PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693606

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693606

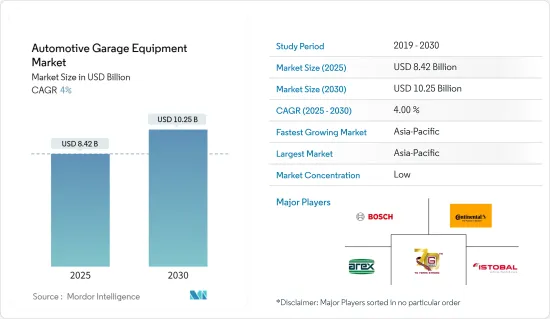

Automotive Garage Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive Garage Equipment Market size is estimated at USD 8.42 billion in 2025, and is expected to reach USD 10.25 billion by 2030, at a CAGR of 4% during the forecast period (2025-2030).

The demand in the automotive garage equipment market is driven by the upgradation of existing repair shops and independent garages and increasing vehicle sales in emerging economies such as India and Brazil.

For example, according to the International Trade Council, Brazil anticipates a 60% surge in electric and hybrid car sales in 2024 based on a stellar performance in 2023, where sales experienced an impressive 91% growth.

Moreover, the market is anticipated to expand as OEMs start prioritizing the accumulation of data on enhancing vehicle performance, which will elevate the need for suitable automotive garage equipment.

In addition, as automakers are gravitating toward technical breakthroughs and the creation of fuel-efficient automobiles, there is likely to be an increase in the demand for automotive garage equipment. Automotive garage equipment manufacturers are experiencing growth in demand for commercial vehicle wheel aligners as extensive fleets of commercial vehicles are now showing greater interest in the advantages of wheel alignment.

For instance, in October 2023, Totalkare, a key distributor of Hunter's cutting-edge heavy-duty wheel alignment equipment, announced a partnership with Hunter Engineering Company, bringing a trio of products to the forefront of the commercial vehicle maintenance industry.

Asia-Pacific, followed by Europe and North America, is expected to witness notable growth over the forecast period. The surge in vehicle production and vehicle production across major countries in these regions and increasing safety concerns among car consumers are expected to drive the demand for automotive garage equipment.

Automotive Garage Equipment Market Trends

Passenger Cars Hold Highest Market Share

Passenger cars have gained immense popularity among drivers over the past few years due to features such as stylish design, compact size, and economic value. Passenger cars are the most common mode of transportation in numerous advanced countries. The improving lifestyles, increasing power purchase parity and disposable income, raising brand awareness, and growing economy are leading to customer preference changes globally, resulting in high sales of passenger cars.

- According to the Society of Indian Automobile Manufacturers, sales of passenger cars increased from 14,67,039 to 17,47,376 units in 2022-23.

With the increase in global demand, electric car sales have been growing exponentially due to falling costs, improving technology, and government support. For instance, over 2.3 million electric cars were sold in the first quarter of 2023, about 25% more than in 2022, according to the International Energy Agency.

The rise in the demand for sport utility vehicles (SUVs) creates profitable opportunities for market players and acts as a major driving factor for the passenger cars segment globally.

The rise in passenger car sales leads to growth in demand for garage equipment as it is needed for various factors such as brake inspection and repair, oil change, tire maintenance, engine diagnostic, and others for better mileage, reliability, and enhanced safety.

The introduction of newer, more efficient garage equipment with advanced technologies and the collaborations of companies to offer various services for automotive repair are also driving the market. Such trends and developments in the market indicate an optimistic outlook for the market in the near future.

- For instance, in January 2024, ETAS and Bosch diagnostic software and information services started joint business activities. In the future, ETAS will offer authoring and diagnostic solutions across the entire vehicle life cycle - from vehicle manufacturing to health monitoring, maintenance, and troubleshooting of vehicles on the road.

Asia-Pacific Holds the Highest Market Share

The Asia-Pacific automotive garage equipment market is expected to grow significantly over the coming years. The demand for automotive garage equipment in the region is mainly supported by increasing sales of new and used cars and commercial vehicles across China, India, and other countries. Various automakers are investing in the development of electric and digital technologies for autonomous, hybrid, and electric vehicles, which is expected to have a positive impact on the market.

- For instance, in January 2024, BYD launched its AI-powered smart car system to better compete with rivals on advanced technologies such as automated parking. The company plans to invest CNY 5 billion (USD 701.8 million) to build the world's first all-terrain professional test drive sites in cities across China.

As the need for timely preventive maintenance has gained significant importance in recent years, most consumers are trying to keep their vehicles in proper condition, positively influencing the market.

Considering the growth of the automotive sector in various countries and vehicles produced with advanced safety and convenient features, automotive workshops are focusing on upgrading their equipment to comply with new-aged vehicles. Many existing players and new startups are launching new equipment to cater to the demand.

- In January 2023, Autel, a leading global provider of automotive intelligent diagnostics, inspection, and TPMS products, launched three major product lines for India, namely automotive diagnostic products, immobilizer series of devices, and TPMS series for automotive tire pressure monitoring systems.

Due to these factors and developments, it is expected that Asia-Pacific will provide numerous opportunities for market players and encourage them to expand their activities in the region, leading to significant growth in the future.

Automotive Garage Equipment Industry Overview

The automotive garage equipment market is consolidated and led by globally and regionally established players. Some of the major players in the market include Continental AG, Robert Bosch GmbH, Autoliv Inc., Denso Corporation, and Delphi Automotive PLC. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions.

- For instance, in September 2023, Google Cloud and Continental announced a strategic partnership. Together, they will provide innovative, flexible, and future-oriented digital solutions for the automotive industry by combining Continental's expertise with Google's data and AI technologies.

- In January 2023, Delphi Technologies launched its new Masters of Motion hub aimed at independent garage technicians. This is the start of a sustained campaign to provide added support for technicians and workshops.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 VALUE CHAIN ANALYSIS

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Sales of Passenger Cars

- 5.2 Market Restraints

- 5.2.1 Failure in Garage Equipment may Result in Downtime of the Repair Work

- 5.3 Industry Attractiveness - Porter's Five Forces Analysis

- 5.3.1 Threat of New Entrants

- 5.3.2 Bargaining Power of Buyers/Consumers

- 5.3.3 Bargaining Power of Suppliers

- 5.3.4 Threat of Substitute Products

- 5.3.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION (Market Size in Value USD billion)

- 6.1 By Equipment Type

- 6.1.1 Lifting Equipment

- 6.1.2 Emission Testing Equipment

- 6.1.3 Body Shop Equipment

- 6.1.4 Wheel and Tire Equipment

- 6.1.5 Vehicle Diagnostic and Testing

- 6.1.6 Washing Equipment

- 6.1.7 Other Equipment Types

- 6.2 By Vehicle Type

- 6.2.1 Passenger Cars

- 6.2.2 Commercial Vehicles

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Rest of North America

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Rest of the world

- 6.3.4.1 South America

- 6.3.4.2 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share

- 7.2 Company Profiles

- 7.2.1 Robert Bosch GmbH

- 7.2.2 Continental AG

- 7.2.3 Istobal SA

- 7.2.4 Aro Equipments Pvt. Ltd

- 7.2.5 Guangzhou Jingjia Auto Equipment Co. Ltd

- 7.2.6 Arex Test Systems BV

- 7.2.7 Boston Garage Equipment Ltd

- 7.2.8 Vehicle Service Group

- 7.2.9 Gray Manufacturing Company Inc.

- 7.2.10 VisiCon Automatisierungstechnik GmbH

- 7.2.11 MAHA Mechanical Engineering Haldenwang GmbH & Co. KG

8 MARKET OPPORTUNITIES AND FUTURE TRENDS