PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1405359

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1405359

Online Clothing Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

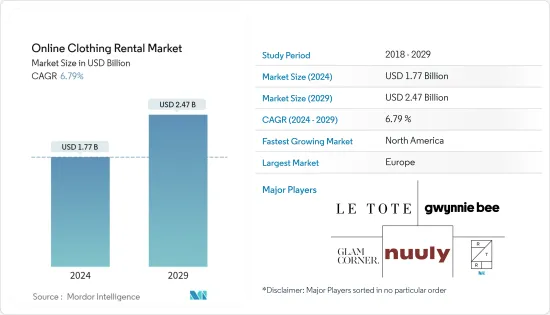

The Online Clothing Rental Market size is estimated at USD 1.77 billion in 2024, and is expected to reach USD 2.47 billion by 2029, growing at a CAGR of 6.79% during the forecast period (2024-2029).

Consumers are increasingly spending on clothing activities due to their increasing disposable incomes, which is a significant factor fueling the growth of the online clothing rental market. The growing demand for costly designer dresses, in conjunction with the changing fashion sense among consumers, is also expected to fuel the growth of the online clothing rental market in the coming years. Additionally, an increasing number of fast fashion brands is another major factor contributing to the development of the online clothing rental market. Additionally, many clothing rental companies have started using subscription-based services online. These services have helped to reach a broader range of customer base, thus stabilizing their market, and are likely to have a positive impact during the forecast period.

The global online clothing market is characterized by the women segment owning a prominent share in factors such as frequent presence across social and corporate events, follow up's with global designer labels, and active engagement on social media platforms that offer discounts and promotions. The market is likely to witness significant growth in the rental of formal dress code segment as consumers are more prone to purchase casual wear in volume while keeping a pair or two of formals in the wardrobe.

The market concentration is low, and players are expected to offer products that encompass local designer labels who develop products that are unique in each way.

Online Clothing Rental Market Trends

Adoption of Subscription Services is Driving the Market

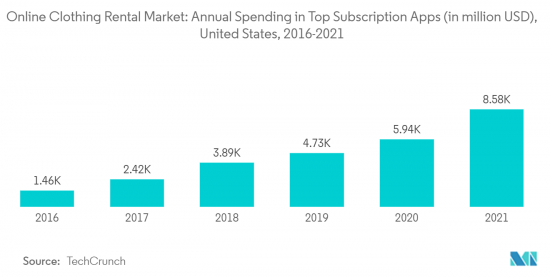

Online clothing rental marketing is witnessing significant changes post-pandemic. It has shifted its focus towards the adoption of subscription-based services. Through this subscription, the customers can buy three to four pieces of clothing simultaneously for an unlimited period for rent in exchange for monthly fees. Monthly/quarterly subscription services are a growing trend in the online clothing rental industry, where retailers provide subscribers with rented clothing on a monthly/quarterly basis online. These services are helping companies to reach a wide range of customer bases and save time in acquiring new customers and generating recurring revenue.

Rent the Runway is the most popular and is one of the oldest companies in this business; known for formal wear for a long time. Presently, the company offers a wide range of apparel for any occasion. Other firms providing subscription packages include Gwynnie Bee, New York & Company Closet, Tuileries, Nova Octo, Nuuly, Armoire, Vince Unfold, and Vivrelle. New companies are entering the market due to rising demand for these services. For instance, in November 2022, to celebrate the launch of its new clothing rental subscription service in the United States, Fashion Forward Box gave away a free membership for a limited time.

North America Growing at Robust Pace

The North American region is fast emerging as a growing market for online clothing rentals. In the region, millennials are increasingly renting out items against owning them. In the United States, clothing rentals fall behind rentals for other categories such as cars, furniture, and electronics, but the trend of online clothing rentals is fast catching up. In a study published in Sustainability in August 2021, a study conducted in the United States showed that GenZ adults are increasingly inclined towards renting rather than owning clothes - which can be attributed to the fact that they focus on usage rather than ownership as part of their consumption habits. Companies and retailers are also responding to the challenge and the opportunity that online clothing rentals pose. For instance, CaaStle operates rental services for its own Gwynnie Bee brand as well as for third-party retailers, including Express, American Eagle Outfitters Inc., and Ascena Retail Group Inc.'s Ann Taylor. It charges a flat fee per active subscriber to provide all aspects of the offer, from logistics to laundry.

Online Clothing Rental Industry Overview

The online clothing rental market is moderately fragmented, with the competitive landscape fragmented with a combination of established retailers and start-ups. While selected retailers are looking for a better way of managing their inventory through rentals, start-ups are looking for business expansion by offering multi-brand product mixes. Some key players active in the market are Le Tote, Gwynnie Bee, Glam Corner, Rent the Runway, and Nuuly, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Men

- 5.1.2 Women

- 5.1.3 Children

- 5.2 Dress Code

- 5.2.1 Formal

- 5.2.2 Casual

- 5.2.3 Partywear

- 5.2.4 Traditional

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Le Tote

- 6.3.2 Gwynnie Bee

- 6.3.3 Glam Corner

- 6.3.4 Run the Runway

- 6.3.5 Nuuly

- 6.3.6 La Reina

- 6.3.7 American Eagle

- 6.3.8 Hire Street

- 6.3.9 Walkin Closet

- 6.3.10 Swishlist Couture LLP

7 MARKET OPPORTUNITIES AND FUTURE TRENDS