PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1436130

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1436130

MEA Venture Capital - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

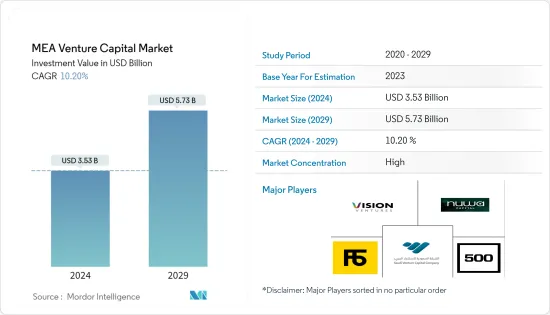

The MEA Venture Capital Market size in terms of investment value is expected to grow from USD 3.53 billion in 2024 to USD 5.73 billion by 2029, at a CAGR of 10.20% during the forecast period (2024-2029).

The outbreak of the Covid-19 pandemic had a significant impact on the global economy, including the venture capital market in the Middle East and Africa (MEA) region. The pandemic caused a slowdown in venture capital investment activity in the first half of the previous year, as investors adopted a more cautious approach due to the economic uncertainty caused by the pandemic. However, investment activity began to pick up in the year's second half, with several notable investments made in the region. The pandemic accelerated the adoption of digital technologies and e-commerce platforms, increasing investment in start-ups and early-stage companies operating in these sectors. While the COVID-19 pandemic presented significant challenges to the MEA venture capital market, it also created new opportunities for investment in sectors that are seeing increased demand due to the pandemic.

With ongoing development and high investor confidence, Middle East and Africa-based start-ups saw a record investment of just over USD 1 billion in the previous year, a 13% increase year over year. It was largely due to huge investments in start-ups such as EMPG (USD 150 million), Kitopi (USD 60 million), and Vezeeta (USD 40 million) in the first half of the year. Historically, the UAE, Egypt, and the Kingdom of Saudi Arabia were the most established innovation centers in the Middle East and Africa, accounting for 65% of agreements in the previous year. Other nations accounted for 25% of all investors in Middle East and Africa-based start-ups in the previous year 2020, demonstrating a strong foreign interest in the region's start-ups.

The Middle East and African start-up scene is similarly capturing attention. It is due to the number of quality entrepreneurs and the significant acquisitions of regional E-Commerce leader souq.com by Amazon (for almost USD 600 million) and the rideshare platform Careem by Uber for over USD 3 billion. Countries in the Gulf leaned forward in regulatory environments to welcome innovative talent and streamline the rule of law to support FinTech and more. The Kingdom of Saudi Arabia's Vision 2030 strategic policy positions start-ups and SMEs as key factors in the kingdom's economic prosperity. The International Finance Corporation (IFC), a member of the World Bank Group, announced it was partnering with the Egyptian FinTech Association on the IFC'S Fintech Acceleration Programme to support innovation and entrepreneurship in the country.

MEA Venture Capital Market Trends

The United Arab Emirates Attracts Higher Investments in the region

The Middle East and Africa (MEA) venture capital market has been growing rapidly in recent years, with a significant increase in investment activity and funding. The United Arab Emirates (UAE) is emerging as a leading destination for venture capital investment in the region. The UAE's favorable business environment, coupled with its strategic location and government support for entrepreneurship and innovation, has made it an attractive destination for venture capital investors. The UAE accounted for 68% of total venture capital funding in the MEA region in the previous year.

The UAE's strong startup ecosystem, with a growing number of incubators, accelerators, and co-working spaces, has also played a vital role in attracting venture capital investment. The country has a thriving technology sector, with startups working on innovative solutions in areas such as e-commerce, fintech, and health tech. Furthermore, the UAE's commitment to digital transformation, including adopting emerging technologies such as artificial intelligence and blockchain, has also created opportunities for startups to develop cutting-edge solutions and attract venture capital funding.

Overall, the UAE's efforts to create a favorable environment for startups and entrepreneurs, coupled with its strategic location and government support, have helped it become a leading destination for venture capital investment in the MEA region. As the region continues to grow and mature, likely, the UAE's role in the venture capital market will only become more prominent.

Favorable Demographics in the Region are Boosting the Venture Capital Market

There are enormous advantages demographically. Of over 400 million people in the region, 31% are under 15. Unlike other ecosystems like China, which must navigate an aging population, the Middle East and Africa include an enormous youth 'opportunity,' where half or more of the populations in most countries are under 35. Young people are connected, as smartphone penetration exceeds 100% in parts of the Gulf. They are enthralled by entrepreneurship and are beginning to see it as a viable path to economic prosperity in a societal structure where most graduates expect a government job.

In addition to youth, women are often leading the charge. Women's participation rate in startups is higher than most regional corporations. Women's entrepreneurship in the Middle East is higher than in many parts of the world. While it is still early days, the impact on job creation is visible, with startups employing thousands of people regionally and, more importantly, making them shareholders in the business.

MEA Venture Capital Industry Overview

The Middle East and Africa Venture Capital Market are fragmented. Around 40% of UAE-based startup investors came from outside the region. Some of the topmost active investors across the region are 500 startups, Falt6Labs Bahrain, Vision Ventures, Wamda Capital, Saudi Venture Capital (SVC), Algebra Ventures, Global Ventures, Beyond Capital, Nuwa Capital, Phoenician Funds, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Funding and Revenue Statistics in Venture Capital Space of Middle East and Africa

- 4.3 Market Drivers

- 4.4 Market Restraints

- 4.5 Value Chain/ Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/ Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Government Regulations and Industry Policies

- 4.8 Imapct of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Local Investors

- 5.1.2 International Investors

- 5.2 By Industry

- 5.2.1 Real Estate

- 5.2.2 Financial Services

- 5.2.3 Food & Beverage

- 5.2.4 Healthcare

- 5.2.5 Transport and Logistics

- 5.2.6 IT and ITeS

- 5.2.7 Education

- 5.2.8 Other Industries (Energy, etc.)

- 5.3 By Country

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 Egypt

- 5.3.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 500 Startups

- 6.2.2 Vision Ventures

- 6.2.3 Falt6Labs Bahrain

- 6.2.4 Wamda Capital

- 6.2.5 Saudi Venture Capital (SVC)

- 6.2.6 Algebra Ventures

- 6.2.7 Global ventures

- 6.2.8 Beyond Capital

- 6.2.9 Nuwa Capital

- 6.2.10 Phoenician Funds*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER