are increasingly using the company's highly regarded digital tools to manage their accounts. In July 2022, customers used the business's digital platforms nearly 1 billion times. The company has a record 55 million verified digital customers, which has increased by 5% from last year's numbers.

- Banking clients get the ability to track their telecom costs for individual branches and can also benchmark them against one another. Meanwhile, the insurance clients appreciate the solution's ability to track the total costs assigned to remote employees for clear visibility into remote costs.

- Also, the increasing demand for better mobile applications for banking services and the increased penetration of IoT devices coupled with a shift towards 5G networks, efforts made towards making improved APIs for seamless user experience, and the growing need of telecom operators to monetize their advanced services are also some of the major factors that are anticipated to drive the market growth.

- Moreover, the growing adoption of advanced technologies, along with the increasing applications of mobile internet in day-to-day operations, has fueled the cutting-edge competition among various technological advancements across BFSI in the booming era of LTE and IoT, which may further propel the demand in the market.

Latin America is Expected to Witness Significant Growth

- The Latin American region is expected to witness significant growth opportunities in the telecom expense management market during the forecast period, primarily owing to the gradual increase in the population using the internet, a growing number of mobile and connected device users, the rising popularity of bring your own device (BYOD) policies among enterprises, and the flourishing IT and telecommunication.

- The existence of a vast number of IT services and product companies, the growing popularity of CYOD and BYOD policies, and enhancing IT and telecom infrastructures may fuel the requirement for efficient telecom expense management products and services.

- In Latin America, the evolution of 4G into 5G is expected to act as a powerful economic growth engine, particularly for enhancing productivity in key vertical sectors. According to GSMA, 4G will continue to be the backbone of the Latin American mobile industry in the near future, accounting for about 70% of total connections by 2025, and the Latin American mobile ecosystem will grow by more than USD 30 billion by 2025.

- Moreover, several governments in Latin America are considering 5G technology as a significant factor in their digital transformation. Hence, governments in the region are making the necessary regulatory changes in spectrum assignment and network deployment rules in order to accelerate the deployment and adoption in their jurisdiction.

- The region is also experiencing a significant shift in the telecom front, where the majority of organizations have migrated their business-critical infrastructure to the cloud, owing to the penetration of hybrid IT API architecture. The healthcare and manufacturing sectors are expected to emerge as prominent adopters of new solutions over the forecast period in order to better manage telecom expenses and offer billing invoices to others.

Telecom Expense Management Industry Overview

The telecom expense management market is semi-consolidated due to the presence of multiple vendors. Several key players in the market are putting constant effort into bringing product innovations. Major companies are entering into strategic collaborations and are also expanding their footprints in developing regions to consolidate their positions in the market.

In Spetember 2023: Crown Jewels Consultant Ltd (CJC), has announced an enhanced collaboration with Calero (formerly Calero-MDSL), and as collaboration is a direct result of multiple clients leveraging CJC's vendor-agnostic expertise for consulting and interfacing with the MDM solution, which include Data discovery, administration, and licensing management via the ILM product to build a structured data source and Cloud-based, hosted DACS for connectivity to external third parties, like Calero.

In August 2022, Calero-MDSL announced the acquisition of Network Control, a telecom expense and managed mobility services vendor based in Waverly, Iowa. This acquisition continued the acquisitive streak of Calero-MDSL and increased its status as the largest telecom expense management solution in terms of spending under management.

In June 2022, Tangoe, the leading technology expense and asset management solution for more than 20 years, unveiled a suite of curated bundles of their full-lifecycle expense management and optimization platform, Tangoe One. The new tiered packages are designed to help mid-size businesses access the Tangoe One platform to simplify, manage, and optimize telecom, mobile, and cloud assets and expenses from one consolidated portal.

In February 2022, Tellennium, a technology expense management company, announced that its Management of Things (MoT) platform had been completely registered with the US Patent and Trademark Office. MoT is a next-generation telecom expense management platform and service solution for mid-to-large organizations, launched in 2021. MoT is a real-time centralized database that gives users comprehensive information about customer invoice expenses, services, and assets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porters Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Mobile Phones and Other Portable Devices

- 5.1.2 Significant Cost Reduction and Expense Visibility

- 5.2 Market Restraints

- 5.2.1 Lack of Interoperability Due to Set Industry Standards

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Invoice Management

- 6.1.2 Sourcing Management

- 6.1.3 Business Management

- 6.1.4 Dispute Management

- 6.1.5 Other Solutions

- 6.2 By Service

- 6.2.1 Hosted Service

- 6.2.2 Managed Service

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Consumer Goods & Retail

- 6.3.3 Manufacturing

- 6.3.4 IT & Telecom

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sakon Inc.

- 7.1.2 Avotus Corporation

- 7.1.3 Tangoe, Inc.

- 7.1.4 Calero-MDSL

- 7.1.5 WidePoint Solutions Corporation

- 7.1.6 Valicom Corporation

- 7.1.7 Upland Software Inc. (Cimpl)

- 7.1.8 CGI Inc.

- 7.1.9 TeleManagement Technologies Inc.

- 7.1.10 Auditel Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET