PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1443955

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1443955

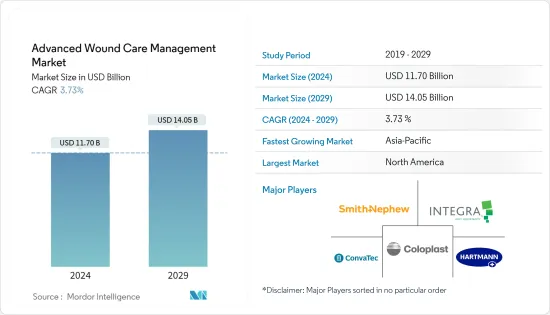

Advanced Wound Care Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Advanced Wound Care Management Market size is estimated at USD 11.70 billion in 2024, and is expected to reach USD 14.05 billion by 2029, growing at a CAGR of 3.73% during the forecast period (2024-2029).

Even though advanced wound care has been a crucial part of healthcare, in the recent past it experienced low demand in the market owing to the surge in COVID-19 cases. Due to the COVID-19 outbreak, healthcare facilities such as hospitals were exhausted with a large number of COVID-19 patients; therefore, many countries postponed elective surgeries and other healthcare procedures for an indefinite period. Moreover, the outbreak of COVID-19 created large-scale opportunities for local manufacturers. Due to the restrictions on movement at international borders, the supply chains of major players were disrupted. This created an opportunity for local players to enter the market for advanced wound care and meet the unmet demands of the end-users.

According to the study published in the International Wound Journal in February 2021, in Germany, the COVID-19 pandemic hindered access to clinical care for chronic wounds. However, the limitations had no appreciable effect on the quality of life associated with wound care or at-home care. Thus, the advanced wound care market was significantly impacted. Moreover, the market is expected to regain its growth as all the restrictions have been lifted and surgical procedures worldwide have started to resume since the last year. For instance, as per the Australian Nursing & Midwifery Journal April 2022 update, roughly 450,000 Australians currently live with chronic wounds, directly costing the Australian healthcare system around AUD 3 billion (USD 1.99 billion) per year. The high prevalence of chronic wounds globally is projected to boost the advanced wound care management market during the forecast period.

The advanced wound care management market is mainly driven by technological advancements, the aging population, problems associated with ineffective traditional wound healing methods, initiatives taken by the government, and a pressing need for swift and safer treatment of chronic wounds. An article published in the Wound Healing Society in February 2021 indicated that chronic wounds impact the quality of life of nearly 2.5% of the total population in the United States and the management of wounds has a significant economic impact on healthcare. Chronic wounds are anticipated to continue to be a significant clinical, social, and economic challenge due to the aging population, the ongoing global threat of diabetes and obesity, and the ongoing issue of infection.

Moreover, the growing surgical volume across the globe is expected to boost the market growth. According to the research study published in June 2021, a total of 92,809 operations were classified as heart surgery procedures in a classical sense, of which 29,444 were isolated coronary artery bypass grafting procedures, 35,469 were isolated heart valve procedures, and the number of isolated heart transplantation increased by 2% to 340. Hence, the high number of heart procedures and surgeries being performed yearly is anticipated to boost the growth of the market studied.

Furthermore, the volume of knee and hip replacement surgeries has increased worldwide in recent years, and persistent wound drainage is a well-known complication following these procedures, which commonly leads to wound development. For instance, as per the June 2021 report of the Canadian Institute of Health Information, 63,496 hip replacement and 75,073 knee replacement surgeries were performed during 2019-2020 in Canada, and there was an average increase of about 5% in recent years in the knee and hip replacement procedures in the country. The rise in surgical procedures is expected to drive the demand for the advanced wound care management market.

In addition, growing technological advancement in wound care products is expected to propel the growth of the market. For instance, in August 2021, researchers at IIT Guwahati, India, invented a low-cost, biodegradable, composite, transparent wound-dressing film. This material, based on the integration of a synthetic polymer, is non-toxic in nature and will create a moist environment that would enable the body to heal on its own through indigenous enzymes, according to recent research.

Thus, all the above-mentioned factors are expected to boost the market over the forecast period. However, the high cost associated with the treatment and reimbursement issues for the new technologies serve as factors that hinder the market.

Advanced Wound Care Management Market Trends

Foam Dressing Segment is Expected to Hold a Major Share in the Studied Market

Foam dressings are used for moderate to heavy exudate wounds. Foam dressings are created from polyurethane or silicone materials that come with or without antibacterial materials, such as silver. Some of these dressings have a 'sticky' side that adheres to the intact wound without adhering to the wound bed. The demand for foam dressing products is increasing owing to increasing burn cases, various ulcers, open wounds, and rising surgical cases around the world. Furthermore, diabetes is expected to be a major factor causing wounds. Thus, a rise in the number of people suffering from diabetes is anticipated to drive the market.

The International Diabetes Federation (IDF) is divided into seven regions, and the United States is one of the 23 countries in the IDF North America and Caribbean (NAC) region. As per data from IDF, out of the 537 million people who have diabetes globally, more than 51 million people reside in the NAC Region; this count is expected to rise to 63 million by 2045. Therefore, the increasing number of diabetes patients who are more prone to getting ulcers is expected to boost the market.

Growing research and development activities are further boosting the market growth over the forecast period. For instance, in June 2022, Medline released its OptifoamGentle EX Foam Dressing. When combined with a pressure injury prevention protocol, the product is intended to help displace pressure. The product has five distinct layers that assist absorb shear stress, friction, and moisture. In May 2022, Winner Medical showcased its latest and industry-leading advanced surgical wound care products, namely the Transparent Film Dressing, Bordered Silicone Foam Dressing with SAF and Antibiosis Series Products, and the new product, the Carboxymethylcellulose (CMC) dressing.

Thus, all the above-mentioned factors are expected to boost segment growth over the forecast period.

Asia-Pacific Region is Expected to Register Significant CAGR Over the Forecast Period

In Asia-Pacific, the market for advanced wound care is estimated to witness the highest CAGR over the forecast period. This can be attributed to changing lifestyles leading to an increase in the incidence of chronic diseases and an increase in the geriatric population in this region.

The incidence of chronic wounds, especially foot ulcers, increased among the diabetic population. For instance, in 2021, the International Diabetes Federation (IDF) reported that the number of diabetic cases in China in 2021 was 140.9 million, which accounts for 10.6% of China's population, and this number is expected to increase to 164.06 million by 2030. According to the same report, the country was reported with 72.83 million undiagnosed cases of diabetes in 2021. Thus, high diabetes prevalence is accompanied by a high incidence of diabetic foot ulcers, raising the demand for advanced wound care management in the region. Additionally, as per the article published in the Journal of Nursing in June 2021, skin damage in the elderly contributes to pressure ulcer formation due to increased friction and shear forces. Thus, the increase in the geriatric population is also expected to contribute to the growth of the market as the elderly tend to have vulnerable skin and require expert wound care management.

The strategic activities by the market players such as product launches are expected to boost market growth. For instance, in September 2022, COSMOTEC, an M3 Group Company, received insurance coverage in Japan for the RECELL System for the treatment of acute burns. Additionally, in March 2022, Advanced Oxygen Therapy Inc. (AOTI) received the Chinese National Medical Products Administration (NMPA) approval for its unique cyclically pressurized topical wound oxygen (TWO2) therapy.

Thus, all the above-mentioned factors are expected to boost market growth over the forecast period.

Advanced Wound Care Management Industry Overview

The advanced wound care management market is highly fragmented, with the presence of a large number of players. As technology progresses and becomes more viable, the quality of life of patients afflicted with chronic wounds improves. Traditional wound care and closure products are being increasingly substituted with advanced wound care management and closure products due to their efficacy and effectiveness in managing wounds by enabling faster healing. Market players are focusing on various growth strategies in order to enhance their market presence through mergers, acquisitions, partnerships, collaborations, new product launches, etc. The key market players in advanced wound care management are Convatec, Integra, Smith and Nephew Hartmann, and Coloplast, among others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidences of Chronic Wounds, Ulcers, and Diabetic Ulcers

- 4.2.2 Increase in Volume of Surgical Procedures Worldwide

- 4.2.3 Growing Demand for Faster Recovery of Wounds

- 4.2.4 Increase in Aging Population

- 4.3 Market Restraints

- 4.3.1 Lack of Proper Reimbursements

- 4.3.2 High Treatment Costs

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Wound Dressings

- 5.1.1.1 Film Dressings

- 5.1.1.2 Foams Dressings

- 5.1.1.3 Hydrogel Dressings

- 5.1.1.4 Collagen Dressings

- 5.1.1.5 Other Dressings

- 5.1.2 Active Wound Care

- 5.1.2.1 Skin Substitutes

- 5.1.2.2 Growth Factors

- 5.1.3 Therapy Devices

- 5.1.3.1 Negative Pressure Wound Therapy

- 5.1.3.2 Pressure Relief Devices

- 5.1.3.3 Hyperbaric Oxygen Equipment

- 5.1.3.4 Compression Therapy

- 5.1.3.5 Other Therapy Devices

- 5.1.4 Other Advance Wound Care Products

- 5.1.1 Wound Dressings

- 5.2 By Wound Type

- 5.2.1 Chronic Wound

- 5.2.1.1 Diabetic Foot Ulcer

- 5.2.1.2 Pressure Ulcer

- 5.2.1.3 Arterial and Venous Ulcer

- 5.2.1.4 Other Chronic Wound

- 5.2.2 Acute Wound

- 5.2.2.1 Surgical Wounds

- 5.2.2.2 Burns

- 5.2.2.3 Other Acute Wounds

- 5.2.1 Chronic Wound

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3M Company

- 6.1.2 Organogenesis Holdings Inc.

- 6.1.3 B. Braun Melsungen AG

- 6.1.4 Cardinal Health, Inc

- 6.1.5 Coloplast A/S

- 6.1.6 ConvaTec Group Plc

- 6.1.7 Integra Lifesciences

- 6.1.8 Molnlycke Health Care

- 6.1.9 MiMedx Group, Inc.

- 6.1.10 Paul Hartmann AG

- 6.1.11 Smith & Nephew

7 MARKET OPPORTUNITIES AND FUTURE TRENDS