PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851536

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851536

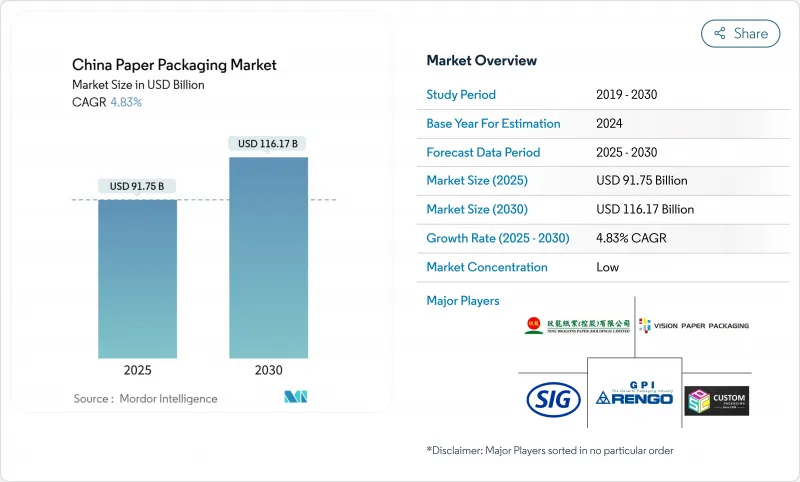

China Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China paper packaging market size stands at USD 91.75 billion in 2025 and is forecast to climb to USD 116.17 billion by 2030, registering a 4.83% CAGR over the period.

Expansion continues despite pulp-price cycles because e-commerce parcel volumes, government plastic-reduction mandates, and food-service growth all channel fresh demand into corrugated and folding-carton formats. Recycled fiber adoption accelerates as China's national carbon-credit scheme rewards manufacturers that raise recovered-content ratios, while advanced digital printing lets brands run short, customized campaigns without inventory waste. Domestic leaders such as Nine Dragons Paper and Sun Paper Group extend capacity through high-speed corrugators and board machines, yet volatility in imported wood fiber and dynamic electricity pricing keeps cost pressure high. Provincial variability in green-packaging enforcement adds complexity, prompting firms to localize formulations and invest in quality-control systems that meet GB 43352-2023 limits on heavy metals and restricted substances.

China Paper Packaging Market Trends and Insights

Growth in e-commerce parcel volume

Express delivery handled 174.5 billion items in 2024, with corrugated packaging accounting for 96.17% of box material, ensuring resilient baseline consumption for the China paper packaging market. Metro-based logistics hubs in Beijing and Shanghai compress last-mile costs and shorten delivery times, but they also intensify performance requirements for secondary boxes that must survive multiple handling cycles. Alibaba's pilot rocket-delivery initiative, targeting one-hour global drop-offs, exemplifies how extreme speed pushes packaging designers to optimize weight-to-strength ratios while preserving shock resistance. QR-code serialization and RFID inserts increasingly appear on shipping cartons, enabling inventory visibility and returns automation. Together these developments cement e-commerce as the structural backbone for the China paper packaging market.

Expansion of food-service and delivery ecosystem

Takeaway orders generate high-density waste in core commercial grids where the top 10% of zones account for 64% of packaging discards, driving restaurants to switch to lighter, fiber-based solutions. Reusable, bagasse-molded trays developed by domestic suppliers such as Sumkoka gain traction among premium franchises, while biosensor labels that track freshness support longer delivery radii without safety compromises. Multinational quick-service chains pilot washable dine-in containers, indicating the direction of future compliance as provincial regulators tighten thresholds on single-use plastics. These factors collectively add momentum to the China paper packaging market.

Volatile waste-paper import rules and raw-material supply

China imported 28 million tons of market pulp in 2023, a 24% rise that exposes mills to freight disruptions and tariff shifts. The ban on post-consumer fibre imports keeps domestic recyclers running near full capacity, raising recovered-paper prices and occasionally forcing converters to down-spec grammage. Tariff cuts on finished paper boost competition from ASEAN mills, eroding domestic margins during price troughs. These dynamics trim growth expectations for the China paper packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Government plastic-reduction mandates favouring paper

- Advanced digital printing and smart-packaging integration

- Escalating energy costs amid decarbonisation targets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corrugated boxes generated 36.24% of China paper packaging market size in 2024 as express freight required light, crush-resistant formats. Dongguan Huangshi Jinhui's 352 m-per-minute corrugator exemplifies capacity build-out that secures just-in-time supply for e-commerce hubs. Yet folding cartons, buoyed by cosmetics premiumisation, are pacing a 7.84% CAGR that will erode corrugated dominance through 2030. Multi-pass digital presses support varnish effects and spot-foil accents without forcing long makeready times, letting boutique beauty labels print limited editions that fetch high margins. Liquid packaging cartons maintain niche relevance by leveraging SIG's alu-layer-free technology, which cuts carbon footprints by 61% while safeguarding dairy shelf life. Speciality sub-lines, including tamper-evident pharma sleeves, grow steadily as healthcare spending rises in urban markets.

Food products held 41.32% of China paper packaging market share in 2024 because takeaway dining dominates urban consumption. Meal-box density spikes in grid hotspots, prompting municipalities to trial closed-loop collection that feeds recycled-fibre mills. Personal-care and cosmetics, though smaller, expand 8.21% yearly on the back of online beauty influencers and rising disposable income. Amcor's recycle-ready pouches and refill pods serve shampoo refill stations in tier-one malls, illustrating how functionality merges with sustainability. Electronics brands demand anti-static, moisture-barrier liners, a lucrative cross-over that corrugated suppliers address by grafting nanoclay coatings onto fluting. Healthcare packaging integrates smart labels for temperature logging, ensuring drug integrity across regional cold chains.

The China Paper Packaging Market Report is Segmented by Product Type (Folding Cartons, Corrugated Boxes, Paper Bags and Sacks, Liquid Packaging Cartons, and More), End-User Industry (Food, Beverage, Healthcare, Personal Care, Household Care, Electronics, and More), Material Type (Virgin Fibre-Based, Recycled Fibre-Based), Packaging Level (Primary, Secondary, Tertiary), and Geography (China). Market Forecasts are in Value (USD).

List of Companies Covered in this Report:

- Nine Dragons Paper (Holdings) Ltd

- Lee & Man Paper Mfg Ltd

- Shanying International Holdings Co., Ltd

- Dongguan Vision Paper Products Co., Ltd

- Rengo Co., Ltd

- Oji Holdings Corp (China Packaging)

- SIG Combibloc Group

- Shanghai Custom Packaging Co., Ltd

- Xiamen Hexing Packaging & Printing Co., Ltd

- JML Packaging

- Suneco Box Co., Ltd

- Asia Pulp & Paper (APP) Sinar Mas

- Shanghai DE Printed Box

- Mondi Group

- Smurfit WestRock

- International Paper (China)

- Yutong Packaging Technology

- Zhejiang Jingxing Paper

- Guangdong Yizhou Packaging

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in e-commerce parcel volume

- 4.2.2 Expansion of food-service and delivery ecosystem

- 4.2.3 Government plastic-reduction mandates favouring paper

- 4.2.4 Advanced digital printing and smart-packaging integration

- 4.2.5 Cross-border e-commerce consolidation boosting corrugated demand

- 4.2.6 National carbon-credit scheme accelerating recycled-content uptake

- 4.3 Market Restraints

- 4.3.1 Volatile waste-paper import rules and raw-material supply

- 4.3.2 Competition from recyclable mono-material plastics

- 4.3.3 Escalating energy costs amid decarbonisation targets

- 4.3.4 Pulp price cycles and domestic wood-pulp shortfall

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 China Pulp and Paper: Opportunities for Foreign Investors

- 4.9 ESG and Sustainability Initiatives

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Folding Cartons

- 5.1.2 Corrugated Boxes

- 5.1.3 Paper Bags and Sacks

- 5.1.4 Liquid Packaging Cartons

- 5.1.5 Other Product Types

- 5.2 By End-user Industry

- 5.2.1 Food

- 5.2.2 Beverage

- 5.2.3 Healthcare and Pharmaceuticals

- 5.2.4 Personal Care and Cosmetics

- 5.2.5 Household Care and Detergents

- 5.2.6 Electronics and Electrical Products

- 5.2.7 Other End-user Industries

- 5.3 By Material Type

- 5.3.1 Virgin Fibre-based

- 5.3.2 Recycled Fibre-based

- 5.4 By Packaging Level

- 5.4.1 Primary Packaging

- 5.4.2 Secondary Packaging

- 5.4.3 Tertiary Packaging

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nine Dragons Paper (Holdings) Ltd

- 6.4.2 Lee & Man Paper Mfg Ltd

- 6.4.3 Shanying International Holdings Co., Ltd

- 6.4.4 Dongguan Vision Paper Products Co., Ltd

- 6.4.5 Rengo Co., Ltd

- 6.4.6 Oji Holdings Corp (China Packaging)

- 6.4.7 SIG Combibloc Group

- 6.4.8 Shanghai Custom Packaging Co., Ltd

- 6.4.9 Xiamen Hexing Packaging & Printing Co., Ltd

- 6.4.10 JML Packaging

- 6.4.11 Suneco Box Co., Ltd

- 6.4.12 Asia Pulp & Paper (APP) Sinar Mas

- 6.4.13 Shanghai DE Printed Box

- 6.4.14 Mondi Group

- 6.4.15 Smurfit WestRock

- 6.4.16 International Paper (China)

- 6.4.17 Yutong Packaging Technology

- 6.4.18 Zhejiang Jingxing Paper

- 6.4.19 Guangdong Yizhou Packaging

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment