PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851340

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851340

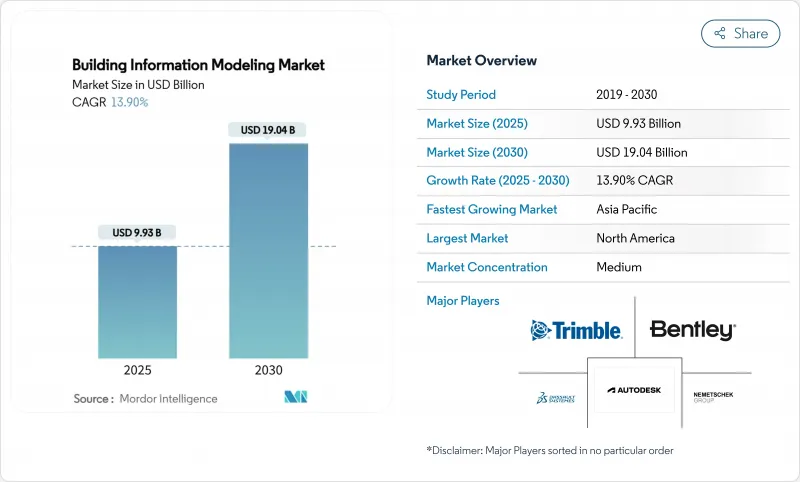

Building Information Modeling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The building information modeling market is valued at USD 9.93 billion in 2025 and is forecast to reach USD 19.04 billion by 2030, advancing at a 13.9% CAGR.

Rapid digital transformation across architecture, engineering, construction and operations is expanding BIM from a visualization tool into a cloud-enabled collaboration platform. Growth is reinforced by tighter government mandates, integration with artificial intelligence and digital twins, and wider SaaS availability that lowers up-front costs for smaller firms. Vendors are also embedding 4D scheduling, 5D cost estimation and sustainability analytics as default capabilities, which keeps switching barriers high. Intense competition is prompting continuous upgrades that improve interoperability and workflow automation, deepening user reliance on subscription ecosystems throughout the project lifecycle.

Global Building Information Modeling Market Trends and Insights

E-mandates and ISO 19650 alignment accelerating global BIM uptake

Mandated BIM use on public projects is normalizing digital delivery workflows across mature construction economies. The United Kingdom's requirement for Level 3 BIM on public projects above GBP 5 million by 2025 encourages structured data exchanges that lower procurement risk. More than 60% of European public agencies now publish formal BIM strategies, which pushes private developers to follow the same standards. Comparable policies in several US states and provinces in Canada have the same cascading effect. Standardization around ISO 19650 simplifies cross-border collaboration, reduces contractual ambiguity and shortens onboarding time for new stakeholders, directly lifting adoption rates for the building information modeling market.

Rise of digital-twin-enabled asset lifecycle management

Owners increasingly connect BIM models with IoT sensors to generate live digital twins that optimize maintenance and reduce downtime. Buildings equipped with sensor-linked twins have reported 5% annual operating cost cuts and 35% faster maintenance response times. The promise of quantified savings during the 80% cost-of-ownership phase is compelling facility operators to upgrade legacy models into data-rich twins, which lifts software and service revenues throughout the operational stage of building information modeling market adoption.

High Licensing & Training Costs for SME Contractors

Initial seat licenses can exceed USD 10,000 while annual renewals and hardware upgrades increase total cost of ownership, causing many small firms to defer adoption. Funding programs such as Singapore's Productivity Solutions Grant that reimburses up to 50% of software expenses partially mitigate the burden, yet cost sensitivity remains a near-term drag on the building information modeling market.

Other drivers and restraints analyzed in the detailed report include:

- Green-building and net-zero compliance pressures

- Modular or off-site construction demanding seamless prefab coordination

- Interoperability & open-standards gaps across authoring tools

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software holds a 68% revenue share worth USD 6.75 billion. Authoring suites such as Revit and Archicad remain the entry point for model creation, with integrated 4D and 5D functions now interpreted as table stakes rather than premium add-ons. Continuous updates that incorporate AI-driven clash detection keep customer churn low, anchoring the building information modeling market.

Service revenue is rising at a 15.8% CAGR as owners and contractors outsource model development, coordination and analytics. Outsourcing gives firms access to scarce talent without fixed payroll commitments. Complex public-transportation schemes in Europe and Asia commonly appoint specialist BIM consultancies, expanding the addressable building information modeling market size for services.

On-premises installations represent USD 7.15 billion and 72% of 2025 revenue. Large design houses favor local servers that align with strict data-sovereignty rules. Security certifications such as FedRAMP and ISO 27001 are gradually easing those concerns, yet entrenched workflows slow migration.

Cloud deployments are growing at 18.5% CAGR. Subscription licensing lowers capital expenditure and delivers instant scalability, letting dispersed project teams co-author models in real time. After pandemic-driven remote work proved viable, many firms adopted SaaS to future-proof operations, steadily shifting the center of gravity of the building information modeling market toward hosted solutions.

The Building Information Modeling Market Report is Segmented by Solution (Software, Services), Deployment Mode (On-Premises, Cloud), Project Lifecycle Stage (Pre-Construction, Construction, Post-Construction), Application (Commercial Buildings, Residential Buildings, and More), End User (Architects and Designers, Engineers, and More), and Geography). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated USD 3.77 billion and 38% of global revenue in 2025. Federal infrastructure spending tied to digital-delivery requirements fuels broad adoption across transportation and utilities. The building information modeling market size in the United States benefits from standardized object libraries that simplify procurement and lifecycle management.

Europe ranks second, anchored by mandates in the United Kingdom and Germany. The continent's 2024 revenue reached USD 3.09 billion and is on course to double by 2032. Regional software champions such as Nemetschek leverage close ties to academic research, which sustains a robust skills pipeline and keeps the building information modeling market competitive.

Asia-Pacific is the fastest-growing region at 15% CAGR. China's smart-city initiatives, Japan's automation push to counter labor shortages, and India's expanding transport corridors create substantial volume. Government incentives in Singapore that cover a portion of software expenditure make it the region's benchmark for policy-led progress, further enlarging the building information modeling market.

The Middle East and Africa remain smaller but exhibit strong momentum in Gulf states. Mega-projects like NEOM in Saudi Arabia adopt full digital-twin strategies, setting new regional standards. Capacity-building programs are underway to upskill local talent, gradually reducing reliance on imported expertise.

- Autodesk Inc.

- Nemetschek SE

- Bentley Systems Inc.

- Trimble Inc.

- Dassault Systemes SE

- Hexagon AB

- AVEVA Group PLC

- Asite Solutions Ltd

- RIB Software GmbH

- Graphisoft SE

- Allplan GmbH

- Topcon Positioning Systems Inc.

- Procore Technologies Inc.

- ACCA Software SPA

- Revizto SA

- CMiC Inc.

- Beck Technology Ltd

- Vectorworks Inc.

- Tekla Corporation (Trimble)

- Bimeye Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-mandates and ISO 19650 Alignment Accelerating Global BIM Uptake

- 4.2.2 Rise of Digital-Twin-enabled Asset Lifecycle Management

- 4.2.3 Green-Building and Net-Zero Compliance Pressures

- 4.2.4 Modular / Off-site Construction Demanding Seamless Prefab Coordination

- 4.2.5 Cloud adoption and SaaS pricing lowering entry barriers

- 4.2.6 AI-driven generative design and predictive analytics boosting productivity

- 4.3 Market Restraints

- 4.3.1 High Licensing and Training Costs for SME Contractors

- 4.3.2 Interoperability and Open-Standards Gaps Across Authoring Tools

- 4.3.3 Cyber-security and IP Protection Concerns in Cloud Workflows

- 4.3.4 Cultural Resistance to Process Re-engineering in Legacy Firms

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution Type

- 5.1.1 Software

- 5.1.1.1 Dimension

- 5.1.1.1.1 3D

- 5.1.1.1.2 4D

- 5.1.1.1.3 5D

- 5.1.1.1.4 6D

- 5.1.1.1.5 7D and Beyond

- 5.1.2 Services

- 5.1.2.1 Consulting and Advisory

- 5.1.2.2 Implementation and Integration

- 5.1.2.3 Training and Support

- 5.1.2.4 Managed Services

- 5.1.1 Software

- 5.2 By Deployment Mode

- 5.2.1 On-premises

- 5.2.2 Cloud

- 5.3 By Project Lifecycle Stage

- 5.3.1 Pre-construction (Planning and Design)

- 5.3.2 Construction (Site Execution)

- 5.3.3 Post-construction (Operations and Maintenance)

- 5.4 By Application

- 5.4.1 Commercial Buildings

- 5.4.2 Residential Buildings

- 5.4.3 Industrial and Manufacturing Facilities

- 5.4.4 Infrastructure (Roads, Rail, Airports, Ports, Bridges)

- 5.4.5 Institutional (Healthcare, Education, Government)

- 5.4.6 Other Applications

- 5.5 By End User

- 5.5.1 Architects and Designers

- 5.5.2 Engineers (Structural, MEP)

- 5.5.3 Contractors and Builders

- 5.5.4 Owners and Developers

- 5.5.5 Facilities and Asset Managers

- 5.5.6 Consultants and Project Managers

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Nordics

- 5.6.3.6 Rest of Europe

- 5.6.4 Middle East

- 5.6.4.1 United Arab Emirates

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 Turkey

- 5.6.4.4 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Rest of Africa

- 5.6.6 Asia-Pacific

- 5.6.6.1 China

- 5.6.6.2 Japan

- 5.6.6.3 India

- 5.6.6.4 South Korea

- 5.6.6.5 Southeast Asia

- 5.6.6.6 Rest of Asia-Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Funding, Partnerships)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Autodesk Inc.

- 6.4.2 Nemetschek SE

- 6.4.3 Bentley Systems Inc.

- 6.4.4 Trimble Inc.

- 6.4.5 Dassault Systemes SE

- 6.4.6 Hexagon AB

- 6.4.7 AVEVA Group PLC

- 6.4.8 Asite Solutions Ltd

- 6.4.9 RIB Software GmbH

- 6.4.10 Graphisoft SE

- 6.4.11 Allplan GmbH

- 6.4.12 Topcon Positioning Systems Inc.

- 6.4.13 Procore Technologies Inc.

- 6.4.14 ACCA Software SPA

- 6.4.15 Revizto SA

- 6.4.16 CMiC Inc.

- 6.4.17 Beck Technology Ltd

- 6.4.18 Vectorworks Inc.

- 6.4.19 Tekla Corporation (Trimble)

- 6.4.20 Bimeye Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment