PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1651046

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1651046

Telecom Billing Revenue Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

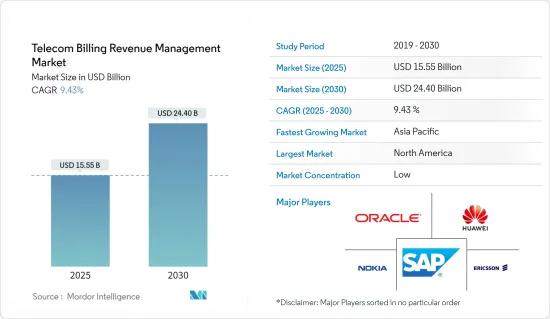

The Telecom Billing Revenue Management Market size is estimated at USD 15.55 billion in 2025, and is expected to reach USD 24.40 billion by 2030, at a CAGR of 9.43% during the forecast period (2025-2030).

Communication Service Providers (CSP) worldwide are experiencing increased subscribers, causing significant issues, including network congestion and call drops. To curb these issues, users have started to demand that CSPs deploy efficient and effective billing and revenue management systems.

Key Highlights

- The process of managing telecom billing and revenue includes the management of debt collection as well as communication services. The procedure involves calculating billing and charging information, managing the customer's payments and invoices, and providing information on data utilization. By optimizing the telecom networks, these solutions are frequently employed by telecommunication and digital service providers to increase operational efficiency.

- In the last decade, the global telecom market has changed dramatically, from the rise of cloud-native businesses that interact with customers via the Internet to the rapid migration of content, applications, and services to the cloud. CSP providers have spent billions upgrading their networks to meet the demand. However, many CSPs continue to operate with traditional business support systems that need more modern revenue management capabilities. Therefore, many CSPs worldwide are adopting current billing and revenue management systems.

- Telecom billing and revenue management platform solutions enable telecom service providers to launch the latest services in the market and help leverage their customer relationships. and develop a sense of harmony between the service providers and end-users. Also, the emergence of software-as-a-service (SaaS) platforms further leverages market growth.

- Vendors in the telecom industry use these software solutions to help detect and manage anomalies in the spectrum and eventually decrease operational costs. Also, these tech-enabled programs further assist the CSPs in increasing their revenue by rectifying problems and deploying new measures to optimize network service and visibility.

- Further, in the current market scenario, CSPs require real-time billing and policy control capabilities to help seize and monetize all IP 5G opportunities, including new use cases, devices, business models, and partnerships. With the growing complexity of managing diverse partners, challenges such as efficiently managing partners, including interconnect, wholesale, OTT/content players, distributors, interconnect, MVNOs, and agents, among others.

- Additionally, with the digital economy accelerating consumption, traditional billing systems can only keep up with a lack of on-demand design or customization. With the new generation of billing systems, build on agile principles in terms of services and products through a flexible business rule engine. The business script helps CSP reduce the time-to-market (TTM) from months to hours. thereby driving demand among the end-users.

- The recent outbreak of the COVID-19 pandemic resulted in a shift in company policies towards work-from-home policies. This remote work from home increased the data consumption of the telecom towers. For instance, two Indian telecom operators reported substantial revenue and earnings before interest, taxes, depreciation, and amortization (EBITDA) growth in the three months ending June (Q1 FY2021) due to tariff growth and higher data usage, defying the economic slowdown from the countrywide lockdown of 68 days up to May-end. The increasing number of devices using the Internet for work from home through mobile phones resulted in an increase in data usage. This increased the demand for telecom billing and revenue management.

Telecom Billing and Revenue Management Market Trends

Mobile Operators to Account Major Market Share

- The proliferation of smartphone users, coupled with numerous mobile applications, has enabled unprecedented growth in subscribers. For instance, According to Cisco Systems, as of 2022, there were around 5.7 billion smartphone users worldwide. This has resulted in significant demand for the capacity of mobile network providers.

- The mobile operators leverage the demand by deploying new technologies such as 5G, Volte, and Vowifi and adding networking capacities. Evidently, the OSS and BSS carrier-class billing solutions also need to keep up the pace and are required to support millions of simultaneous transactions.

- The market for revenue management systems for telecom invoicing in Europe will increase. Government efforts to promote 5G connectivity are expanding, and key market players are becoming more prevalent in the area, which can be attributed to the market's development. Additionally, the demand for efficient invoicing and revenue management systems and services is growing as mobile users grow and telecom service companies continuously add new services to their portfolios.

- Also, owing to the increase in the competitive landscape of the telecom industry worldwide, led by innovations in network capabilities, service, and other customer experience management enhancements, mobile operators are able to focus on strategies to help accelerate new product and service launches backed by a robust revenue-sharing model. By leveraging solutions such as telecom billing revenue management, operators can automate the business process, such as maintaining billing accuracy and improving customer experience by managing end-to-end disputes.

- Additionally, the solution would also enable mobile operators to save costs by eliminating the fraud associated with managing the stakeholders' revenue shares. For instance, according to the Communications Fraud Control Association (CFCA), mobile operators worldwide lose around USD 38 billion annually due to fraud and uncollected revenues.

North America to Hold Major Share

- North America is expected to hold a significant market share due to its significantly mature telecom industry. For instance, following several commercial 5G launches by major US mobile operators, the region now has prominent 5G coverage. In fact, a GSMA study estimates that 5G adoption in North America will rise to 46% by 2025, i.e., 200 5G connections.

- The study further reveals that around 321 million unique mobile subscribers in North America represent 83% of the population. Additionally, by 2025, the number is forecast to reach 345 million, i.e., 85% of the population.

- Additionally, the United States is among the nations with the highest levels of technological adoption worldwide. The nation is renowned for its ground-breaking startups. This high share is mostly due to the market's adoption of cutting-edge technology and the increased demand from the telecom industry. Due to the adoption of cutting-edge technologies like IoT, 5G, analytics, and cloud, the U.S. also dominated the telecom billing and revenue management market in terms of revenue.

- The increasing number of subscribers, coupled with high consumer spending on various mobile services and the presence of a few of the prominent players in the region, including Amdocs, Oracle, CSG International, and HPE, among others, is set to leverage market growth. Additionally, the region's communication industry is well-established and has a high penetration of telecom products and services. The region's telecom sector produces a vast amount of data, which in turn is increasing demand for telecom billing and revenue management.

- Additionally, the post-COVID-19 situation as the region emerged from lockdown, the backdrop of new ways of working, and potential shifts in the dominant globalization telecom model in the region enabled an acceleration in the rate of automation of services. These services include billing and revenue management. This instance is expected to further leverage the market's growth going forward.

Telecom Billing and Revenue Management Industry Overview

The telecom billing revenue management market is very competitive and moving towards fragmentation as it currently consists of many players. Several key players in the global telecom billing revenue management market are making constant efforts to bring product advancements. A few prominent companies are entering into collaborations and are also expanding their footprints in developing regions to consolidate their positions in the market. The major players are Ericsson, Huawei Technologies, SAP SE, and Oracle Corp., among others.

- January 2023 - Ericsson and Ooredoo Kuwait teamed up to roll out Ericsson billing across their networks. The billing system update helped create competitive marketing plans for 5G products while also enabling 5G evolution across Ooredoo Kuwait's network.

- January 2023 - NEC Corporation gave NTT DOCOMO a charging gateway function (CGF) for the high-performance processing of billing information. The CGF supports new services' quick start, provision, and monetization by organizing the diverse range of billing information sent from 5GC and connecting to the BSS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Number of Cellular or Mobile Subscribers

- 4.2.2 Growing Complexities in Revenue Sharing Across the Telecom Ecosystem

- 4.3 Market Restraints

- 4.3.1 Presence of Stringent Telecom Regulations

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Type

- 5.2.1 Software

- 5.2.2 Service

- 5.3 By Operator

- 5.3.1 Mobile Operator

- 5.3.2 Internet Service Provider

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 NetCracker Technology Corporation

- 6.1.2 CSG Systems International Inc.

- 6.1.3 Oracle Corporation

- 6.1.4 Ericsson

- 6.1.5 Huawei Technologies

- 6.1.6 SAP Se

- 6.1.7 Nokia

- 6.1.8 Comarch SA

- 6.1.9 Optiva, Inc.

- 6.1.10 Enghouse Networks

- 6.1.11 Sterlite Technologies Limited

- 6.1.12 Intracom Telecom SA

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS