Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690950

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690950

LEO Satellite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 204 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

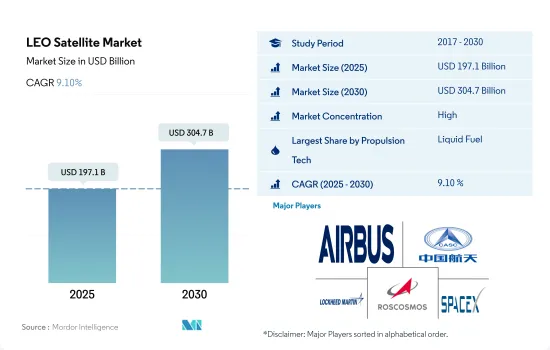

The LEO Satellite Market size is estimated at 197.1 billion USD in 2025, and is expected to reach 304.7 billion USD by 2030, growing at a CAGR of 9.10% during the forecast period (2025-2030).

Liquid fuel propulsion system occupies majority of the market share

- Low Earth orbit (LEO) satellites have become integral to various industries, including telecommunications, Earth observation, navigation, and remote sensing. The propulsion system plays a crucial role in determining the performance, efficiency, and operational capabilities of these satellites.

- Liquid propulsion systems have been widely used in the LEO satellite market, offering high thrust and specific impulse capabilities. These systems typically use liquid fuels, such as hydrazine, combined with oxidizers like nitrogen tetroxide. Liquid propulsion enables precise orbital maneuvers, geostationary transfer orbit (GTO) insertion, and mission flexibility. LEO satellite missions requiring complex orbital adjustments, payload delivery to specific orbits, and satellite decommissioning rely on liquid propulsion systems.

- Electric propulsion has gained significant traction in the LEO satellite market due to its fuel efficiency and extended mission lifetimes. Electric propulsion systems, including ions and Hall-effect thrusters, utilize electric fields to accelerate ions and generate thrust. Electric propulsion enables the deployment of large-scale LEO satellite constellations, as demonstrated by companies like SpaceX's Starlink and OneWeb. These systems are particularly suitable for applications that require precise station-keeping maneuvers and orbital adjustments over extended periods.

- Gas-based propulsion systems, including cold gas and warm gas thrusters, are extensively used in the LEO satellite market. These systems utilize compressed gases, such as nitrogen or xenon, to generate thrust. LEO satellite missions that require rapid orbital changes or frequent repositioning often rely on gas-based propulsion systems due to their higher thrust capabilities.

North America is driving the market demand with a market share of 85.4% in 2029

- The global LEO satellite market is expected to grow significantly in the coming years, driven by increasing demand for high-speed internet, communication services, and data transfer across different industries. The market can be analyzed with respect to North America, Europe, and Asia-Pacific as to market share and revenue generation. During 2017-2022, more than 4100 satellites were manufactured and launched by various operators in this segment into LEO.

- North America is expected to dominate the global LEO satellite market due to the presence of several leading market players, such as The Boeing Company, Lockheed Martin, and Northrop Grumman. The US government has also been investing heavily in the development of advanced satellite technology, which is expected to drive the growth of the market in North America. During 2017-2022, the region accounted for 72% of the total satellites manufactured and launched into LEO.

- The LEO satellite market is expected to grow significantly due to the increasing demand for high-speed internet and communication services in Europe. The European Space Agency (ESA) has been investing heavily in the development of advanced satellite technology, which is expected to drive the growth of the market. During 2017-2022, the region accounted for 12% of the total satellites manufactured and launched into LEO.

- Asia-Pacific is expected to witness significant growth in the LEO satellite market due to the increasing demand for satellite-based communication services in countries such as China, India, and Japan. During 2017-2022, Asia-Pacific accounted for 9% of the total satellites manufactured and launched into LEO.

Global LEO Satellite Market Trends

The trend for better fuel and operational efficiency is expected to positively impact the market

- The success of a satellite mission is highly dependent on the accuracy of measuring its mass properties before the flight and the proper ballasting of the satellite to bring the mass properties within tight limits. Failure to properly control mass properties can result in the satellite tumbling end over end after launch or quickly using up its thruster capacity in an attempt to point in the correct direction. Solar panels must continue to point toward the sun as the satellite orbits the Earth.

- Low earth orbit satellites orbit from 160 to 2000 km above the Earth, take approximately 1.5 hours for a full orbit, and only cover a portion of the Earth's surface. The mass of a satellite has a significant impact on the launch of the satellite. This is because the heavier the satellite, the more fuel and energy are required to launch it into space. Launching a satellite involves accelerating it to a very high speed, typically around 28,000 km per hour, to place it in orbit around the Earth. The amount of energy required to achieve this speed is proportional to the mass of the satellite.

- As a result, a heavier satellite requires a larger rocket and more fuel to launch it into space. This, in turn, increases the cost of the launch and can also limit the types of launch vehicles that can be used. The major classification types according to mass are large satellites that are more than 1,000 kg. During 2017-2022, 65+ large satellites were launched in the LEO orbit. A medium-sized satellite has a mass of 500 and 1000 kg, and 250+ medium-sized satellites were launched. Satellites with a launch mass of less than 500 kg are small satellites. There are 4000+ small satellites in the LEO orbit.

Growing demand for earth observation, imaging, and connectivity services is expected to surge the research and development expenditure in LEO satellites category

- Low Earth orbit (LEO) is an orbit relatively closer to the surface of the Earth. LEO is usually below 1000 km altitude but can be as high as 160 km above Earth. LEO satellites are widely used for communications, military reconnaissance, and other imaging applications. Communications satellites have the advantage of short signal runtimes to LEO. This reduction in propagation delay results in lower latency. Most satellites sent into space are in the LEO constellation. One of the major LEO satellite constellations is owned by satellite communications provider Iridium. The competitive rivalry in the LEO orbit globally is high as companies such as Amazon-owned Kuiper Systems want to compete with companies like OneWeb's Starlink to provide broadband connectivity from space. After Federal Communications Commission approval, the company plans to launch its first satellite to be launched in 2023.

- Considering the increase in space-related activities in the Asia-Pacific region, satellite manufacturers are enhancing their satellite production capabilities. The prominent Asia-Pacific countries with robust space infrastructure are China, India, Japan, and South Korea. China National Space Administration announced space exploration priorities for 2021-2025, including enhancing national civil space infrastructure facilities. As a part of this plan, the Chinese government established China Satellite Network Group Co. Ltd to develop a 13,000-satellite constellation for satellite internet. Overall, the trend in R&D expenditure on LEO satellites is an increase, driven by the need for innovation and government funding. This investment is expected to lead to the development of new technologies that will improve the performance and capabilities of LEO satellites.

LEO Satellite Industry Overview

The LEO Satellite Market is fairly consolidated, with the top five companies occupying 95.84%. The major players in this market are Airbus SE, China Aerospace Science and Technology Corporation (CASC), Lockheed Martin Corporation, ROSCOSMOS and Space Exploration Technologies Corp. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 72596

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Mass

- 4.2 Spending On Space Programs

- 4.3 Regulatory Framework

- 4.3.1 Global

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 China

- 4.3.6 France

- 4.3.7 Germany

- 4.3.8 India

- 4.3.9 Iran

- 4.3.10 Japan

- 4.3.11 New Zealand

- 4.3.12 Russia

- 4.3.13 Singapore

- 4.3.14 South Korea

- 4.3.15 United Arab Emirates

- 4.3.16 United Kingdom

- 4.3.17 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application

- 5.1.1 Communication

- 5.1.2 Earth Observation

- 5.1.3 Navigation

- 5.1.4 Space Observation

- 5.1.5 Others

- 5.2 Satellite Mass

- 5.2.1 10-100kg

- 5.2.2 100-500kg

- 5.2.3 500-1000kg

- 5.2.4 Below 10 Kg

- 5.2.5 above 1000kg

- 5.3 End User

- 5.3.1 Commercial

- 5.3.2 Military & Government

- 5.3.3 Other

- 5.4 Propulsion Tech

- 5.4.1 Electric

- 5.4.2 Gas based

- 5.4.3 Liquid Fuel

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Airbus SE

- 6.4.2 Astrocast

- 6.4.3 China Aerospace Science and Technology Corporation (CASC)

- 6.4.4 German Orbital Systems

- 6.4.5 GomSpaceApS

- 6.4.6 Lockheed Martin Corporation

- 6.4.7 Nano Avionics

- 6.4.8 Planet Labs Inc.

- 6.4.9 ROSCOSMOS

- 6.4.10 Space Exploration Technologies Corp.

- 6.4.11 SpaceQuest Ltd

- 6.4.12 Surrey Satellite Technology Ltd.

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.