PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403029

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403029

Digital Forensics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

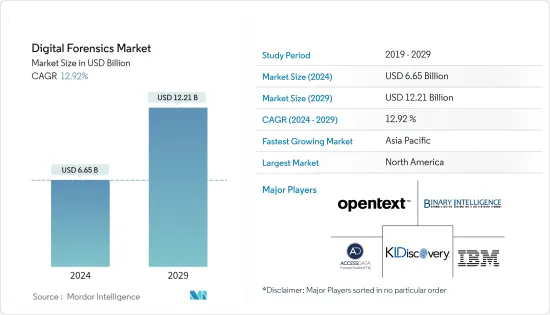

The Digital Forensics Market size is estimated at USD 6.65 billion in 2024, and is expected to reach USD 12.21 billion by 2029, growing at a CAGR of 12.92% during the forecast period (2024-2029).

Key Highlights

- The massive use of Internet of Things (IoT) devices coupled with factors such as stringent government regulations and increasing cyber-attack instances on enterprises are expected to drive the demand for digital forensics software during the forecast period.

- Digital forensics has grown from addressing minor computer crimes to investigating complex international cases that significantly affect the world. Digital forensics includes recovering and investigating material found in digital devices, often concerning computer crimes.

- Most forensics are oriented toward desktops, laptops, and associated media, including hard drives, floppy disks, and optical discs. However, other forms of digital forensics, such as mobile phones and other handheld devices, are becoming increasingly popular for digital curation and preservation. The adoption of digital forensics is growing due to the advancements in IoT devices, such as traditional crime lab infrastructure, increasing penetration in corporate sectors, and the rise in cyber attacks and crimes. For instance, according to the Internet Crime Complaint Center (ICC) and Federal Bureau of Investigation (FBI), 43,300 cases of online identity theft were reported to the IC3. Phishing and similar fraud ranked first, with 2,41,342 complaints.

- Additionally, as enterprises worldwide are transforming digitally, cloud adoption has been on the rise, which brings policies, such as BYOD, to the forefront in many industries. The increase in cloud computing applications providing access to files and other data from anywhere has made collaboration for different teams from different locations simpler for companies. Therefore, if more devices are connected to an enterprise, more sources would be available for hackers to intrude into the enterprise networks.

- Lack of skilled professionals and preplanning investments among Organizations could restrain the market unless the organization could invest in the best digital forensic vendors who could able to detect, analyze and reconstruct the data and make the enterprises follow a proactive approach for threat protection and digital forensics where there is a chance for the market growth. Other factors, such as lack of specialized skills, usage of proprietary operating systems, and high level of encryption in new mobile applications, may hinder the market's growth.

- During COVID-19, the demand for remote working solutions surged due to the organization's transition from conventional workplace methods to working from home by complying with legal and societal goals, such as social distancing and self-isolation. During this period, significant organizational stress and crisis, newer fraud and misconduct risks emerged, internal controls lagged behind the evolving threats, and the need for forensic investigations increased.

Digital Forensics Market Trends

Mobile Forensics Type Segment is Expected to Hold Significant Market Share

- Mobile forensics is an important type of digital forensics, specifically examining and analyzing devices such as smartphones and tablets. It involves recovering, preserving, and analyzing digital evidence from mobile devices to aid the investigation.

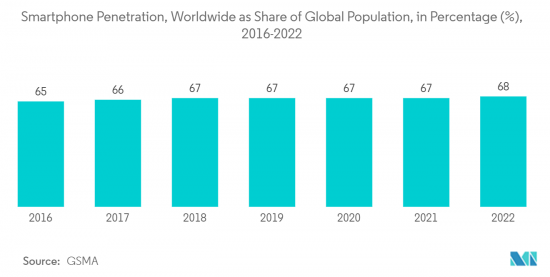

- According to GSMA, The global smartphone penetration rate was estimated at 68 percent in 2022, which increased from 2018, with an estimated 6.3 billion smartphone subscriptions globally and a global population of around 7.4 billion. The increasing prevalence of mobile devices has led to the development of diverse and specialized mobile forensic tools and techniques.

- As mobile devices increasingly gravitate between personal and professional use, the data streams may also witness rapid growth. The mobile forensics process primarily aims to recover digital evidence or any relevant data from the device in a way that may preserve the evidence in a sound condition. The mobile forensic processes have precise rules that can isolate, seize, transport, and store data for analysis and prove digital evidence safely originating from mobile devices. Mobile devices include tablets, cellphones, PDAs, and other similar personal use equipment.

- In mobile forensics, evidence sources include the device's external and internal memory, SIM cards, cell towers, and network servers. The strong security of the SIM cards and the proprietary operating systems may obstruct evidence acquisition. The data on these mobile devices are personal. Therefore, the information becomes very crucial for forensic investigators. The physical acquisition of these devices has become essential to obtain this evidence without alteration.

- Moreover, increasing devices, the importance of social evidence, the increase in big data, and mobile malware are expected to become the major driving factors for mobile forensic solutions in the coming years. Although the field of mobile forensics is under continuous research, newer concepts, such as the involvement of cloud computing in the ecosystem and the evolution of mobile enterprise solutions, particularly mobile device management and BYOD, have brought new opportunities and issues to the sector.

North America is Expected to Hold Significant Market Share

- North America holds a considerable share of the global digital forensics market due to its robust economy, technological advancements, and high incidences of cybercrime. The market has been experiencing steady growth, driven by increasing cyber threats, regulatory compliance requirements, and the need for effective digital investigations.

- The law enforcement and government sectors are North America's primary digital forensics services and solutions consumers. Law enforcement agencies rely on digital forensics to investigate cybercrimes, fraud, intellectual property theft, and other criminal activities involving digital evidence.

- North America is expected to have a prominent share in the digital forensics market, where governments and private citizens can use this technology for criminal and civil cases. Agencies, like the FBI and State Police departments, are using this technology to catch criminals and terrorists involved in illegal activities online. In the private sector, this system is used for similar investigations inside the companies. The technological advancements in the forensics department and the growth in cybercrimes and advanced theft mechanisms are expected to increase investments in the digital forensics market.

- The growing number of cyber threats and attacks by organizations and individuals is increasing in the United States. According to the Identity Theft Resource Center, the number of data compromises and individuals impacted in the United States in 2022 was 1,802 and 422.14 million, respectively.

- North America is at the forefront of technological innovations in digital forensics. The region houses several leading technology companies, research institutions, and forensic laboratories that contribute to developing advanced tools and techniques. This includes advancements in mobile forensics, cloud forensics, artificial intelligence (AI)-based analytics, and forensic data analytics.

Digital Forensics Industry Overview

The Digital Forensics Market is highly fragmented, with the presence of major players like IBM Corporation, Binary Intelligence LLC, Guidance Software Inc. (OpenText), AccessData Group LLC, and KLDiscovery Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In October 2023, Softcell and Binalyze announced a strategic partnership to offer digital forensics and incident response solutions in India. The collaboration of these two security-centric advanced organizations is anticipated to boost noteworthy advancements in digital forensics incident response and cybersecurity competencies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of IoT Devices Driving Demand for Digital Forensics Solutions and Services

- 5.1.2 Network Forensics is Expected to Hold a Significant Market Share

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled Professionals and Preplanning among Organizations

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Service

- 6.2 By Type

- 6.2.1 Mobile Forensics

- 6.2.2 Computer Forensics

- 6.2.3 Network Forensics

- 6.2.4 Other Types

- 6.3 By End-user Vertical

- 6.3.1 Government and Law Enforcement Agencies

- 6.3.2 BFSI

- 6.3.3 IT and Telecom

- 6.3.4 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Binary Intelligence LLC

- 7.1.3 Guidance Software Inc. (Opentext)

- 7.1.4 AccessData Group LLC

- 7.1.5 KLDiscovery Inc.

- 7.1.6 Paraben Corporation

- 7.1.7 FireEye Inc.

- 7.1.8 LogRhythm Inc.

- 7.1.9 Cisco Systems Inc.

- 7.1.10 Oxygen Forensics Inc.

- 7.1.11 MSAB Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS