PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692440

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692440

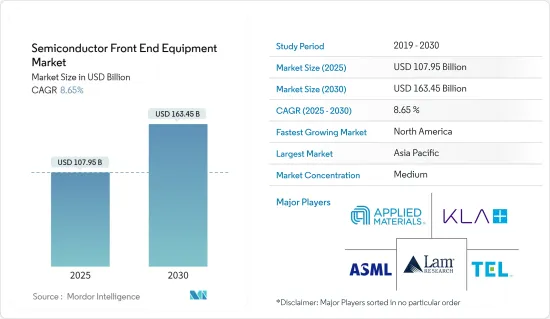

Semiconductor Front End Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Semiconductor Front End Equipment Market size is estimated at USD 107.95 billion in 2025, and is expected to reach USD 163.45 billion by 2030, at a CAGR of 8.65% during the forecast period (2025-2030).

The front-end procedure necessitates a multitude of intricate phases to convert a wafer into a completed device. These steps incorporate wafer cleaning, oxidation, and photolithography to pattern devices, along with etching, deposition, doping, and metallization steps. Inspection and metrology equipment is utilized for process control. This is when the wafers are inspected to identify irregularities that potentially induce issues with the end product. In addition to this, optical techniques are also used, and e-beam inspection is often needed to find the smallest defects.

Key Highlights

- The demand for semiconductor front-end equipment is expected to observe a noteworthy surge as some of the major front-end equipment-producing companies observed record-breaking revenue against a backdrop of a downturn in the semiconductor industry instead of the mild and short-term correction. It was driven by capacity expansion, new fab projects, and high demand for advanced technologies and solutions across the front-end equipment market.

- After registering a record of significant sales last year, the wafer fab equipment, which includes wafer processing, fab facilities, and mask/reticle equipment, is projected to be a bit low in 2023, and this contraction marks a significant improvement. The upward revision is primarily due to China's strong equipment spending. The market grew managing uncertainties created by geopolitical challenges, including the US and Dutch governments' export control regulations and global macro concerns around inflation, rising interest rates, and lower GDP growth in certain economies.

- Consumer electronics is the fastest-growing segment, contributing to market expansion. The use of smartphones, anticipated to rise with population growth, is the key driver of this market. Consumer electronics drive the industry due to increased demand for tablets, smartphones, laptops, computers, and wearable gadgets. As semiconductors advance, new market areas, such as machine learning, are rapidly being integrated.

- The most fascinating "must-win" technologies of the future, such as artificial intelligence, the Internet of Things, quantum computing, and enhanced wireless networks, are currently supported by semiconductors. Semiconductors and microelectronics are advancing to satisfy the complicated demands of a constantly changing digital environment as the world seamlessly integrates breakthrough technology into every aspect of life. Big Data and AI drive this increase and call for smaller, more powerful chips, making their production more difficult and increasing the need for technological innovation.

- Rapid advancements in data storage, computing power, and algorithms have enabled the development and deployment of AI systems. The increased use of digital devices and the Internet has generated extensive volumes of data. AI systems rely on large datasets to train and improve their performance.

- The Internet of Things (IoT), big data, cloud manufacturing, cyber-physical systems (CPS), the Internet of Services (IoS), robotics, augmented reality, and other emerging technologies are included in the Industry 4.0 idea. Creating additional smart industrial processes depends on adopting these technologies, which will unite the physical and digital worlds by encompassing several future industrial advancements.

- As global work-from-home trends gain momentum, the demand for cloud services surges, prompting data center providers to expand their capacities. This, in turn, fuels the global appetite for chips and memory. SEMI reports a notable uptick in investments in 300 mm fabs. Projections suggest that the industry will witness the addition of a minimum of 38 new 300 mm fabs between 2020 and 2024.

- This surge is set to boost the capacity by approximately 1.8 million wafers, pushing the total beyond 7 million. Notably, Taiwan is slated to host 11 of these new volume fabs, with China following closely with eight. Additionally, TSMC is in the process of constructing a new 300 mm fab in Arizona. By the close of 2024, the tally of 300 mm volume fabs is anticipated to hit a significant 161 units.

Semiconductor Front End Equipment Market Trends

Semiconductor Fabrication Plant to be the Largest End-user Industry

- After the design stage, semiconductor chips are manufactured or fabricated in facilities called fabs or foundries. In front-end fabrication, chips are manufactured on circular sheets of silicon or, less commonly, other semiconducting materials called wafers, typically about 8 or 12 inches in diameter.

- Fabrication is a process that turns designs into chips, relying on various SMEs and materials. First, a furnace forms a cylinder of silicon, which is cut into disc-shaped wafers. Semiconductor fabrication facilities ("fabs") make chips into wafers in two steps: forming transistors and other electrical devices in material layers within the silicon and forming metal interconnects between the electrical devices in insulating layers above the silicon. Together, the electrical devices and interconnects form circuits.

- Firms headquartered in the United States, Taiwan, South Korea, Japan, and China control most of the world's fab market share and fab capacity, which are also physically located in these countries. Semiconductor product development requires working harmoniously for many businesses (from materials to logistics). The complex process of fabricating semiconductor devices has also increased the development cost. Companies have leveraged different business models to lower expenditures and survive in semiconductors.

- In November 2023, China brought 42 lithography systems worth USD 816.8 million. The Netherlands supplied 16 lithography systems, totaling USD 762.7 million, a tenfold increase from the previous year. Additionally, China imported 21 systems from the Netherlands in October. Japanese companies Canon and Nikon also supplied China with lithography tools. Thus, an upward revision is expected in the demand for front-end equipment in semiconductor fabrication plants.

- The global economy is expected to recover, and the demand for components is expected to rise owing to not only growth in the smartphone, server, notebook computer, TV, and automobile markets next year but also the continued rollout of next-generation networks, including 5G base stations and Wi-Fi 6 technologies.

- According to the European 5G Observatory, as of 2023, Germany had the maximum 5G base stations among European Union (EU) member states, with approximately 90,000 base stations installed. The design and manufacturing of these chips and their research can provide hundreds of thousands of high-paying jobs, making onshoring/re-shoring a popular topic politically. It is why foundries and equipment companies are planning and mapping enormous investments in their backyards. For instance, TEL announced plans to invest more than USD 600 million in equipment manufacturing facilities in Japan.

- IDMs still play a significant role by investing in wafer fabrication capacities. For instance, in June 2023, Intel and the German government announced signing a revised letter of intent for planning a leading-edge wafer fabrication site in Magdeburg with more than EUR 30 billion for two first-of-a-kind European semiconductor facilities. In December 2023, the company reportedly acquired six high-NA EUV lithography machines from ASML, which is scheduled for shipment in 2024, according to South Korean media outlets. This acquisition is expected to be its secret weapon to overtake Samsung and TSMC at the 2nm node.

- In July 2023, Samsung announced it would spend USD 17 billion to build a semiconductor fabrication plant on a 1,200-acre plot of land in Austin, Texas. Owing to the geopolitical tension between China and Taiwan, chipmakers turned to the United States for manufacturing. Due to low taxes and new subsidies, Texas has emerged as a suitable place to do business. Global semiconductor manufacturing equipment companies are expanding facilities in South Korea. The company plans to invest USD 230 billion over the next 20 years in a new domestic production hub, attracting other players and fostering a chip supply system.

China is Expected to Hold a Significant Market Share

- According to CSET, China holds a noteworthy market share in all major segments besides assembly and packaging tools. However, China faces the greatest challenge in lithography tools, particularly extreme ultraviolet (EUV) photolithography and deep ultraviolet (DUV) photolithography.

- Imprint lithography, e-beam, laser lithography, resist processing equipment, photomask inspection, and repair tools pose significant obstacles. Over the past few years, China has consistently invested in importing advanced lithography equipment to support its chip industry.

- However, with its technological capabilities, the country constantly strives to enhance its self-dependency on front-end equipment and invest significantly to introduce it into the market.

- In December 2023, Shanghai Micro Electronics Equipment Group (SMEE), a Chinese company specializing in lithography tools, unveiled its inaugural machine capable of processing wafers using a cutting-edge 28nm-class process technology. This significant achievement highlights SMEE's dedication to constructing advanced lithography machines. The scanner, known as SSA/800-10W, marks a significant milestone for the company.

- US sanctions have been formulated to impede China's progress in developing the most cutting-edge chips globally as the technological rivalry between the two countries intensifies. SMIC and other chip manufacturers are dedicated to enhancing the nation's autonomy by advancing chip production. SMIC collaborates closely with local tool manufacturers, utilizing its advanced lithography equipment, and seeks external assistance from Huawei to enhance yields in advanced node processes.

- Due to the continuous US sanctions on Chinese technology, the area strives for self-sufficiency. The Chinese government is investing substantially in the research and development of advanced chip technology. It also encourages local manufacturers to shift their focus to higher-node chips with various uses in the economy and emerging industries like electric vehicles (EVs). The growing government initiatives and the increasing investments by local vendors to boost domestic chip production are expected to create a notable demand for the front-end market.

- According to CAAM, in August 2023, China's new energy vehicle sales were approximately 846,000 units, of which 808,000 were passenger electric vehicles and 39,000 were commercial electric vehicles. The sales of passenger battery electric vehicles (BEVs) and passenger plug-in hybrid electric vehicles (PHEVs) were 559,000 and 248,000 units, respectively.

Semiconductor Front End Equipment Market Overview

The semiconductor front-end equipment market is semi-consolidated, with major players like Applied Materials Inc., ASML Holding NV, Tokyo Electron Limited, LAM Research Corporation, and KLA Corporation. Market players are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2024 - ASML Holding NV unveiled its latest chipmaking machine, the High-NA extreme ultraviolet, priced at EUR 350 million, weighing as much as two Airbus A320s. Intel Corp. secured the first shipment for its Oregon factory, with chip production set to begin late next year. The machine achieves 8-nanometer thick semiconductor lines, 1.7 times smaller than its predecessor, enhancing chip transistor density for increased processing speeds and memory.

- January 2024 - Applied Materials Inc. collaborated with Google to advance augmented reality (AR) technologies. This partnership leverages Applied Materials' expertise in materials engineering with Google's platforms to develop lightweight visual display systems for the next era of AR experiences. The goal is to expedite the creation of multiple generations of AR products, applications, and services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Needs of Consumer Electronic Devices Boosting the Manufacturing Prospects

- 5.1.2 Proliferation of Artificial Intelligence, IoT, and Connected Devices Across Industry Verticals

- 5.2 Market Restraints

- 5.2.1 Dynamic Nature of Technologies Requires Several Changes in Manufacturing Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Lithography Equipment

- 6.1.2 Etching Equipment

- 6.1.3 Deposition Equipment

- 6.1.4 Other Equipment Types

- 6.2 By End-user Industry

- 6.2.1 Semiconductor Fabrication Plant

- 6.2.2 Semiconductor Electronics Manufacturing

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 Europe

- 6.3.3 China

- 6.3.4 South Korea

- 6.3.5 Taiwan

- 6.3.6 Japan

- 6.3.7 Latin America

- 6.3.8 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Applied Materials Inc.

- 7.1.2 ASML Holding NV

- 7.1.3 Tokyo Electron Limited

- 7.1.4 LAM Research Corporation

- 7.1.5 KLA Corporation

- 7.1.6 Nikon Corporation

- 7.1.7 VEECO Instruments Inc.

- 7.1.8 Plasma Therm

- 7.1.9 Hitachi High -Technologies Corporation

- 7.1.10 Carl Zeiss AG

- 7.1.11 Screen Holdings Co. Ltd

8 INVESTMENTS ANALYSIS

9 FUTURE OF THE MARKET