PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1536886

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1536886

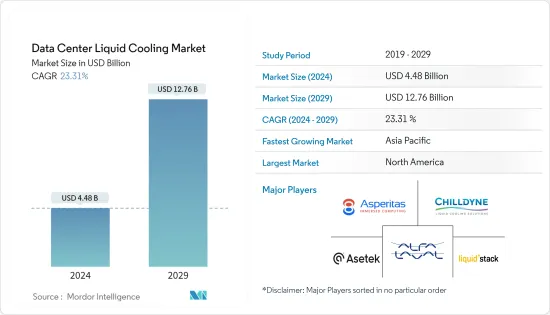

Data Center Liquid Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Data Center Liquid Cooling Market size is estimated at USD 4.48 billion in 2024, and is expected to reach USD 12.76 billion by 2029, growing at a CAGR of 23.31% during the forecast period (2024-2029).

The need for data centers has grown as the population grows increasingly connected and dependent on digital infrastructure. Effective cooling solutions are urgently needed to ensure optimal performance and avoid expensive downtime due to the data center development and growth spike.

Key Highlights

- Data center growth has been significantly aided by the uptake of cloud computing solutions and the spread of big data analytics. Businesses increasingly rely on cloud-based services and storing enormous amounts of data for processing and research. For instance, to meet the rising demand, cloud industry giants like Amazon Web Services (AWB), Microsoft Azure, and Google Cloud Platform continuously extend their data center footprints.

- Growing developments in IT infrastructure in emerging economies, such as India, Hong Kong, China, Indonesia, and other emerging countries, are likely to boost the demand for data centers. The demand for data centers is expected to increase due to the adoption of the cloud model, which has cost and operational benefits for the IT industry.

- Data center operators are wary of potential downtime losses while shifting to new cooling systems. Hence, they overlook operational expenditures and continue using outdated cooling systems. This trend slows the adoption of new technologies that are perceived to be untested.

- A new wave of post-pandemic digital transformation among businesses is expected to drive the market. Many companies have started to rely on third-party colocation facilities to house their data centers, and there's a growing trend towards hybrid IT - combining the power of hosted centers with multi-cloud environments.

Data Center Liquid Cooling Market Trends

Edge Computing to Witness Significant Growth

- In the forecast period, organizations are expected to witness rapid growth in the number of IP-connected mobile and machine-to-machine (M2M) devices, which will handle significant amounts of IP traffic.

- The demand is expected to rise for faster Wi-Fi service and application delivery from online providers. Also, some M2M devices, such as autonomous vehicles, will require real-time communications with local processing resources to guarantee safety.

- The deployment of edge data centers benefits many new technologies, including fifth-generation (5G) networks and the Internet of Things (IoT), as the adoption of (IoT) connections is expected to more than double, with the number of wide-area IoT 6 billion by 2028. and Industrial Internet of Things (IIoT) of devices, autonomous vehicles, virtual and augmented reality, artificial intelligence and machine learning, data analytics, and video streaming and surveillance.

- Moreover, the emergence of 5G wireless infrastructure has urged data center operators to opt for edge computing infrastructure to work with networks offering lower latency and higher resiliency. Multi-access edge computing (MEC) aids network services in connecting to users closely. Hence, the demand for efficient edge data centers is expected to be augmented by many factors, including the introduction of 5G technology across the world and the growing trend of autonomous or self-driving vehicles and smart cities.

- However, a key requirement of large-scale edge computing roll-outs will be low operating costs. In edge deployments, immersive liquid cooling is known to provide dramatic energy-saving benefits.

- The reliability and no-touch features of liquid cooling solutions will match the need for extended mean time to maintenance and longer intervention intervals needed for viable operation and management of remotely located equipment.

North America to Hold the Largest Market Share

- North America is an early adopter of newer technologies. The data center investors are increasingly investing in liquid immersion and direct-to-chip cooling solutions. The importance of edge data centers has been aided by the emergence of 5G networks worldwide, and the United States is among the earliest adopters of the technology. Many operators in the United States, such as EdgePresence, EdgeMicro, and American Towers, have started investing in these centers.

- The mobile data traffic in the United States increased considerably over the years, from 1.26 exabytes per month of data traffic in 2017 to 7.75 exabytes per month of data traffic by 2022, as reported by Cisco Systems. Ericsson says this data traffic is expected to triple further by 2030. Thus, the distributed cloud that may secure the low latency and high bandwidth required to connect such scale easily is coming into action.

- The United States is witnessing massive growth in internet usage by people and businesses. The country is the largest market in data center operations, and it continues to grow due to the higher consumption of data by end-users. The growing popularity of the Internet of Things (IoT) is a significant driver for the US hyper-scale data center market, leading to additional facilities that can support exabytes of data generated by both business users and consumers.

- The United States will be the fastest-growing data center market in the region in the coming years. The significant drivers of data center construction in the United States. have been recent economic incentives and tax benefits. Approximately 27 states leverage these factors to attract data center projects. In addition, the heavy tax breaks implemented in the United States indicate a government-front aim to construct new mega data centers or renovate existing ones. Such instances in the market create more of a need for data center liquid cooling services in the region.

Data Center Liquid Cooling Industry Overview

The data center liquid cooling market is fragmented and highly competitive and consists of several significant players like Alfa Laval Corporate AB, LiquidStack Inc., Asetek Inc. A/S, AsperitasChilldyne Inc., etc. In terms of market share, few important players currently dominate the market. The widely deployed cooling system is still air cooling, and liquid cooling systems have a relatively small share in the overall cooling landscape. As relatively high costs are considered market challenges, the immersion cooling systems market is estimated to have a significant threat of substitutes.

- March 2024 - Summer announced its membership in the recently established Liquid Cooling Coalition (LCC), a premier industry forum comprised of stakeholders, including industrial coolant producers, original equipment manufacturers, original device manufacturers, high-performance computing application operators, and data center providers.

- March 2024 - Vertiv, a significant provider of critical infrastructure and continuity solutions, is now a Solution Advisor: Consultant partner in the Nvidia Partner Network (NPN), providing more comprehensive access to Vertiv's experience and complete power and cooling solutions portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Evolution Of Data Center Cooling

- 4.1.1 Air Conditioners/Handlers

- 4.1.2 Chillers And Economizer Systems

- 4.1.3 Liquid Cooling Systems

- 4.1.4 Row/Rack/Ddoor/Over-head Cooling Systems

- 4.2 Overview of Data Center Cooling Market

- 4.3 Energy Consumption, Computing Density Metrics and Key Considerations For Liquid Cooling

- 4.4 Industry Stakeholder Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Degree of Competition

- 4.5.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Development of IT Infrastructure in the Region

- 5.1.2 Emergence of Green Data Centers

- 5.2 Market Restraints

- 5.2.1 Costs, Adaptability Requirements, and Power Outages

- 5.3 Assessment of COVID-19 Impact on the Industry

6 OUTLOOK OF REAR DOOR HEAT EXCHANGERS (RDHX) IN DATA CENTERS

- 6.1 Technical Comparison of RDHx and Liquid Cooling (Direct and Indirect) in Data Centers

- 6.2 Recent Developments by Data Center Cooling Technology Vendors in the Context Of RDHx and Liquid Cooling Market

- 6.3 Approximate Global Market Share of RDHx (in USD Billion)

- 6.4 List of Key RDHx Vendors (Business Overview, Portfolio and Recent Developments)

7 DIRECT COOLING OR IMMERSION COOLING MARKET

- 7.1 Direct Cooling Market Overview And Estimate

- 7.2 Immersion Cooling - Key Application

- 7.2.1 High-performance Computing

- 7.2.2 Edge Computing

- 7.2.3 Cryptocurrency Mining

- 7.3 Immersion Cooling Fluids

- 7.3.1 Fluorocarbon-based Fluids

- 7.3.2 Hydrocarbons Fluids

8 INDIRECT OR DIRECT-TO-CHIP COOLING MARKET

- 8.1 Indirect Cooling Market Overview and Estimates

- 8.2 Indirect or Direct-to-chip Cooling Key Applications

9 MARKET SEGMENTATION

- 9.1 By Geography***

- 9.1.1 North America

- 9.1.2 Europe

- 9.1.3 Asia

- 9.1.4 Australia and New Zealand

- 9.1.5 Latin America

- 9.1.6 Middle East and Africa

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles*

- 10.1.1 Alfa Laval Corporate AB

- 10.1.2 LiquidStack Inc.

- 10.1.3 Asetek Inc. A/S

- 10.1.4 Asperitas

- 10.1.5 Chilldyne Inc.

- 10.1.6 CoolIT Systems Inc.

- 10.1.7 Fujitsu Ltd.

- 10.1.8 Mikros Technologies

- 10.1.9 Kaori Heat Treatment Co. Ltd

- 10.1.10 Lenovo Group Limited

- 10.1.11 LiquidCool Solutions Inc.

- 10.1.12 Midas Green Technologies

- 10.1.13 Iceotope Technologies Ltd

- 10.1.14 USystems Ltd (Legrand Group)

- 10.1.15 Rittal GmbH & Co. KG

- 10.1.16 Schneider Electric

- 10.1.17 Submer Technologies & Submer Inc.

- 10.1.18 Vertiv Group Corp.

- 10.1.19 Wakefield Thermal Solutions Inc.

- 10.1.20 Wiwynn Corporation

- 10.1.21 3M Company

- 10.1.22 Engineered Fluids Inc.

- 10.1.23 Green Revolution Cooling Inc.

- 10.1.24 Solvay SA

11 COOLING TECHNOLOGY INNOVATIONS ACROSS THE VALUE CHAIN

12 INVESTMENT ANALYSIS AND MARKET OUTLOOK