PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685706

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685706

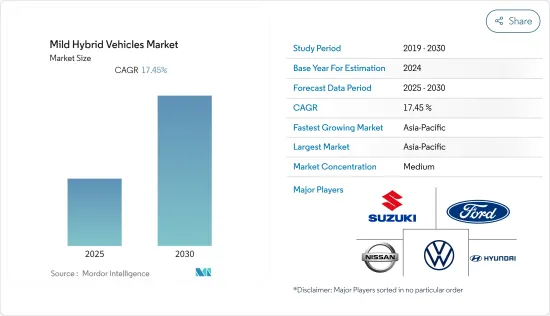

Mild Hybrid Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Mild Hybrid Vehicles Market is expected to register a CAGR of 17.45% during the forecast period.

Stringent emission standards, fuel efficiency, and government incentives are the major factors driving automakers and buyers to shift toward hybrid vehicles from conventional vehicles. However, demand for battery-electric vehicles is growing significantly, which might hinder the growth of the mild hybrid vehicle market.

Asia-Pacific is expected to grow faster during the forecast period. However, certain trends in emerging countries, like India, may hinder the sales growth of hybrid vehicle types as the country recently removed the subsidy for mild hybrid vehicles under the FAME scheme. North America and Europe are expected to witness considerable growth for mild hybrid vehicles as these regions are focusing more on the growth of pure electric or full hybrid vehicles.

Mild Hybrid Vehicles Market Trends

48V and Above Mild Hybrid Vehicles Continue to Capture the Major Market Share

Over the past three years, many automakers started launching a 48V mild hybrid as a standard feature in their new vehicle models. The demand for mild hybrid vehicles equipped with less than 48V capacity steadily grew in various countries across the globe.

One of the key advantages of 48V and above mild hybrid vehicles is that they can offer many of the benefits of full hybrid vehicles, such as regenerative braking and engine start-stop technology, at a lower cost. It makes them a more cost-effective option for improving fuel efficiency and reducing emissions, especially for larger vehicles such as SUVs and trucks.

Several major automakers, such as Mercedes-Benz, Audi, and BMW, are investing in 48 V mild hybrid technology, and many of their new models now feature this technology. For example, the 2022 Mercedes-Benz S-Class offers a 48 V mild hybrid system that provides an additional 22 horsepower and up to 184 lb-ft of torque while also improving fuel efficiency by up to 10%.

Automobile manufacturers in various countries globally are launching vehicles with a mild hybrid system with less than 48 V capacity, which is further increasing demand for the less than 48 V capacity segment.

Leading vehicle manufacturers such as Suzuki Corporation, Mahindra, Hyundai, etc., launched vehicles with a 12 V mild hybrid in the past. With increasing demand from end users, manufacturers are now focusing on developing vehicles with a 48 V mild hybrid system, which is expected to challenge the growth of the market over the forecast period.

Asia-Pacific Continues to Capture the Major Market Share

Asia-Pacific is capturing the largest share of the market owing to the highest vehicle sales, majorly in China. Many automotive companies planned to invest in the Asia-Pacific market to cater to the strong demand for hybrid vehicles.

With an aim for long-term development and to realize the zero-emission goal, Chinese automakers are working on strong HEV, PHEV, high-efficiency engines, and other advanced technologies while introducing 48V mild hybrid technology. For instance,

- In September 2022, Volvo launched its latest range of petrol mild-hybrid cars in India. The company's 2023 line-up includes the petrol mild-hybrid version of its flagship SUV XC90, mid-size SUV XC60, compact SUV XC40, and its luxury sedan S90.

The Indian government also undertook multiple initiatives to promote the manufacturing and adoption of electric vehicles in India to reduce emissions as per international conventions and develop e-mobility in the wake of rapid urbanization.

The National Electric Mobility Mission Plan (NEMMP) and Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India (FAME I and II) schemes helped create the initial interest and exposure to electric mobility. The Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India (FAME) program, first implemented in 2015 and updated in 2019, provides consumers and domestic companies with various incentives. For instance, in phase II of FAME, the government announced an outlay of USD 1.4 billion through 2022. This phase focused on the electrification of public and shared transportation through subsidizing 7090 e-buses, 500,000 electric three-wheelers, 550,000 electric passenger vehicles, and 1,000,000 electric two-wheelers.

The above plans by automakers and governments for electric mobility are anticipated to further boost mild hybrid vehicle sales in the Asia-Pacific market during the forecast period.

Mild Hybrid Vehicles Industry Overview

Some of the major players in the market include Nissan Motor Co. Ltd, Volkswagen Group, Suzuki Motor Corporation, Hyundai Motor Company, Ford Motor Company, and Toyota Motor Corporation, among others. New product launches by various automobile manufacturers are also boosting the demand for mild hybrid cars.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Fuel Efficiency and Emissions Reduction

- 4.1.2 Government Regulations and Incentives

- 4.2 Market Restraints

- 4.2.1 Competing Alternative Technologies

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Capacity Type

- 5.1.1 Less than 48V

- 5.1.2 48V and Above

- 5.2 Vehicle Type

- 5.2.1 Passenger Car

- 5.2.2 Commercial Vehicle

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Toyota Motor Corporation

- 6.2.2 Nissan Motor Co. Ltd

- 6.2.3 Honda Motor Company Ltd

- 6.2.4 Hyundai Motor Company

- 6.2.5 Kia Motors Corporation

- 6.2.6 Suzuki Motor Corporation

- 6.2.7 Daimler AG

- 6.2.8 Volvo Group

- 6.2.9 Volkswagen Group

- 6.2.10 BMW AG

- 6.2.11 Ford Motor Company

- 6.2.12 Audi AG

- 6.2.13 Mitsubishi Motors Corporation

- 6.2.14 BYD Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Consumer Awareness and Preference for Hybrid Technology

- 7.2 Integration of Advanced Driver Assistance Systems (ADAS)