PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523391

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523391

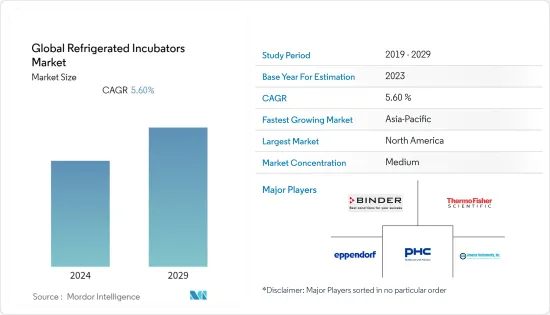

Global Refrigerated Incubators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Global Refrigerated Incubators Market size is estimated at USD 656.64 million in 2024, and is expected to reach USD 862.28 million by 2029, growing at a CAGR of 5.60% during the forecast period (2024-2029).

The refrigerated incubators market is expected to grow over the forecast period due to factors such as the rising adoption of refrigerated incubators for research activities targeting infectious diseases and increasing technological advancements in refrigerated incubators.

Research related to infectious diseases has been advancing, which is expected to create more demand for refrigerated incubators to maintain the optimum temperature required for specific reagents, microorganisms, etc., involved in the research. For instance, in September 2023, the University of Chicago received federal support with funding of USD 12.4 million from the National Institute of Allergy and Infectious Disease (NAID) to support research activities and studies in emerging infectious diseases. Such wide-scale research programs are expected to increase the demand for refrigerated incubators to maintain the optimum temperature of the microbes under study.

Additionally, technological advancements and the latest trends in the refrigerated incubator market, such as password-protected settings, door opening alarms, auto decontamination cycles, self-calibration, pre-set alarms, over-temperature alarms, and thermostats, safe, reproducible incubation, and even at high ambient temperatures are expected to drive the sales of refrigerated incubators during the forecast period. For instance, the new refrigerated incubators offered by Thermo Scientific, including Heratherm Refrigerated Incubators, Peltier Low-Temperature Incubators, and Precision Plant Growth Chambers, utilize powerful compressor technology. The technology is designed to provide optimal temperature conditions for applications that need thermal stability and uniformity above, around, or below the usual ambient laboratory temperature.

Moreover, the new product launches and strategic activities by major players in the market are positively affecting the growth of the market studied. For instance, in September 2023, Esco Lifesciences introduced the refrigerated incubator Isotherm, which was incorporated with pre-heat chamber technology, microprocessor PID technology, auto-defrost system, and other advanced features. It was available in various sizes, including 110 l, 170 l, and 240 l.

Therefore, owing to the aforementioned factors, including the increasing research and technological advancements of refrigerated incubators, the market studied is anticipated to witness growth during the forecast period. However, the availability of alternative incubators is likely to impede market growth.

Global Refrigerated Incubators Market Trends

51 to 200 l Segment is Expected to Witness Significant Growth During the Forecast Period

- The 51 to 200-l refrigerated incubators comprise powerful and highly efficient portable units with an internal fan to prevent thermal layering and keep a consistent temperature. Such incubators reduce daily manual tasks and repetitive instrument operations through real-time control.

- A wide range of applications of 51 to 200 l refrigerated incubators type involves microbiological analyses, determining germ count, biological specimen cultivation above and below room temperature, and accelerating aging tests. For instance, in November 2023, the Innovation Foundation at Oklahoma State University introduced the plan for Innovation Park and its aim to expand the services with genomic analysis capabilities by efficiently storing and managing biological samples from human, plant, and animal specimens for research activities in the future. Such factors highly support the adoption of refrigerated incubators in laboratories.

- Further, refrigeration plays a significant role in biologics maintenance, which increases awareness about the significance of refrigerated incubators, including 51 to 200-l refrigerated incubators that offer highly efficient refrigeration. Hence, owing to the above factors, the adoption of these products is likely to increase among the target population, driving market growth.

- Therefore, the 51 to 200 l segment is expected to witness significant growth during the forecast period due to the abovementioned factors, including its applications in the research.

North America is Expected to Witness Significant Growth During the Forecast Period

- North America is expected to witness significant growth during the forecast period, owing to factors such as the high burden of chronic and infectious diseases, high research investments, and the presence of leading players in the region. The region has a high prevalence of chronic and infectious diseases, requiring refrigerated incubators to maintain the optimum temperature of the therapeutic products. For instance, in November 2023, as per the data published by the Centers for Disease Control and Prevention (CDC), around 31 million people in the United States were infected with flu during 2022-2023. Further, as per the data published by the Canadian government in December 2023, over 163 laboratory-confirmed influenza outbreaks were reported in Canada from August 2023 to December 2023. These factors are expected to contribute to the growth of the market in North America.

- Furthermore, the high concentration of market players or manufacturers' presence in the region is also expected to drive the growth of the refrigerated incubators market in the country. For instance, in February 2023, PHC Corporation of North America (PHCNA) announced the launch of PHCbi brand VIP ECO SMART ultra-low temperature freezer series for use in facilities such as academic research institutes and pharmaceutical companies. These continuous product approvals in the region are anticipated to drive the country's growth in the market.

- Therefore, owing to the aforementioned factors, including the high burden of chronic and infectious diseases and the presence of leading market players, the market is anticipated to grow in North America.

Global Refrigerated Incubators Industry Overview

The refrigerated incubators market is fragmented in nature due to the presence of several companies operating globally and regionally. The key players operating in the market include Binder GmbH, Thermo Fisher Scientific, PHC Holdings Corporation, Eppendorf AG, and Amerex Instruments Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of Refrigerated Incubators for Research Activities Targeting Infectious Diseases

- 4.2.2 Increasing Technological Advancements in Refrigerated Incubators

- 4.3 Market Restraints

- 4.3.1 Availability of Alternative Incubators

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Type

- 5.1.1 Below 50 l

- 5.1.2 51 to 200 l

- 5.1.3 201 to 750 l

- 5.1.4 751 to 1,500 l

- 5.1.5 Above 1,501 l

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Research Laboratories and Academic Institutes

- 5.2.3 Pharmaceutical and Biotechnology Companies

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Binder GmbH

- 6.1.2 Thermo Fisher Scientific

- 6.1.3 PHC Holdings Corporation

- 6.1.4 Eppendorf AG

- 6.1.5 Amerex Instruments Inc.

- 6.1.6 Sheldon Manufacturing Inc.

- 6.1.7 LEEC Ltd.

- 6.1.8 Memmert GmbH + Co. KG

- 6.1.9 Benchmark Scientific

- 6.1.10 Gilson Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS