Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693657

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693657

Bus - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 307 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

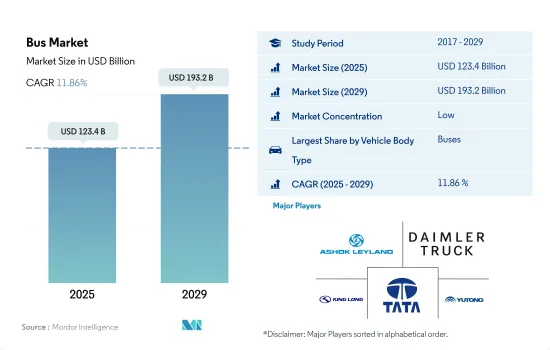

The Bus Market size is estimated at 123.4 billion USD in 2025, and is expected to reach 193.2 billion USD by 2029, growing at a CAGR of 11.86% during the forecast period (2025-2029).

Electric buses offer significantly lower total cost of ownership compared to diesel buses through reduced fuel and maintenance costs

- Fuel constitutes a major part of the operating cost of any vehicle. Using an electric bus for public transport reduces fuel costs, along with other upfront costs and the total cost of ownership. By 2030, the prices for electric buses are expected to decrease to the price level of diesel fuel buses. Electric buses help reduce 81-83% of the maintenance and operating costs compared to a diesel-engine bus.

- An electric bus costs USD 750,000 compared to USD 500,000 for a typical diesel transit vehicle. Despite their higher initial costs, electric buses are a cost-effective alternative. They offer lower operating costs due to lower maintenance and fuel expenditures, as well as greater cost predictability due to the relative stability of electricity prices compared to fossil fuel prices, resulting in significant savings over the course of their lifetime. With favorable legislation, electric buses are more financially feasible. Manufacturers of electric buses assert that these vehicles more than make up for their higher initial cost, with fuel savings of USD 4,00,000 and maintenance savings of about USD 1,25,000.

- Although the components of the global e-bus ecosystem are being implemented in accordance with established government regulations, the immediate challenge of setting up and managing e-bus charging stations in terms of planning, the scope of responsibilities, and operation must be addressed on a high-priority basis to expedite the development of the e-bus ecosystem across the world.

Global Bus Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Bus Industry Overview

The Bus Market is fragmented, with the top five companies occupying 12.60%. The major players in this market are Ashok Leyland Limited, Daimler Truck Holding AG, King Long United Automotive Industry Co. Ltd., Tata Motors Limited and Zhengzhou Yutong Bus Co. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93050

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Shared Rides

- 4.8 Impact Of Electrification

- 4.9 EV Charging Station

- 4.10 Battery Pack Price

- 4.10.1 Africa

- 4.10.2 Asia-Pacific

- 4.10.3 Europe

- 4.10.4 Middle East

- 4.10.5 North America

- 4.10.6 South America

- 4.11 New Xev Models Announced

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Hybrid and Electric Vehicles

- 5.1.1.1 By Fuel Category

- 5.1.1.1.1 BEV

- 5.1.1.1.2 FCEV

- 5.1.1.1.3 HEV

- 5.1.1.1.4 PHEV

- 5.1.2 ICE

- 5.1.2.1 By Fuel Category

- 5.1.1 Hybrid and Electric Vehicles

- 5.2 Region

- 5.2.1 Africa

- 5.2.2 Asia-Pacific

- 5.2.2.1 India

- 5.2.2.2 Japan

- 5.2.3 Europe

- 5.2.3.1 Czech Republic

- 5.2.4 Middle East

- 5.2.5 North America

- 5.2.5.1 Canada

- 5.2.5.2 Mexico

- 5.2.5.3 US

- 5.2.6 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Anhui Ankai Automobile Co. Ltd.

- 6.4.2 Ashok Leyland Limited

- 6.4.3 Byd Auto Industry Company Limited

- 6.4.4 Daimler Truck Holding AG

- 6.4.5 King Long United Automotive Industry Co. Ltd.

- 6.4.6 NFI Group Inc.

- 6.4.7 Proterra INC.

- 6.4.8 Tata Motors Limited

- 6.4.9 Volvo Group

- 6.4.10 Zhengzhou Yutong Bus Co. Ltd.

- 6.4.11 Zhongtong Bus Holding Co. Ltd.

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.