PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640326

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640326

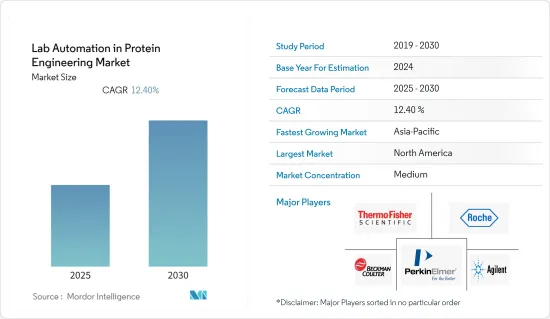

Lab Automation in Protein Engineering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Lab Automation in Protein Engineering Market is expected to register a CAGR of 12.4% during the forecast period.

Key Highlights

- Protein-energy malnutrition (PEM) is rising in emerging economies' rural communities. It refers to a collection of illnesses that includes kwashiorkor, marasmus, and marasmus-kwashiorkor transitional phases. As a result, the incidence of kwashiorkor varies by region. It is pretty uncommon in the United States. Central America, Southeast Asia, Congo, Jamaica, Puerto Rico, and South Africa are impacted. As a result, the rising frequency of protein-deficiency illnesses boosts total market demand.

- The healthcare business has been affected by a growing number of government efforts, such as sponsoring R&D for protein engineering and awareness programs. As a result, the government is funding several research initiatives ahead of time. For example, Protein Technologies Ltd (PTL) obtained money from the UK government's Technology Strategy Board (now Innovate UK) for their ground-breaking protein engineering research.

- Protein engineering also has great potential in the agrochemical business because it can lead to better-functioning enzymes, boost crop yields, or make biofuel production easier. It is also anticipated to play a vital role as a technique for achieving the higher agricultural outcomes required to satisfy future needs.

- Since the outbreak of COVID-19, labs have been turning their premises and resources into COVID-19 testing facilities, increasing automation equipment use. The University of Washington's laboratories were the first to do so. The statement came after the Broad Institute announced that its clinical processing lab would be converted into a large-scale COVID-19 testing facility.

Lab Automation in Protein Engineering Market Trends

Automated Liquid Handler Equipment Accounted for the Largest Market Share

- Liquid handlers are usually employed in biochemical and chemical laboratories. Automated liquid handling robots help in dispensing samples and other fluids in laboratories. Automated liquid handlers minimize run times and maximize accuracy. Moreover, liquid handlers can operate across a wide range of volumes, extending into nanolitres, thus proving their usefulness in dispensing operations.

- Leading companies have set the benchmark for the development of automated liquid handlers and are constantly investing in developing premium products to increase productivity effectively. The evolution of liquid handlers, capable of handling minute volumes of liquids, has contributed to the rapid development of modular lab automation systems in the market.

- According to the Robotic Industries Association, the life science sector has the third-highest growth in industrial robots, in terms of automated liquid handlers, automated plate handlers, robotic arms, and others, to meet the demand.

- According to Parker, one of the trends in life science robotics is fluidics getting more straightforward in robotic analyzers. This trend arose because clinical laboratories and hospitals cannot afford an instrument to go down when critical samples are involved. Specific robotic systems that used to have 50 needles on the end of a dispensing unit and lots of tubing increasingly use special valve manifolds that eliminate the need for tubing and result in less chance of failure. The manifolds minimize the possibility of leakage.

North America Occupied the Largest Market Share

- North America has been a pioneer in clinical research for years. This region is home to major pharmaceutical companies, like Pfizer, Novartis, GlaxoSmithKline, J&J, and Novartis. The part also has the highest concentration of contract research organizations (CROs). Some significant CROs are Laboratory Corp. of America Holdings, IQVIA, Syneos Health, and Parexel International Corp. Owing to the presence of all the major players in the industry and stringent FDA regulations; the market is very competitive in the region. To gain an advantage over competitors, the genomics research organizations in the area are increasingly adopting robotics and automation in labs.

- The genomic industry, especially in the United States, is still growing and is expected to increase over the coming years. The availability of new genome sequencing technologies, well-established healthcare infrastructure, and the increasing geriatric population are significant contributing factors to revenue growth. In the United States, the need to accommodate growth and the drive to boost efficiency are priming blood centers to acquire fully automated walkaway systems to perform types and screens or test specimens for infectious diseases.

- Many companies are involved in innovation due to their extensive R&D capabilities. Individual areas of automation can encompass purification, protein engineering, compound synthesis, biological testing, and analysis in the lab equipped with a Magnamotion track.

Lab Automation in Protein Engineering Industry Overview

The lab automation in protein engineering market is moderately competitive, owing to many small and big players exporting products to many countries. The key strategies adopted by the major players are technological advancement in development, partnerships, and merger and acquisition. Some of the major players in the market are Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, Siemens Healthineers, Danaher Corporation, and PerkinElmer. Some of the recent developments in the market are:

- January 2023 - BD (Becton, Dickinson and Company), a leading medical technology provider, unveiled a new robotic track system for the BD Kiestra microbiology laboratory solution worldwide. This system automates the processing of lab specimens, which could help to cut down on manual labor. The new BD Kiestra 3rd Generation Complete Lab Automation System is expandable to fit the specific demands of labs and allows them to connect several BD Kiestra modules in a flexible and customized total lab automation configuration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trend of Digital Transformation for Laboratories with IoT

- 5.1.2 Effective Management of the Huge Amount of Data Generated

- 5.2 Market Restraints

- 5.2.1 Expensive Initial Setup

6 MARKET SEGMENTATION

- 6.1 By Equipment

- 6.1.1 Automated Liquid Handlers

- 6.1.2 Automated Plate Handlers

- 6.1.3 Robotic Arms

- 6.1.4 Automated Storage and Retrieval Systems (AS/RS)

- 6.1.5 Other Equipment

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thermo Fisher Scientific Inc.

- 7.1.2 Danaher Corporation/Beckman Coulter

- 7.1.3 Hudson Robotics Inc.

- 7.1.4 Becton, Dickinson and Company

- 7.1.5 Synchron Lab Automation

- 7.1.6 Agilent Technologies Inc.

- 7.1.7 Siemens Healthineers AG

- 7.1.8 Tecan Group Ltd

- 7.1.9 Perkinelmer Inc.

- 7.1.10 Eli Lilly and Company

- 7.1.11 F. Hoffmann-La Roche Ltd

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS