PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644392

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644392

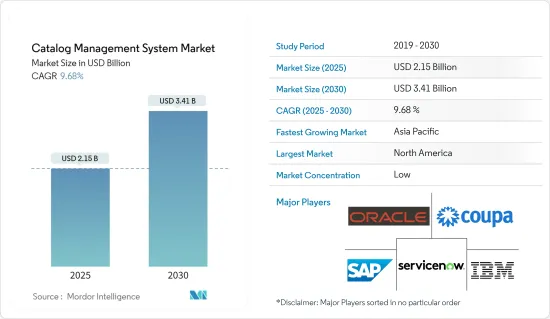

Catalog Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Catalog Management System Market size is estimated at USD 2.15 billion in 2025, and is expected to reach USD 3.41 billion by 2030, at a CAGR of 9.68% during the forecast period (2025-2030).

The requirement to have centrally managed product and service data, increasing customer requirements, and expanding the number of digital transformation initiatives in the retail and e-commerce industry verticals are determinants driving the growth of the catalog management market.

Key Highlights

- Catalog management systems enable companies to manage their product data in a single system, resulting in vast catalogs with optimum layout and design. Catalog management systems streamline workflow and manage catalog modifications across all channels, locations, and platforms. Catalog management makes creating tailored and seasonal catalogs for many industries easier, resulting in new business Opportunities.

- The cloud deployment model would grow tremendously in the catalog management systems market. Significant factors include interactive dashboards, ease of flexibility, enhanced security features, and better scalability that could promote businesses to utilize cloud deployment. In addition, SMEs prefer the cloud-deployed catalog management system because of its economic benefits and drive the global market.

- Customers globally are becoming tech-savvy and prefer to engage with businesses via digital channels, such as social media, mobile apps, and websites. Hence, nowadays, this industry vertical is wholly focused on customer satisfaction, requirements, and feedback and is adopting digital technologies.

- Moreover, the e-commerce and retail industry verticals strategize customer engagement channels to fulfill the needs of technologically advanced consumers. For example, Vue.ai uses AI to enhance product data, control content, create graphics, and assist retailers in creating organized Catalogs.

- Data collection and transmission from one channel to another are involved in catalog management. Catal catalog management systems also include data synchronization and publication across channels. Many businesses believe that catalog management systems could result in data breaches in their highly abstracted data sets because they lack sufficient information about security frameworks and how to implement them. Concerns regarding data security are the main barriers limiting the adoption of catalog management solutions.

- In addition to capturing and uploading data and mapping it to consumer demands, these systems offer a fast overview of the products in a channel. They also assist in real-time data validation, enrichment, and augmentation. They automate the production of catalog information utilizing data from many sources to enhance product assortment and accomplish quicker product data syndication across channels. After the pandemic, the market has been proliferating with increased digital transformation activities in various sectors.

Catalog Management System Market Trends

Growing Digital Transformation Initiatives Drives the Market

Growing digital transformation initiatives in the retail and e-commerce sectors are driving the catalog management system market. Customers throughout the globe are growing more tech-savvy, preferring to interact with businesses through digital channels such as social media, smartphone applications, and websites. This industrial vertical is very concerned with customer satisfaction, requirements, and feedback, and it is progressively embracing digital technology. Furthermore, the retail and e-commerce sector vertical is designing customer interaction methods to meet the global need for digitally sophisticated customers.

With the increasing need for smartphones and other data-hungry devices in the digital era, giving customers the right products at the right time continues to challenge CSPs. It can be challenging for CSPs to efficiently create, manage, and monetize data offers. A centralized product catalog assists in seizing revenue-generating opportunities, reducing time-to-market (TTM), delivering unparalleled Quality of Experience (QoE), retaining a profitable subscriber base, reducing churn, and improving brand loyalty.

Furthermore, the increasing affordability of catalog management software is likely to propel the catalog management system market forward. Furthermore, the growing desire for centralized systems for better marketing and selling products and services is driving global demand. Small and medium-sized businesses and huge corporations use advanced software and services to centrally handle offers/discounts, product data, payment systems, and inventories. The newest technologies, such as artificial intelligence, are likely to improve the capabilities of catalog management solutions substantially, providing great growth potential to the catalog management systems market.

To develop and improve their company operations, industries such as BFSI, retail, and healthcare have invested in and adopted new technologies such as Artificial Intelligence (AI) and Machine Learning (ML) by picking data from reliable sources, contextual suggestions, and product rankings, AI-enabled catalog management delivers enrichment procedures, anomaly detection, and automatic classification of items. AI-powered catalog management system solutions may generate automatic perceptions of data problems and aid in the creation of a unified perspective of the data.

According to IHL Group, Retailers using artificial intelligence (AI) and machine learning (ML) technologies performed better than their competitors. In 2023 and 2024, retail companies using this kind of technology saw a two-digit growth in their sales compared to previous years. Similarly, their annual profit grew by roughly eight percent, outperforming retailers who did not use AI or ML solutions.

Asia Pacific is Expected to be the Fastest Growing Market

APAC is foreseen to be the fastest-growing region in the global catalog management systems market during the forecast period. Rapid economic developments, digitalization, globalization, and the increased adoption of cloud-based technologies are expected to drive the APAC region's catalog management systems market.

The catalog management market in Asia-Pacific is expected to be fueled by an increase in the adoption of catalog management solutions by many SMEs in the region. The growth of the e-commerce sector in the region is also estimated to drive the catalog management market during the forecast period.

According to the India Brand Equity Foundation, the Indian e-commerce sector is expected to grow by 21.5% and reach USD 74.8 billion in the previous year. By 2030, it is anticipated that India's e-commerce business will be worth USD 350 billion. In addition, the surge in internet and smartphone usage has spurred the country's industry's growth.

The GSMA community has swiftly expanded to over 2,000 members from over 60 countries, with more growth expected in the current year, with inaugural members including AIS, Axiata, depa, DHL, Globe, Huawei, Kominfo, Maxis, MDEC, Schneider Electric, Telkomsel, and Viettel. The ecosystem was created to facilitate collaboration on Sector 4.0 and digital transformation built on 5G networks, edge-cloud services, enterprise IoT, and AI for all players in the 5G industry, including government agencies, industry groups, and mobile network providers. This shows the growth potential of digital transformation of businesses in the region and driving the market in APAC.

The need for cost optimization and effective utilization of IT and telecom infrastructures is expected to propel the demand for catalog management systems solutions and associated services.

Catalog Management System Industry Overview

The Catalog Management System Market is highly fragmented, with major players like IBM Corporation, Oracle Corporation, SAP SE, Coupa Software Inc., and ServiceNow Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

February 2024 - IBM Announced the availability of the Open-Source Mistral AI Model on Watsonx, expanding model choice to assist enterprises in scaling AI with trust and flexibility. IBM offers an optimized version of Mixtral-8x7B that offers the potential to cut latency by up to 75% - It adds to a growing catalog of IBM, third-party, and open-source models to give clients choice and flexibility - The latest open-source model available on watsonx AI and data platform with enterprise-ready AI studio, data store, and governance capabilities.

December 2023 - Salsify, one of the leading Product Experience Management (PXM) platforms, partnered with Mamenta, a pioneer in empowering brands to expand their global marketplace presence. Mamenta's robust catalog management capabilities and Salsify's PXM platform would enable brands to manage and optimize product catalogs efficiently.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Digital Transformation Initiatives

- 5.1.2 Necessity of Centralized Systems for Improved Marketing and Selling

- 5.2 Market Restraints

- 5.2.1 Privacy and Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Service Catalogs

- 6.1.2 Product Catalogs

- 6.2 By Deployment Type

- 6.2.1 Cloud

- 6.2.2 On-Premises

- 6.3 By Industry Vertical

- 6.3.1 IT and Telecom

- 6.3.2 Retail and E-commerce

- 6.3.3 BFSI

- 6.3.4 Media and Entertainment

- 6.3.5 Travel and Hospitality

- 6.3.6 Other Industry Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Oracle Corporation

- 7.1.3 SAP SE

- 7.1.4 Coupa Software Inc.

- 7.1.5 ServiceNow Inc.

- 7.1.6 Proactis Holdings Plc

- 7.1.7 Fujitsu Limited

- 7.1.8 Broadcom Corporation

- 7.1.9 Comarch SA

- 7.1.10 Zycus Inc

- 7.1.11 GEP Worldwide

- 7.1.12 Telefonaktiebolaget LM Ericsson

- 7.1.13 Salsify Inc.

- 7.1.14 Insite Software Solutions, Inc.

- 7.1.15 Amdocs

- 7.1.16 Vroozi, Inc.

- 7.1.17 Sellercloud Inc.

- 7.1.18 Plytix.com ApS

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET