PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1536938

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1536938

Connected Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

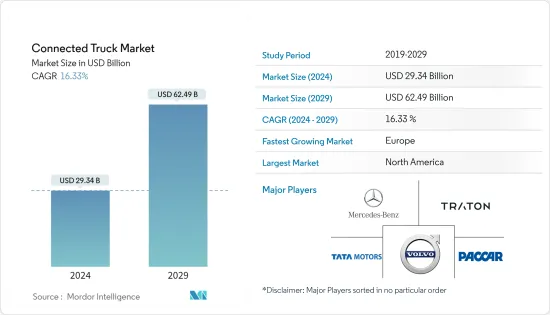

The Connected Truck Market size is estimated at USD 29.34 billion in 2024, and is expected to reach USD 62.49 billion by 2029, growing at a CAGR of 16.33% during the forecast period (2024-2029).

The connected truck market is experiencing robust growth, fuelled by the rapid integration of advanced technologies into the transportation and logistics sector. A surge in demand for telematics solutions, IoT-enabled connectivity, and data analytics applications in commercial vehicles characterizes the market. Key drivers include the need for enhanced fleet management efficiency, improved safety, and compliance with stringent emissions and regulatory standards.

The rise of e-commerce and increasing industrialization are driving the demand for real-time tracking, remote diagnostics, and predictive maintenance in commercial vehicles. Fleet operators increasingly adopt connected truck technologies to optimize routes, monitor driver behavior, and minimize downtime, improving overall operational efficiency. Through connected truck technology, fleet operators anticipate optimizing factors, such as fuel, maintenance, and wages of drivers, which together contribute more than 60% of the total cost of ownership. More than 35 million trucks globally are expected to be connected within the next five years.

Furthermore, North America and Europe dominate the connected truck market, propelled by established infrastructure and regulatory frameworks. However, the Asia-Pacific region is emerging as a potential market with the increasing adoption of connected solutions in emerging economies. The market landscape is characterized by intense competition, with major players focusing on strategic collaborations, partnerships, and product innovations to gain a competitive edge. For instance,

In May 2023, Daimler Truck, MFTBC, Hino, and Toyota joined hands to achieve carbon neutrality and create a prosperous mobility society by developing CASE technologies (Connected / Autonomous & Automated / Shared / Electric) and strengthening the commercial vehicle business on a global scale. MFTBC and Hino would create synergies and enhance the competitiveness of Japanese truck manufacturers.

Despite the promising growth, challenges such as data security concerns, interoperability issues, and initial implementation costs pose potential barriers to market expansion. However, ongoing technological advancements and favorable government initiatives promoting smart transportation are expected to sustain the positive trajectory of the connected truck market.

Connected Truck Market Trends

Increasing Use of Telematics in the Commercial Vehicle Market to Drive the Connected Truck Market

Telematics plays a significant role in developing unique solutions for efficient supply chain logistics and fleet management. Telematics provides real-time visibility and data to optimize procedures and processes, maintain product integrity, optimize shelf-life, and reduce losses and insurance risks across the supply chain.

Telematics is becoming a critical component in commercial logistics and supply chains because it addresses key challenges related to safety and regulatory compliance, driver monitoring, insurance, and infrastructure.

Telematics solutions integrate capabilities like live traffic updates, smart routing and tracking, rapid roadside assistance in case of accidents or breakdowns, automatic toll transactions, and insurance telematics. Therefore, they are critical to optimizing the operational metrics of fleets, such as fuel cost reduction, resource optimization, and real-time connectivity.

The growing e-commerce sector and increased online shopping activities also significantly contribute to the growing demand for connected trucks. Retail e-commerce sales worldwide in 2022 remained over USD 6 trillion, registering an annual growth rate of 11.16%. The total online retail revenue in Asian countries alone added up to nearly USD 1.7 trillion in 2022.

Additionally, most e-commerce companies have in-house logistics operations and are ordering large fleets of connected trucks incorporating telematics control units. Trucks with telematics control units enable them to monitor trucks remotely for safety, fleet performance, fuel efficiency, the behavior of drivers, and predictive maintenance. For instance,

In October 2022, Amazon announced it would invest EUR 1 billion in electric vans, trucks, and low-emission package hubs across Europe over the next five years. These vehicles also feature next-generation connected technologies like telematics. The company aims to increase its electric and connected vans fleet from 3,000 to 10,000. The company also plans to deploy 1,500 heavy-duty electric trucks in Europe for middle-mile deliveries.

Moreover, companies are spending huge amounts on making telematics technology more advanced and integrating telematics devices in commercial vehicles. For instance,

In October 2022, Lytx Inc. and Daimler Trucks, North America, announced their new partnership wherein Lytx Inc. would launch a new telematics and camera solution factory-fitted on select Western Star and Freightliner models sold in North America.

Based on all the above factors, the growing usage of telematics and the large fleet orders from e-commerce companies are expected to drive the growth of the connected trucks market over the forecast period.

North America and Europe are Playing Key Role in the Connected Truck Market Growth

Geographically, Europe and North America hold the major shares of the connected truck market, owing to the expansion of the automotive sector in these regions. The robust transportation infrastructures in both regions provide a solid foundation for integrating connected technologies into trucking operations. Additionally, well-developed road networks and communication systems facilitate the seamless implementation of telematics solutions, real-time tracking, and data-driven analytics in commercial vehicles.

Furthermore, stringent regulatory environments in North America and Europe play a pivotal role in propelling the adoption of connected truck solutions. Regulations addressing safety, emissions, and fuel efficiency standards drive the need for advanced technologies that enable real-time monitoring and compliance. For instance, North America's Advanced Clean Fleets (ACF) regulation states that beginning January 1, 2024, trucks must be registered in the CARB (California Air Resources Board) Online System to conduct drayage activities in California.

Industry collaboration is another key factor contributing to the dominance of these regions. Major truck manufacturers, technology providers, and fleet management companies have garnered strategic partnerships, accelerating the development and deployment of connected truck solutions. Major telecom companies across North America are partnering with leading connected truck companies to expand their product portfolios. For instance,

In October 2022, Drivewyze, the leader in connected truck services and operator of the largest public-private weigh station bypass network in North America, partnered with telecom major Verizon Connect to provide Verizon Connect Reveal customers with integrated access to Drivewyze weigh station bypass and Drivewyze Safety+ services.

The demand for connected trucks in Asia-Pacific is anticipated to grow rapidly over the next five years owing to the region's burgeoning economies and increasing emphasis on smart transportation solutions. The Chinese government focuses on several advanced vehicle technologies, like ADAS features and electric mobility. Major automakers in the country are updating their portfolio by introducing the new level 2 and level 3 ADAS features. For instance,

In July 2022, the Dongfeng Chenglong H5 was licensed for its first heavy-duty autonomous truck in China. The Chenglong H5's remote driving system runs on China Mobile's 5G network.

While North America and Europe currently lead the way, other regions, particularly the Asia-Pacific, are expected to catch up with the growth pace during the forecast period.

Connected Truck Indsutry Overview

The connected truck market is consolidated and majorly dominated by a few global players, which include Daimler Truck SE, Traton SE, Tata Motors Ltd, Volvo Trucks Corporation, and PACCAR. These players also engage in joint ventures, mergers and acquisitions, new product launches, and product development to expand their brand portfolios and cement their market positions.

For instance, in October 2022, Aurora Innovation Inc. and Ryder Technology Inc. collaborated to pilot on-site fleet maintenance. Ryder would embed skilled technicians to work alongside Aurora technicians at Aurora's South Dallas campus.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Government Norms Mandating the Integration of Connected Technologies in Commercial Vehicles are Driving the Growth

- 4.1.2 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Lack of IT Enabled Infrastructure in Emerging Economies Restricts the Connected Truck Market Growth

- 4.2.2 Cyber Security Threats Remain a Concern for the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Billion)

- 5.1 Vehicle Type

- 5.1.1 Light Commercial Vehicles

- 5.1.2 Heavy Commercial Vehicles

- 5.2 Range

- 5.2.1 Dedicated Short-Range Communication (DSRC)

- 5.2.1.1 Blind Spot Warning (BSW)

- 5.2.1.2 Forward Collision Warning (FCW)

- 5.2.1.3 Lane Departure Warning (LDW)

- 5.2.1.4 Emergency Brake Assist (EBA)

- 5.2.1.5 Other Ranges

- 5.2.2 Long-range (Telematics Control Unit)

- 5.2.1 Dedicated Short-Range Communication (DSRC)

- 5.3 Communication Type

- 5.3.1 Vehicle-to-Vehicle (V2V)

- 5.3.2 Vehicle-to-Cloud (V2C)

- 5.3.3 Vehicle-to-Infrastructure (V2I)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Continental AG

- 6.2.3 Denso Corporation

- 6.2.4 Aptiv Global Operations Limited

- 6.2.5 ZF Friedrichshafen AG

- 6.2.6 NXP Semiconductors NV

- 6.2.7 Magna International Inc.

- 6.2.8 Sierra Wireless

- 6.2.9 Mercedes-Benz Group AG

- 6.2.10 AB Volvo

- 6.2.11 Harman International

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of 5G and Cloud-based Technology in Automobiles to be a Future Trend

8 MARKET SIZE AND FORECAST IN TERMS OF VOLUME

9 ANALYSIS OF THE TECHNOLOGICAL TRENDS AND INNOVATIONS WITHIN THE CONNECTED TRUCK MARKET

10 ANALYSIS OF REGULATORY FRAMEWORKS IMPACTING THE CONNECTED TRUCK MARKET