PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690826

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690826

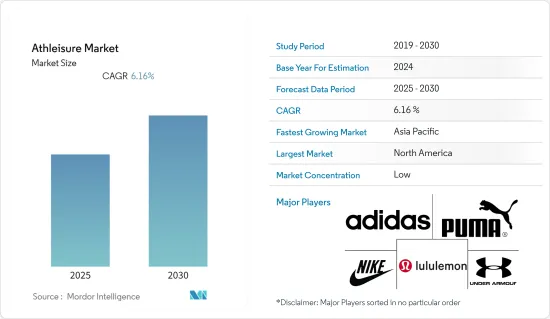

Athleisure - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Athleisure Market is expected to register a CAGR of 6.16% during the forecast period.

The athleisure market size is expected to grow from USD 319.10 billion in 2023 to USD 430.28 billion by 2028, at a CAGR of 6.16% during the forecast period (2023-2028).

Key Highlights

- Rising health and self-consciousness and a desire to lead active lifestyles and appear fit are encouraging consumers to incorporate sports and fitness activities into their daily routines. This increased participation has led to a change in market dynamics, resulting in an increased demand for athleisure products.

- Additionally, the availability of sports apparel with enhanced properties such as moisture management, temperature control, and other performance-boosting characteristics that prevent discomfort and potential injury has captured the interest of consumers who are willing to pay more for such additional benefits.

- For instance, Nike claims that its Dri-FIT fabric used in its sports apparel products supports the body's natural cooling system by wicking away sweat and dispersing it across the fabric's surface to evaporate faster. Hence, these enhanced features in athleisure products have propelled consumer habits to wear athletic apparel while performing athleisure activities.

- The primary strategies adopted by the top companies operating in the market studied are product innovation and partnership. Both strategies are effective in parallel, as players generally collaborate with other companies and well-known personalities to launch their new products. For instance, in March 2022, Abercrombie & Fitch, a leading American apparel company, announced the launch of a new activewear sub-brand named YPB stands for Your Personal Best. The brand aims to empower customers to use the brand for a variety of activities, including running, stretching, lifting, and reclining.

- Moreover, an increase in government initiatives in various countries to improve sports participation played a key role in driving the demand for athleisure in the last few years. For instance, in November 2021, the government of England recommended launching a 'Work Out to Help Out' campaign to incentivize people to get involved in organized sports.

- Similarly, in August 2023, the United Kingdom government announced that it will join forces with former sports stars, health professionals, and fitness experts to help an additional 3.5 million adults and children get physically active by 2030 as part of a major national activity drive. However, the strong presence of counterfeit goods in the marketplace has become a significant threat to brand manufacturers and the market's growth. The growth of the luxury athleisure market has been affected by the presence of various counterfeit products, which may be difficult to identify as fake.

Athleisure Market Trends

Increased Sports Participation and Flourishing Demand for Sports Apparel

- The increasing popularity of fitness activities, such as aerobics, running, weight training, and yoga, along with an increase in the number of women participating in fitness and sports-related activities and surging memberships in gym and health clubs, is driving the demand for athleisure products.

- Influenced by health and wellness trends, a growing number of consumers around the world have been engaging themselves in at-home and outdoor physical activities to improve health and well-being. This factor has propelled the demand for sports apparel, which is usually made from highly absorbent material and provides comfort.

- For instance, In April 2022, the Australian Government funded USD 4.4 million for Cricket Australia and the ICC Men's T20 World Cup 2022 local organizing committee to support the legacy objectives of the T20 World Cup and enrich Australian cricket's vision of being a sport for all. Similarly, as per the survey conducted in association with Japan Sports Agency in November 2021, in Japan, 15.1% of respondents in their twenties stated that they used fitness clubs.

- Moreover, celebrity endorsements, international sporting events, social media influence, and government initiatives and campaigns such as #FitIndia (by the Government of India) have been encouraging consumers to participate in fitness and sports activities, leading to more spending on athleisure products across the world.

- For instance, in March 2022, it was revealed that the Government of Australia has plans to invest AUD 10.7 million in major sporting events, such as the ICC T20 Men's World Cup 2022 and the FIFA Women's Football World Cup 2023, among other events, to drive increased community engagement, gender equality, and physical activity participation to maximize social, economic and sporting outcomes. Such factors, coupled with raising consumers' interest in sports participation, are expected to boost the market's growth during the forecast period.

Asia-Pacific is the Fastest-growing Market

- The growing health awareness among the emerging middle class and the increasing sporting environment in countries such as China, India, Australia, and Japan are anticipated to boost the demand for athleisure products in the region during the forecast period. The athleisure market in Asia-Pacific has traditionally been dominated by major international brands such as Reebok, Adidas, Nike, Puma, and Lotto. The players in the market use various strategies like launching ad campaigns and using new technologies to innovate products to remain active in the market and increase their brand visibility and image.

- For example, in September 2021, Adidas Australia launched a ''4DFWD'' 3D printed running shoe. The 4DFWD shoe has been created using printing to create an e-midsole lattice structure that redirects vertical impact forces into horizontal forward motion. The shoes were made available through online and in offline Adidas stores across the country. Such strategic moves from major players, coupled with their aggressive promotional activities, are attracting consumers to consider athleisure wear while performing sports or fitness activities.

- Moreover, the combination of casual and athletic designs has led to a growing demand for sports apparel that can be worn casually. This 'athleisure' trend has led a growing number of consumers to seek out sports apparel, such as sneakers, yoga pants, joggers, track pants, tank tops, sports bras, and hoodies, for casual wear. Furthermore, increased consumer spending on fitness apparel as a fashion statement contributes to the appeal of sportswear in this region. Furthermore, many domestic brands such as Mizuno, Asics, HRX, and Sfida have also registered significant market penetration by constantly introducing different types of athletic wear, including clothing, footwear, and accessories, across e-commerce platforms. Such factors are expected to boost the market's growth during the forecast period.

Athleisure Industry Overview

The athleisure market is highly competitive and fragmented. Major market players are focusing on developing a diversified product portfolio, which is intensifying the competition in the market. The most active companies in the market include Nike Inc., Adidas AG, Puma SE, Under Armour Inc., and Lululemon Athletica Inc. These companies have been taking significant measures to increase their market penetration across the world with product innovations, the establishment of new bases, setting up more production plants, and associated R&D centers. These players are also active on social media platforms to advertise their athleisure products to attract more consumers worldwide.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Sports Participation and Flourishing Demand for Sports Apparel

- 4.1.2 Rising Innovation in Athleisure Products

- 4.2 Market Restraints

- 4.2.1 Penetration of Counterfeit Products

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Clothing

- 5.1.2 Footwear

- 5.1.3 Other Product Types

- 5.2 End User

- 5.2.1 Men

- 5.2.2 Women

- 5.2.3 Kids

- 5.3 Distribution Channel

- 5.3.1 Offline Retail Stores

- 5.3.2 Online Retail Stores

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Spain

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted By Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Adidas AG

- 6.3.2 Nike Inc.

- 6.3.3 Under Armour Inc.

- 6.3.4 New Balance Athletics Inc.

- 6.3.5 Columbia Sportswear Company

- 6.3.6 ASICS Corporation

- 6.3.7 Puma SE

- 6.3.8 VF Corporation

- 6.3.9 Wolverine Worldwide Inc.

- 6.3.10 Lululemon Athletica Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS