PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1405733

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1405733

Metal Cleaning Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

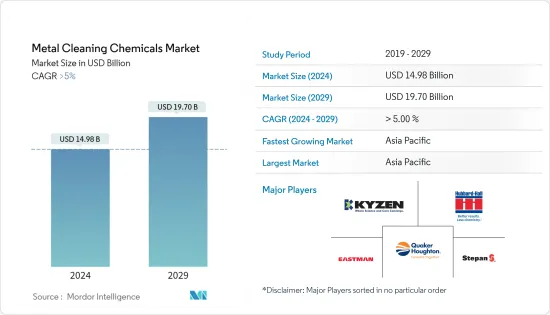

The Metal Cleaning Chemicals Market size is estimated at USD 14.98 billion in 2024, and is expected to reach USD 19.70 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The COVID-19 pandemic had a positive impact on the metal cleaning chemicals market, as demand for disinfectants, all-purpose cleaners, surface cleaners, detergents, soaps, and other hygiene products increased. This positively affected the pharmaceutical and chemical companies to boost their sales in the hygiene and cleaning sector.

The increasing demand for industrial cleaning and maintenance in the manufacturing sector is driving the market growth.

Most cleaning chemicals are corrosive and dangerous to mix with oxygen. Waste management and the harmful effects of cleaning chemicals are major challenges hindering market growth.

Further, green and bio-based metal cleaning chemicals are growing in demand due to their effectiveness, safety, and sustainability. They are likely to create opportunities for rapid and profitable expansion in the global market.

Asia-Pacific region dominated the market for metal cleaning chemicals, with India, China, and Japan representing major countries in terms of consumption.

Metal Cleaning Chemicals Market Trends

Increasing Demand in the Steel Sector

- The steel industry is the largest user of metal cleaning chemicals because it needs to keep its metallic surfaces clean. Industrial metal cleaners are a valuable solution for this challenge because they can clean equipment without having to disassemble and reassemble it, and they also prevent corrosion after cleaning.

- This segment is growing due to urbanization, technological advancements, government support, strong demand for steel in industrial applications, increasing manufacturing needs, and a growing focus on industrial cleaning and maintenance.

- The World Steel Association predicts that finished steel usage will increase by 1.0% in 2023, following a 2.3% decline in 2022. China's economy had a significant impact on steel production in 2022, which fell by 4%. Due to prolonged COVID-19 containment measures, which reduced demand for real estate and construction projects, steel production is expected to remain stable in China in 2023.

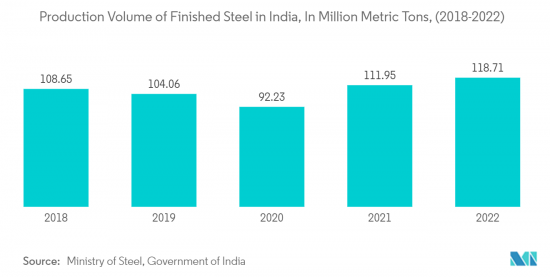

- India's increased production of finished steel products in 2022, driven by infrastructure spending, strong consumer demand, and automotive industry growth, is expected to boost the metal cleaning chemicals market associated with steel production during the forecast period.

- India produced over 125 million metric tons of steel in the fiscal year 2022-23, according to the National Steel Policy. New Delhi aims to increase this production to 300 million metric tons by 2030.

- Steel is one of the most significant metal types in the metal cleaning chemicals market and is expected to drive this market further during the forecast period.

Asia-Pacific to Dominate the Metal Cleaning Chemicals Market

- The Asia-Pacific market is expected to grow at the fastest rate due to the high production and consumption of metals such as steel and aluminum. These metals are widely used in the manufacturing of various components, vehicle frames, and industrial control panels, among others, and require metal cleaning solutions to be cleaned.

- The rapid economic growth in the region, coupled with rising disposable incomes, is creating opportunities for international companies to enter the local market and increase their visibility and revenue potential.

- India produced 125.32 million metric tons of crude steel and 121.29 million metric tons of finished steel in fiscal year 2022-23, making it the world's second-largest producer of crude steel, according to the World Steel Association.

- The global automotive industry grew by 6% in 2022, according to OICA. In developed and developing countries across the world, including China, Germany, South Korea, Canada, the United Kingdom, and Italy, automotive production increased in 2022. Over 85 million motor vehicles were manufactured in 2022.

- According to IBEF (India Brand Equity Foundation), 30 companies have had 67 applications approved for the Production Linked Incentive (PLI) Scheme for Specialty Steel. These approvals are expected to attract an investment of INR 4,250 trillion (USD 5.19 billion) and increase downstream iron and steel capacity by 26 million tonnes.

- Invest India predicts that India will become a USD 1 trillion digital economy in the Electronics System Design and Manufacturing (ESDM) sector by fiscal year 2026. The Indian electronics market is currently worth USD 155 billion, with domestic production accounting for 65%. Additionally, the Semicon India Program, a USD 10 billion incentive program, was launched to develop a sustainable semiconductor and display ecosystem in the country.

- According to PwC, India's chemical industry is one of the world's fastest-growing sectors, projected to reach a value of USD 304 billion by 2025.

- India is the world's 6th and Asia's 3rd largest producer of chemicals, contributing 7% to India's GDP, according to IBEF. The government allocated INR 173.45 crore (USD 20.93 million) to the Department of Chemicals and Petrochemicals in the Union Budget for 2023-24.

- Asia-Pacific is experiencing rapid growth and investment from governments and businesses in the region. It is poised to become the world's dominant chemical market, with China, India, and Japan leading production and consumption.

Metal Cleaning Chemicals Industry Overview

The metal cleaning chemicals market is fragmented in nature. The major players (not in any particular order) include Quaker Houghton, Stepan Company, Hubbard-Hall, KYZEN CORPORATION, and Eastman Chemical Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Manufacturing Industries

- 4.1.2 Growing Market for Aqueous-Based Metal Cleaning Solutions

- 4.1.3 Rising Demand in the Aerospace Industry

- 4.2 Restraints

- 4.2.1 Health and Safety Concerns Related to the Use of Metal Cleaning Chemicals

- 4.2.2 High Cost of Advanced Metal Cleaning Chemicals

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Type

- 5.1.1 Acidic

- 5.1.2 Basic

- 5.1.3 Neutral

- 5.2 Form

- 5.2.1 Aqueous

- 5.2.2 Solvent

- 5.3 End-user Industry

- 5.3.1 Aerpospace

- 5.3.2 Automotive and Transportation

- 5.3.3 Electrical and Electronics

- 5.3.4 Chemical and Pharmaceutical

- 5.3.5 Oil and Gas

- 5.3.6 Other End-user Industries (Healthcare, and Food and Beverage)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arrow Solutions

- 6.4.2 Avudai Surface Treatments Pvt Ltd

- 6.4.3 BASF SE

- 6.4.4 CLARIANT

- 6.4.5 Chautauqua Chemical Company

- 6.4.6 Crest Chemicals.

- 6.4.7 Delstar Metal Finishing, Inc.

- 6.4.8 Dow

- 6.4.9 DST-CHEMICALS

- 6.4.10 Eastman Chemical Company

- 6.4.11 Ecolab

- 6.4.12 Elmer Wallace Ltd.

- 6.4.13 Hubbard-Hall

- 6.4.14 Henkel AG & Co. KGaA

- 6.4.15 ICL

- 6.4.16 KYZEN CORPORATION

- 6.4.17 Lincoln Chemical Corporation

- 6.4.18 Luster-On Products, Inc.

- 6.4.19 Modern Chemical, Inc.

- 6.4.20 PARKER HANNIFIN CORP

- 6.4.21 PCC Group

- 6.4.22 Quaker Houghton

- 6.4.23 Rochester Midland Corp

- 6.4.24 Solugen

- 6.4.25 Spartan Chemical Company, Inc.

- 6.4.26 Stepan Company

- 6.4.27 The Chemours Company

- 6.4.28 Zavenir Daubert

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based Cleaning Chemicals

- 7.2 Growing Demand in the Healthcare Industry