PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850382

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850382

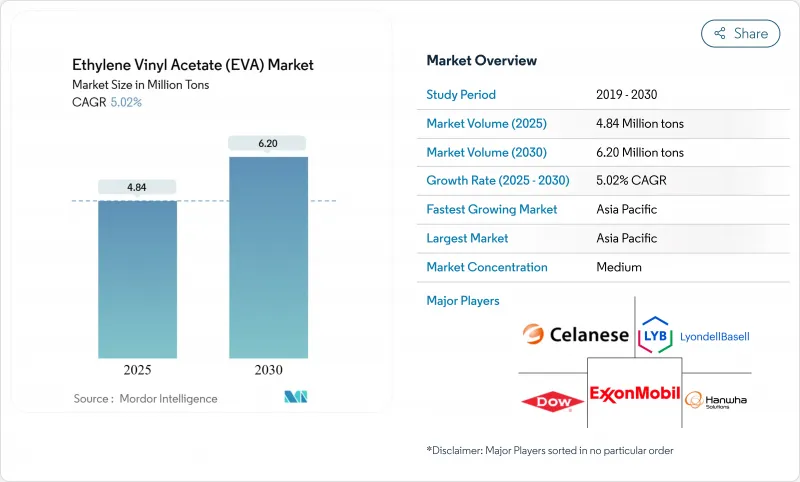

Ethylene Vinyl Acetate (EVA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Ethylene vinyl acetate market stands at 4.84 million tons in 2025 and is forecast to reach 6.20 million tons by 2030, reflecting a healthy 5.02% CAGR over 2025-2030.

In volume terms, this projects a 1.6 million ton expansion, anchored in EVA's versatility across flexible packaging, footwear foams, solar encapsulation and specialty films. The low processing temperatures of EVA, its compatibility with a broad range of polymer blends and its ability to satisfy demanding seal-through-contamination requirements have made it indispensable to brand owners looking for efficiency gains and waste reduction. Supply chain localization in Asia-Pacific, coupled with rising agricultural film consumption in arid regions, is reinforcing regional demand. Meanwhile, innovations such as supercritical CO2 foaming enable lighter midsoles and orthopedic insoles, increasing EVA's value proposition in performance footwear. Ongoing feedstock volatility and escalating regulatory scrutiny of single-use plastics temper near-term profitability, but producers are countering these headwinds through vertical integration, biomass-derived grades and closed-loop recycling pilots, sustaining the Ethylene vinyl acetate market growth path.

Global Ethylene Vinyl Acetate (EVA) Market Trends and Insights

Lightweight EVA foams revolutionizing footwear manufacturing

Supercritical CO2 foaming introduced in 2024 allows producers to generate closed-cell EVA structures with densities below 0.15 g/cm3, trimming finished shoe weight by up to 30% while enhancing rebound. Footwear brands rapidly adopted this technology across Chinese and Vietnamese factories to meet consumer demand for lighter athletic shoes and to satisfy corporate greenhouse-gas reduction goals. Investment in in-house foaming lines now offers supply security, reducing reliance on outsourced midsoles. Alongside weight savings, brands cite lower cycle times and fewer volatile organic compound emissions than traditional chemical foaming, strengthening the Ethylene vinyl acetate market position in athletic and medical footwear.

Increasing demand from agricultural applications

Field trials in arid northwest China showed EVA mulch films cut soil evaporation by 75% and lifted soybean yields by 19%. These improvements, coupled with EVA's high elongation and crack resistance, are driving greenhouse, silage, and tunnel film upgrades across India and North Africa. Global fertilizer cost inflation is further tilting farmer economics toward films that maximize nutrient uptake and water efficiency. With governments promoting water-smart agriculture, the Ethylene vinyl acetate market benefits from policy subsidies that offset farmers' up-front film costs.

Volatility in vinyl acetate monomer & ethylene feedstocks

VAM and ethylene represent up to 80% of EVA production cost. Geopolitical tensions and planned cracker shutdowns in 2024 swung spot VAM prices by 18% quarter-to-quarter, eroding processor margins. Integrated players such as LyondellBasell are optimizing feedstock pools and leveraging favorable North American ethane economics to mitigate exposure. Non-integrated converters, however, must navigate price contracts with wider escalators, creating uncertainty for the Ethylene vinyl acetate market's short-term profitability.

Other drivers and restraints analyzed in the detailed report include:

- Shift toward recyclable flexible food packaging in North America

- Growth of renewable energy driving solar encapsulation demand

- Regulatory crackdown on single-use plastics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Low-density EVA accounted for 47% of the Ethylene vinyl acetate market in 2024, reflecting its superior flexibility, clarity and easy processing across extrusion, injection and blow-molding lines. Within this segment, high-density grades is projected to rise at a 6.56% CAGR through 2030 as footwear, medical tubing and cushioning foams proliferate. Low vinyl-acetate (less than 12%) variants serve packaging shrink films, whereas higher VA content (28-40%) delivers elastic recovery for sports-shoe midsoles. Medium-density grades balance stiffness and toughness for laminated pouches, while high-density EVA remains niche in wire-and-cable jacketing. Custom compounding-such as Celanese's EVA-polyamide hybrids for battery gaskets-is allowing converters to fine-tune melt indices and sealing windows inside the Ethylene vinyl acetate market.

Producers are boosting sustainability by blending bio-naphtha and certified mass-balance feedstocks. Dow-Mitsui's biomass-derived portfolio replaces fossil carbon without altering processing parameters, giving brands a direct route to Scope 3 emission reductions. Coupled with recyclate-ready additive packages that minimize yellowing, such offerings cement low-density EVA's leadership within the Ethylene vinyl acetate market.

Films captured 43% of the Ethylene vinyl acetate market in 2024, buoyed by food packaging, stretch hoods and industrial pallet shrink. Market leaders attained down-gauge ratios nearing 20% over the last three years, thanks to improved slip-agent dispersion and real-time thickness-control sensors. Agricultural films are a high-growth sub-segment; EVA-based greenhouse covers achieve greater than 90% light transmittance and cut heating costs in continental climates A&C Plastics. Adhesives form the second-largest application cluster, where hot-melt EVA systems bond diverse substrates at lower temperatures, reducing char formation and line maintenance.

Solar encapsulation is the most dynamic sub-segment. The Ethylene vinyl acetate market size for encapsulant sheets is expected to grow at a 7.05% CAGR to 2030 as global solar panel output scales. EVA's lower cost offsets its moderate moisture resistance compared with polyolefin elastomers, preserving its market edge. Laminator manufacturers continue to fine-tune cycle times and gel-content targets to push module throughput, anchoring EVA as the incumbent technology.

The Ethylene Vinyl Acetate Market Report Segments the Industry by Grade (Low Density, Medium Density, and More), Application (Films, Adhesives, and More), End-Use Industry (Packaging, Photovoltaic, and More), Processing Technology (Extrusion, Injection Molding, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific retained a 63% volume share of the Ethylene vinyl acetate market in 2024. China commands the largest installed EVA capacity, supported by integrated naphtha crackers and energy-efficient autoclave processes. The region's footwear supply chain relies heavily on Vietnamese and Indonesian foam extruders, while Chinese solar panel makers such as LONGi and JinkoSolar consume vast quantities of encapsulant film. Government incentives for greenhouse modernization in India push EVA agricultural film uptake.

North America remains the technology leader in recyclable flexible packaging. Converters in the United States upgraded blown-film lines with multilayer die heads that co-extrude high-VA EVA seal layers against high-density core layers, reducing total structure thickness by 12-15%. Demand is buttressed by federal tax credits for domestic photovoltaic manufacturing, driving a domestic shift toward 3-layer encapsulant sheets.

Europe faces the strictest regulatory environment. German and French automakers source cross-linked EVA sound-deadening sheets for battery-electric vehicles, leveraging the polymer's high damping and chemical resistance. However, the new Packaging and Packaging Waste Regulation mandates recyclability pathways, encouraging compounders to develop peroxide-free cross-linking systems that remain compatible with existing recycling streams. Western European producers are investing in bio-naphtha-based EVA grades to meet customer net-zero targets, sustaining the Ethylene vinyl acetate market's resilience despite legislative pressure.

- Asia Polymer Corporation

- BASF-YPC Company Limited

- Benson Polymers Pvt Ltd.

- Braskem

- Celanese Corporation

- China Petrochemical Corporation.

- Clariant

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Hanwha Solutions

- Hyundai Chemical

- Innospec

- Jiangsu Sailboat Petrochemical Co., Ltd.

- Levima Group Co., Ltd.

- LOTTE Chemical Corporation

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Repsol

- Saudi Arabian Oil Co.

- Sinochem Holdings Corporation Ltd

- Sipchem Company

- Sumitomo Chemical Co. Ltd

- Zhejiang Petroleum & Chemical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Lightweight EVA Foams Driving Footwear Manufacturing in Asia-Pacific

- 4.2.2 Increasing Demand from Agricultural Applications

- 4.2.3 Shift Toward Recyclable Flexible Food Packaging in North America

- 4.2.4 Growth of Renewable Energy

- 4.2.5 Increasing Demand from the Packaging Industry

- 4.3 Market Restraints

- 4.3.1 Volatility in Vinyl Acetate Monomer and Ethylene Feedstock Prices

- 4.3.2 Regulatory Crack-down on Single-Use Plastics in EU and US

- 4.3.3 Increasing Threat of Substitutes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Grade

- 5.1.1 Low Density

- 5.1.2 Medium Density

- 5.1.3 High Density

- 5.2 By Application

- 5.2.1 Films

- 5.2.2 Adhesives

- 5.2.3 Foams

- 5.2.4 Solar Cell Encapsulation

- 5.2.5 Other Applications

- 5.3 By End-use Industry

- 5.3.1 Packaging

- 5.3.2 Photovoltaic

- 5.3.3 Agriculture

- 5.3.4 Footwear and Sporting Goods

- 5.3.5 Automotive and Transportation

- 5.3.6 Electrical and Electronics

- 5.3.7 Others

- 5.4 By Processing Technology

- 5.4.1 Extrusion

- 5.4.2 Injection Molding

- 5.4.3 Blow Molding

- 5.4.4 Other Processes

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Asia Polymer Corporation

- 6.4.2 BASF-YPC Company Limited

- 6.4.3 Benson Polymers Pvt Ltd.

- 6.4.4 Braskem

- 6.4.5 Celanese Corporation

- 6.4.6 China Petrochemical Corporation.

- 6.4.7 Clariant

- 6.4.8 Dow

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Formosa Plastics Corporation

- 6.4.11 Hanwha Solutions

- 6.4.12 Hyundai Chemical

- 6.4.13 Innospec

- 6.4.14 Jiangsu Sailboat Petrochemical Co., Ltd.

- 6.4.15 Levima Group Co., Ltd.

- 6.4.16 LOTTE Chemical Corporation

- 6.4.17 LG Chem

- 6.4.18 LyondellBasell Industries Holdings B.V.

- 6.4.19 Repsol

- 6.4.20 Saudi Arabian Oil Co.

- 6.4.21 Sinochem Holdings Corporation Ltd

- 6.4.22 Sipchem Company

- 6.4.23 Sumitomo Chemical Co. Ltd

- 6.4.24 Zhejiang Petroleum & Chemical

7 Market Opportunities and Future Outlook

- 7.1 Increasing Demand for Photovoltaic (PV) Solar Cell Encapsulants

- 7.2 White-space and Unmet-need Assessment