PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686527

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686527

Command And Control Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

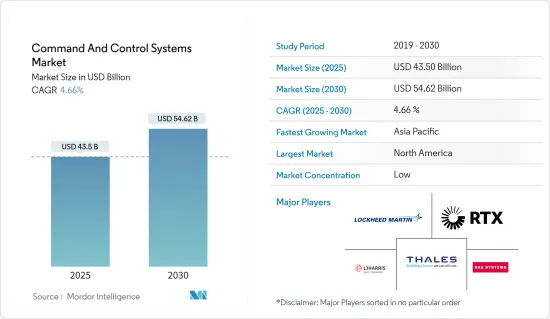

The Command And Control Systems Market size is estimated at USD 43.50 billion in 2025, and is expected to reach USD 54.62 billion by 2030, at a CAGR of 4.66% during the forecast period (2025-2030).

Increasing political disputes and warfare situations, growing terrorism, and growing cross-border conflicts led to the strengthening of global defense capabilities. Increasing military expenditure facilitated the armies to focus more on procuring new generation C2 systems, as the capabilities of the existing C2 systems are not up to the industry benchmark. The ongoing military modernization programs and rising spending on procurement of advanced defense systems will drive the market during the forecast period.

During wartime, defense departments cannot include any obsolete technologies, especially in C4ISR systems, because these systems are used for communication, strategic planning, and decision-making. C2 systems are a crucial part of C4ISR systems, whose growth is expected to be very rapid. The ongoing R&D activities to develop advanced systems may provide growth opportunities for the market in the coming years. Satellite communications (SATCOM) became a firmly established part of modern military operations by providing enhanced capabilities for C2 in remote and austere environments. The growing use of SATCOM is expected to bring new opportunities for the market in the coming years.

However, command and control systems need to integrate with existing infrastructure, including legacy systems, communication networks, and hardware platforms. Integration is complex because it must ensure seamless interoperability and data exchange between diverse systems, which might developed by different OEMs or operate on different protocols. Such integration challenges can lead to project delays, cost overruns, and operational inefficiencies.

Moreover, constant investment in research and development for the latest C2 systems is essential for staying ahead of emerging threats and developing the latest solutions to counter them. Interoperability and scalability are key traits of the latest command and control systems, allowing them to adapt to changing operational environments.

Command and Control Systems Market Trends

Land Based Platform Will Showcase Remarkable Growth During the Forecast Period

The land-based command and control systems segment is estimated to hold the largest market share during the forecast period due to its high usage on the battlefield. The increasing number of military modernization programs and procurement of advanced defense systems by the defense forces drive the market growth. The growing military operations worldwide due to various geopolitical issues and the growth of terrorist and hostile activities increased the demand for building fixed-base control centers and land-based command headquarters.

The land-based C2 systems act as a communication bridge between troops and ground station personnel on the battlefield. For instance, in October 2023, Elbit Systems Ltd. subsidiary Elbit Systems Sweden AB was awarded a contract of USD 170 million to participate as an integration partner in the Swedish Army digitalization program LSS Mark. As the integration partner, Elbit Systems Sweden will integrate, install, maintain, and upgrade command and control systems on a variety of platforms, from command posts and vehicles to dismounted systems.

Thus, growing investment in the procurement of advanced command and control systems and an increase in annual defense budget allocation to infrastructure development of various countries drive the growth of the market land-based segment.

Asia-Pacific is Estimated to Show Remarkable Growth During the Forecast Period

Asia-Pacific will experience significant growth during the forecast period. The growth is attributed to growing defense expenditure and rising military modernization programs by countries like China, India, South Korea, and others. Increasing tensions between India and China over the line of control (LOC), rising cross-border conflicts, and growing terrorist activities across the region led to increased spending on the defense sector by Asian countries.

In addition, countries such as India, China, Japan, and Australia participate in several airborne, land, space, and naval modernization programs. For instance, in August 2022, Lockheed Martin Australia partnered with the Royal Australian Air Force (RAAF) and Defence Science and Technology Group (DSTG) to explore systems. It is to leverage artificial intelligence to support rapid decision-making at tactical levels of command and control across various domains.

Similarly, in Japan, in January 2024, Northrop Grumman Corporation and Mitsubishi Electric Corporation signed an agreement to collaborate on integrated air and missile defense capabilities for Japan's ground-based systems. The companies will combine their respective technologies to develop a networking solution to integrate Japan's air and missile defense capabilities. It is to share target information across various defense systems. It will increase Japan's defense capability by improving situational awareness, increased interoperability, and effective resource management.

Command and Control Systems Industry Overview

The market for command and control systems is fragmented, with the presence of several global and local players holding significant shares of the market. Some of the prominent players are L3Harris Technologies Inc., Lockheed Martin Corporation, THALES, RTX Corporation, and BAE Systems plc.

With growing competition in the market, key OEMs are focusing on the development of next-generation solutions for defense forces. For instance, in November 2023, Space Systems Command (SSC) awarded an eight-year USD 579 million contract to Kratos Defense and Security Solutions as part of the Command-and-Control System-Consolidated (CCS-C) Sustainment and Resiliency (C-SAR) contract to provide satellite control capabilities to US Space Force and US Space Command. As per the contract, Kratos will provide direct support to Defense Satellite Communications System (DSCS) III, Advanced Extremely High Frequency (AEHF), Milstar Satellite Communications System, and Wideband Global Satellite (WGS) satellite systems.

Similarly, in August 2023, the US Air Force researchers are taking the support and assistance of an additional 13 defense tech companies to mature, demonstrate, and proliferate technologies for military forces to respond to global threats in 15 minutes or less. US Air Force officials announced the 13 additional companies in July 2023 in the potential USD 950 million Joint All Domain Command and Control (JADC2) program. This US Air Force program aims to develop systems across all military domains in an open-architecture family of systems that integrate several platforms to enable new warfighting capabilities.

Such growing focus on innovation, research, and development, and the introduction of advanced systems from various defense organizations are driving the market growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Platform

- 5.1.1 Land

- 5.1.2 Air

- 5.1.3 Sea

- 5.1.4 Space

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 South Africa

- 5.2.5.3 Saudi Arabia

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 RTX Corporation

- 6.2.2 THALES

- 6.2.3 General Dynamics Corporation

- 6.2.4 L3Harris Technologies, Inc.

- 6.2.5 BAE Systems plc

- 6.2.6 Honeywell International Inc.

- 6.2.7 Saab AB

- 6.2.8 CACI International Inc

- 6.2.9 Kratos Defense & Security Solutions, Inc.

- 6.2.10 Leonardo S.p.A

- 6.2.11 Lockheed Martin Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS