PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523321

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523321

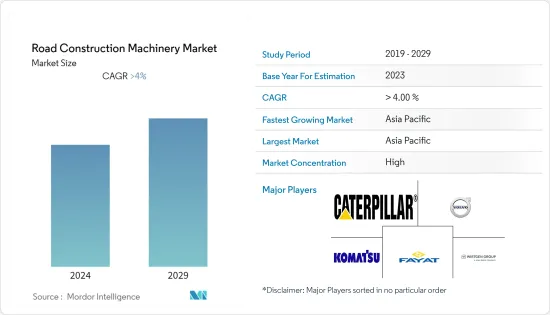

Road Construction Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Road Construction Machinery Market size is estimated at USD 189.16 billion in 2024, and is expected to reach USD 231.81 billion by 2029, growing at a CAGR of 4.15% during the forecast period (2024-2029).

The increase in road construction activity is expected to drive the demand for road construction machinery. Various government programs, such as stimulus packages and infrastructure developments, encouraged road construction equipment to drive market expansion between 2024 and 2029.

Over the long term, increasing investments in road projects, the launch of electric road construction machinery, and the replacement of older fleets by newer machines are creating demand in the construction equipment industry with a surge in sales of road construction machinery. However, the increasing demand for rental machinery services is expected to act as a restraint for the market's growth, as renting machinery is preferred by small and medium-scale companies to lessen the costs of labor, training, and equipment purchases.

Furthermore, digitalization, connectivity, and automation are driving market development forward, substantially impacting construction projects. Construction and construction materials companies are geared up to invest in new technologies to cope with the increasing demand for advanced construction machinery and replace the older ones with new or upgraded machinery fleets. Additionally, an increase in the number of favorable government policies aimed at encouraging the Public-Private Partnership (PPP) model is also expected to bode well for the growth of the road construction equipment market from 2024 to 2029.

Road Construction Machinery Market Trends

The Motor Graders Segment is Expected to Register the Fastest Growth Between 2024 and 2029

The road construction industry is a significant driver of demand for motor graders across the world, with major projects such as highways, airports, and public facilities requiring the use of these machines for grading and leveling roads and other surfaces.

The increasing trend toward urbanization also fuels demand for motor graders as developers seek to build and maintain better roads and transport networks in crowded city centers. As a result of the evident need for motor graders, multiple equipment manufacturers across the world have been introducing new products to cater to the market demand. For instance,

- In April 2023, Bell Equipment's new range of motor graders, G140, was announced. This new equipment is well suited to all maintenance and light to medium construction tasks and is fitted with the ZF Ergopower transmission.

- In March 2023, Clairemont Equipment Company is set to broaden its operational reach by extending its Komatsu territory from San Diego to Los Angeles. This expansion positions the company as the designated sales and service provider for Komatsu construction equipment across the entirety of southern California, United States.

Moreover, developing nations are undertaking large-scale projects such as highway extensions and expressways to connect towns and villages. As a result, road construction equipment is expected to see a significant demand between 2024 and 2029. The increase in motor graders, backhoe loaders, and excavators count indicates the road construction equipment market's incremental growth.

- In September 2023, the Government of Germany announced an investment of EUR 269.6 billion (USD 299.6 billion) for the development of road transport infrastructure across the country.

Due to such aforementioned factors and the rise in construction and infrastructure development activities, this market segment is anticipated to witness a significant growth rate between 2024 and 2029.

Asia-Pacific is Anticipated to Capture a Major Market Share in the Market

Asia-Pacific is expected to play a significant role, followed by North America and Europe. Asia-Pacific is a significant market for road construction machinery, such as motor graders, compactors, road rollers, and pavers. India and China are some of the largest markets for road machinery in the world, contributing more than 25% of the worldwide road machinery sales, thus making Asia-Pacific the most lucrative market for road construction machinery.

The Indian government aims to elevate the country to a multi-trillion-dollar economy by 2026, with infrastructure development playing a pivotal role. The construction sector, constituting about 8% of India's GDP and being the second-largest employer, is poised for significant growth, offering over 50 million job opportunities. With an expected valuation of USD 1.4 trillion in the coming years, the construction segment presents unprecedented opportunities. For instance,

- In June 2022, the Minister of Road Transport and Highways inaugurated 15 projects related to national highways in Patna and Hajipur, Bihar, with a total investment of USD 1.7 billion.

- India allocated USD 2.67 billion to expand its national highway networks by 25000 kilometers under the PM GATI SHAKTI initiative in 2022.

- Similarly, China had set up a USD 74.69 billion infrastructure fund to spur infrastructure spending in 2022. These initiatives are anticipated to further boost the demand for road construction machinery in Asia-Pacific.

Furthermore, several players in the Asia-Pacific road construction machinery market are establishing various business strategies to enhance the market offering, and a few companies are introducing new products. For instance,

- In March 2023, Sandvik AB, a Sweden-based construction and mining equipment manufacturer, announced the establishment of a new production unit in Malaysia for manufacturing underground loaders and construction dump trucks. Equipment production is planned to begin in Q4 2023. The company set an annual manufacturing capacity that is planned to increase gradually to 300 loaders and dump trucks and 500 battery cages by 2030.

- In September 2023, SANY Group, a China-based industrial and construction equipment manufacturer, opened its subsidiary in Quezon City, Manila, Philippines.

Considering the aforementioned factors and product launches in major international markets, like India, China, Japan, Malaysia, and the Philippines, the Asia-Pacific road construction machinery market is expected to have steady growth during the study period.

Road Construction Machinery Industry Overview

The road construction machinery market is moderately fragmented. The market is characterized by the presence of several players who have secured long-term supply contracts with major infrastructure companies and government agencies. These players also engage in joint ventures, mergers and acquisitions, new product launches, and product development to expand their brand portfolios and cement their market positions. For instance,

- In July 2023, Volvo Construction Equipment, a Sweden-based construction equipment manufacturer, announced a new dealership facility in the Malaysian state of Borneo to better serve customers. The Borneo VCE dealership is a sub-dealer of Volvo Construction Equipment Malaysia, and it will be responsible for sales of articulated haulers, compact excavators, compact wheel loaders, crawler excavators, wheel loaders, and wheeled excavators. It will provide total sales and service support to the company's product line.

- In April 2023, Nasser Bin Khaled Heavy Equipment, a subsidiary of NBK Group, announced the supply of the latest machinery and equipment from the prominent brand "Hixen" by Shandong Hixen Machinery to the Qatari market. Hixen machinery mainly includes crawler excavators, wheel excavators, wheel loaders, backhoe loaders, and skid steer loaders.

- In February 2023, CASE Construction Equipment launched the new joystick levers for the 836C and 856C motor graders. The new joystick control delivers improved moldboard control, along with a range of steering upgrades, which are an addition to the grader's already great features.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Infrastructure Development and Highway Construction Activities to Drive the Market

- 4.2 Market Restraints

- 4.2.1 Lack of Skilled Labor May Hamper the Market Expansion

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market size Value in USD billion)

- 5.1 By Machine Type

- 5.1.1 Motor Graders

- 5.1.2 Road Roller

- 5.1.3 Wheel Loaders

- 5.1.4 Concrete Mixer

- 5.1.5 Others

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 South America

- 5.2.4.2 Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Sany Heavy Industry Co. Ltd

- 6.2.2 Caterpillar Inc.

- 6.2.3 Palfinger AG

- 6.2.4 Terex Corporation

- 6.2.5 Liebherr-International AG

- 6.2.6 Deere & Company

- 6.2.7 Zoomlion Heavy Industry Science and Technology Co. Ltd

- 6.2.8 Komatsu Ltd

- 6.2.9 Wirtgen Group

- 6.2.10 Fayat Group

- 6.2.11 Wacker Neuson Group

- 6.2.12 Ammann Group

- 6.2.13 CNH Industrial

- 6.2.14 Volvo CE

- 6.2.15 Hitachi Sumitomo Heavy Industries Construction Cranes Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS