PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1522863

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1522863

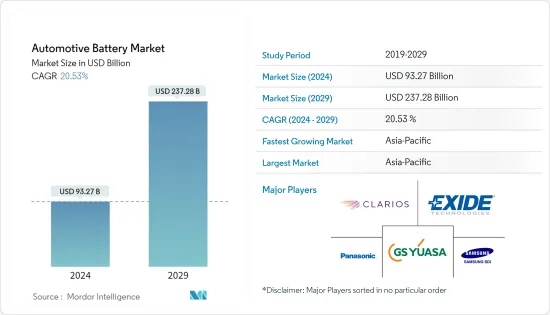

Automotive Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Automotive Battery Market size is estimated at USD 93.27 billion in 2024, and is expected to reach USD 237.28 billion by 2029, growing at a CAGR of 20.53% during the forecast period (2024-2029).

An automotive battery is an electrochemical device that can store and generate electrical energy. When starting the engine, the automotive battery provides electric current to power the starting motor and ignition system. When the alternator is not handling the load, it works as a voltage stabilizer by giving current to the lights, radio, and other electrical accessories.

Globally rising demand for sustainable transportation and cleaner energy has engaged the demand for battery electric vehicles. Consumer constraints such as vehicle range, greater upfront prices, limited model availability, and lack of knowledge are being solved by promotional activities and government legislation. These variables will have an impact on the demand for electric vehicles, which will drive the target market. In addition to this, an increase in the global battery production capacity has helped achieve economies of scale in the automotive battery industry, another major driver for market growth.

Automotive Battery Market Trends

The Electric Vehicles Segment is Anticipated to Drive the Market

Governments around the world are setting ambitious targets to reduce emissions, and promoting the use of electric vehicles is seen as one way to achieve these goals. For instance, the European Union aims to reduce its greenhouse gas emissions by 55% by 2030, and China has set a target of having 25% of new cars sold by 2025 to be electric. Lithium-ion batteries, which are used in most electric vehicles, have seen significant improvements in terms of energy density, charging time, and overall performance. This has made electric vehicles more practical and appealing to consumers.

The increasing demand for EVs will lead to technological advancements in battery chemistry and materials, which will require more sophisticated and efficient automotive batteries to ensure safety and performance. Many prominent automobile manufacturers are focusing on building long-term business relationships with automotive battery manufacturing companies. For instance,

In June 2023, according to a Panasonic Holdings representative, the Japanese corporation intends to increase the output of electric vehicle batteries at a Nevada factory jointly managed with Tesla by 10% within three years. Panasonic Energy plans to add a 15th production line to the Gigafactory Nevada. At a meeting, Panasonic Energy announced a proposal to boost the Nevada factory's manufacturing capacity by 10% by March 2026.

As the electric vehicle market is growing, many companies are involved in the development and manufacturing of automotive batteries for commercial vehicles as well. Stellantis NV and Samsung SDI announced in May 2022 that they would invest more than USD 2.5 billion in a new joint-venture battery plant in Kokomo, Indiana.

With the electric vehicle market set to continue its rapid growth, the demand for automotive batteries is expected to rise in tandem, presenting significant opportunities for companies operating in this space.

Asia-Pacific is Expected to Dominate the Automotive Battery Market

Asia-Pacific is expected to have the fastest growth in the value of automotive batteries, owing to the increasing demand for electric passenger and commercial vehicles. The region has most of the battery manufacturers' presence and automobile vehicle manufacturers. China is the largest manufacturer and consumer of electric vehicles in the world. Sales targets, favorable laws, and municipal air-quality targets are supporting domestic demand. For instance, China has imposed a quota on manufacturers of electric or hybrid vehicles, which must represent at least 10% of total new sales. Also, the city of Beijing only issues 10,000 permits for the registration of combustion engine vehicles per month to encourage its inhabitants to switch to electric vehicles.

China has approximately 80% of the world's Li-ion manufacturing capacity, and it is by far the front-runner in the battery race. The nation also controls other facets of the battery supply chain, such as the extraction and processing of lithium and graphite, two of the crucial minerals used in batteries. Several players in the region are establishing various business strategies to gain market offerings. For instance,

- In June 2023, Mazda Motor, a Japan-based vehicle manufacturer, and Panasonic Corporation agreed to enter discussions on establishing a medium- to long-term partnership to meet the demand for battery electric vehicles and automotive batteries in a rapidly expanding market.

- In May 2023, the Orano group and the XTC New Energy group signed agreements to create two joint ventures devoted to the production of critical materials for electric vehicle batteries.

Increasing product demand for automotive applications in various countries, including South Korea, India, Malaysia, and Indonesia, is likely to influence the region's growth between 2024 and 2030.

Automotive Battery Industry Overview

The automotive battery market is consolidated. A few prominent companies include Panasonic Corporation, Exide Technologies, Clarios, GS Yuasa Corporation, Samsung SDI Co. Ltd, and LG Chem Ltd. Several companies in the market are focusing on improving their products and service portfolios to widen their customer base. Some other key players aim to expand their presence in the market through product and service launches, offerings expansion, mergers, and collaborations with other companies. For instance, in March 2023, the United States and Japan reached an agreement regarding the trade of critical minerals used for EV batteries to secure the supplies of battery materials.

In March 2023, Li-Cycle Holdings Corp. signed a definitive agreement for a global lithium-ion battery recycling partnership with the KION Group and announced plans to develop a new lithium-ion battery recycling facility in France.

In March 2023, Morrow Batteries (Morrow) invested EUR 20 million in the production of Lithium iron phosphate (LFP) battery cells in South Korea.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand For Electric Vehicles is Anticipated to Boost the Market

- 4.2 Market Restraints

- 4.2.1 High Cost Associated with Electric Vehicles is Anticipated to Restrain the Growth of the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Battery Types

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Drive Type

- 5.3.1 Internal Combustion Engine

- 5.3.2 Electric Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 A123 Systems

- 6.2.2 Panasonic Corporation

- 6.2.3 Exide Technologies

- 6.2.4 VARTA

- 6.2.5 Clarios

- 6.2.6 GS Yuasa Corporation

- 6.2.7 Hitachi Group Ltd

- 6.2.8 Robert Bosch GmbH

- 6.2.9 China Aviation Lithium Battery Co. Ltd

- 6.2.10 Contemporary Amperex Technology Co. Limited

- 6.2.11 SAMSUNG SDI Co. Ltd

- 6.2.12 East Penn Manufacturing Co.

- 6.2.13 LG Chem Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS