PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689974

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689974

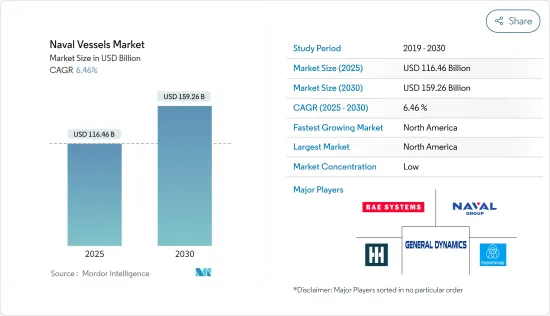

Naval Vessels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Naval Vessels Market size is estimated at USD 116.46 billion in 2025, and is expected to reach USD 159.26 billion by 2030, at a CAGR of 6.46% during the forecast period (2025-2030).

As geopolitical tensions and marine disputes between countries increase, they strive to enhance their naval capabilities. Several countries are upgrading their existing naval fleets or replacing their aging fleets with newer-generation vessels with advanced features. With several countries increasing their defense spending over the past decade, the industry witnessed large-scale procurement and development activities.

Technological advancements also support the development of newer-generation naval vessels, as each country wants to update its maritime combat capabilities. As several countries currently operate older naval fleets, they emphasize procuring ships with the latest technologies to gain a qualitative technological edge over their adversaries. Counties worldwide heavily invest in their existing naval fleets' development, expansion, modernization, and gradation. Developing and procuring new naval vessels, such as frigates, submarines, etc., are expected to generate demand for newer combat vessels. On the other hand, geopolitical uncertainties and economic factors are anticipated to hinder the market's growth.

Naval Vessels Market Trends

Submarines Segment is Expected to Witness Significant Growth During the Forecast Period

- Due to advancements in integrated technologies, such as silent engine operations and torpedo targeting technologies, submarines have evolved into versatile and lethal platforms. A submarine can be broadly classified as a ballistic missile, guided missile, nuclear attack, or conventional attack submarine.

- In the present scenario, governments worldwide plan to invest in procuring advanced submarine systems, which can then be deployed to carry out various activities, from missile attacks to underwater detection and surveillance. Moreover, the growth of the submarine market is driven by factors such as the increase in global geopolitical conflicts, increasing terrorism activities in international waters, and the demand to have a comprehensive underwater study of enemy territories to gain strategic stability. The United States, the United Kingdom, France, China, Russia, and India are some nations with an armada of submarines designed for specific scenarios.

- Several acquisition programs for nuclear-powered submarines are currently underway. For instance, in March 2023, the United States, Australia, and the United Kingdom announced a framework enabling Australia to acquire nuclear-powered submarines, thereby making Australia the seventh country in the world to possess this technology. Under the contract, Australia will procure three US Virginia-class nuclear-powered submarines by the early 2030s and can buy two additional vessels if required. Such developments are expected to drive the growth of the segment in the coming years.

North America to Witness Highest Growth During the Forecast Period

- The United States mainly drives the North American naval vessels market. The US Navy has over 490 ships in service and the reserve fleet, with 90 more in the planning and ordering stage or under construction.

- The US Navy plans to implement force structure expansion plans and aims to reach its 355-ship goal by FY 2034 through a mix of service life extensions and new construction.

- The United States has invested its vast technological prowess toward the indigenous development of several weapon systems to foster its military prowess over all dominion - land, air, and water.

- In the FY2023 budget proposal, the US Navy proposed a total budget request of USD 230.8 billion, including USD 180.5 billion for the US Navy and USD 50.3 billion for the US Marine Corps. As part of the country's naval expansion projects, the US Navy proposed plans to modernize its fleet by excluding and including various warships and carrier fleets in the Navy. The USS Nimitz is to be removed from the battle force by the FY2025, gradually accepting the Gerald R Ford-class carriers to be inducted readily into the fleet of agile force. The first of the new ships, USS Gerald R Ford (CVN 78), is scheduled for its first operational deployment near or in the third quarter of 2022.

- Thus, the increasing spending on naval programs and a growing focus on enhancing naval capabilities are driving the market's growth in the region.

Naval Combat Vessels Industry Overview

The market for naval vessels is semi-consolidated, with many local players in Europe and Asia-Pacific catering to the requirements of maritime vessels to the navies. Some prominent players in the market are General Dynamics Corporation, Huntington Ingalls Industries Inc., BAE Systems PLC, Naval Group SA, and ThyssenKrupp AG.

- With the industry's growing competition, innovation is critical for players to stand out. Many countries are trying to procure next-generation warships that possess advanced capabilities. For instance, in February 2023, the UK Royal Navy awarded a contract to BAE Systems PLC to initiate construction of the third Dreadnought Class submarine, Warspite, at its shipyard in Cumbria. The submarine will have advanced technology and a carrying capacity for nuclear deterrence.

- OEMs are expected to enjoy healthy revenue growth owing to fleet expansion and modernization efforts from navies worldwide. The market players also collaborate to develop advanced naval vessels to meet the armed forces' demands. Such partnerships will help the players expand their business during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vessel Type

- 5.1.1 Destroyers

- 5.1.2 Frigates

- 5.1.3 Submarines

- 5.1.4 Corvettes

- 5.1.5 Aircraft Carriers

- 5.1.6 Other Vessel Types

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Australia

- 5.2.3.6 Singapore

- 5.2.3.7 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 General Dynamics Corporation

- 6.2.2 ThyssenKrupp AG

- 6.2.3 BAE Systems PLC

- 6.2.4 Naval Group SA

- 6.2.5 EDGE Group PJSC

- 6.2.6 Damen Shipyards Group

- 6.2.7 HD Korea Shipbuilding & Offshore Engineering Co. Ltd

- 6.2.8 Huntington Ingalls Industries Inc.

- 6.2.9 Lockheed Martin Corporation

- 6.2.10 Austal Limited

- 6.2.11 FINCANTIERI SpA

- 6.2.12 Hanwha Ocean (Hanwha Group)

- 6.2.13 LARSEN & TOUBRO LIMITED

- 6.3 Other Players

- 6.3.1 PT PAL Indonesia

- 6.3.2 Navantia SA SME

- 6.3.3 Kalashnikov Group

- 6.3.4 Fr. Lurssen Werft Gmbh & Co. KG

- 6.3.5 China State Shipbuilding Corporation Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS