PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910483

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910483

Particle Board - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

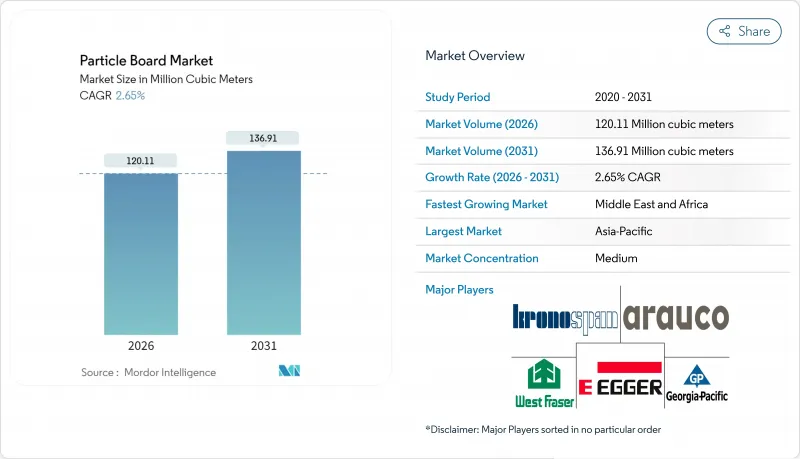

The Particle Board Market was valued at 117.02 Million cubic meters in 2025 and estimated to grow from 120.11 Million cubic meters in 2026 to reach 136.91 Million cubic meters by 2031, at a CAGR of 2.65% during the forecast period (2026-2031).

The expansion pace confirms a maturing industry yet highlights strategic inflection points: raw-material diversification toward agricultural residues, stricter global emission rules, and a widening performance gap between technology-enabled producers and capacity-driven competitors. Segment leaders channel capital into low-emission resin systems, feedstock security, and process automation to defend margins as formaldehyde regulations tighten in North America and the EU. Elevated demand from flat-pack furniture, rising urban middle-class consumption, and ongoing infrastructure investments in emerging economies combine to sustain volume growth even as price competition intensifies. Meanwhile, sugar-sector decarbonization frees up bagasse, allowing manufacturers to hedge wood-fiber risk and bolster sustainability credentials, factors that increasingly influence procurement decisions among construction buyers and furniture OEMs.

Global Particle Board Market Trends and Insights

Surging Global Flat-Pack and RTA Furniture Production

Flat-pack furniture relies on predictable substrate thickness and density, specifications that particle board delivers consistently across large-scale production runs. Multinational retailers standardize panel requirements to streamline global sourcing; as a result, volumes remain less sensitive to regional housing cycles and more aligned with replacement furniture demand that turns faster than traditional solid-wood pieces. Uniform density permits precise weight calculations, raising container utilization rates and lowering logistics expenses by up to 20%. Automated boring and fastening equipment in RTA assembly plants further entrenches particle board as the primary substrate because its structure tolerates repeat machining without significant tool wear. Global procurement teams increasingly negotiate long-term supply contracts to secure qualified boards certified under CARB 2 or EPA TSCA Title VI, reinforcing demand visibility for compliant producers and allowing them to invest confidently in capacity upgrades.

Rapid Urbanisation in Tier-2/3 Asian Cities Boosting Affordable Housing Interiors

Secondary urban clusters in India, Vietnam, Indonesia, and the Philippines absorb rural migration and generate demand for cost-effective interior fixtures. Government-subsidized apartment schemes specify modular cabinetry and wardrobe systems that favor particle board for its balance of cost, machinability, and laminate compatibility. As average living space per household declines, designers favor built-in storage that maximizes every square meter; particle board's ease of profiling enables compact, multifunctional furniture that meets space constraints without inflating budgets. Local panel mills, often located within 300 km of furniture clusters, shorten lead times and reduce inventory carrying costs for OEMs that operate on slim margins. These dynamics underpin stable, volume-driven growth across the region despite periodic slowdowns in tier-1 metropolitan housing starts.

Competitive Threat from Ultra-Thin MDF in Ready-To-Assemble Furniture

Advances in refining and pressing allow MDF producers to manufacture 4-6 mm boards that maintain edge integrity and screw-holding capacity superior to particle board at equivalent thickness. Furniture designers exploit these attributes to shrink package dimensions and shipping weight, driving incremental cost savings across global logistics chains. As MDF mills scale thin-panel output, the historical price gap narrows, prompting RTA brands to shift visible components to MDF while relegating particle board to concealed parts. Particle board suppliers respond by investing in finer-particle surface layers and post-press surface sanding lines to improve laminate adhesion, yet competitive pressure persists until they achieve comparable thin-panel dimensional stability.

Other drivers and restraints analyzed in the detailed report include:

- Cost Advantage vs. MDF and Plywood for Non-Load-Bearing Uses

- Emission-Compliant Urea-Formaldehyde Resins Unlocking Import Demand in EU and NA

- Volatile Resin and Methanol Prices Squeezing Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wood residue controlled 76.20% of global volume in 2025, underscoring the entrenched supply chains that connect sawmills to board presses situated in the same industrial parks. This raw-material pathway lowers inbound freight outlays and secures fiber homogeneity, enabling continuous-press operators to run high-speed lines with minimal downtime. The particle board market size tied to wood residue is expected to edge up at 2.25% CAGR, mirroring overall housing refurbishment activity in mature economies. Bagasse, though currently at 12.15% share, posts the highest growth at 3.38% CAGR, propelled by sugar-sector policy incentives and rising buyer preference for low-carbon materials; together these factors could lift bagasse to 13.10% share by 2031, absorbing roughly 3.35 million m3 of incremental capacity. Greater feedstock plurality helps producers cushion log-price volatility and meet EU due-diligence regulations that scrutinize deforestation-linked fiber sources. The particle board market share for alternative agricultural residues such as wheat straw, oil-palm frond, and coconut husk remains modest, yet pilot plants in Canada and Malaysia demonstrate technical feasibility, suggesting long-term upside once supply aggregation bottlenecks resolve.

The transition toward non-wood inputs also influences capital-investment patterns. Mills optimized for bagasse integrate de-pithing drums, additional dryer zones, and higher-throughput classifiers to compensate for moisture and pith variability. Process modifications carry incremental capex of USD 80-100 per m3 of annual capacity, a manageable uplift that is increasingly financed through green-bond instruments given the feedstock's favorable life-cycle carbon profile. Early-adopter mills secure export premiums in markets where builders pursue LEED or BREEAM points, validating the strategic relevance of agricultural-waste panels beyond niche positioning.

The Particle Board Market Report is Segmented by Raw Material (Wood Residue, Bagasse, and Other Raw Materials), Application (Furniture, Construction, Infrastructure, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Cubic Meters).

Geography Analysis

Asia-Pacific contributed 45.30% of global volume in 2025, translating to roughly 53.0 million m3, underpinned by dense manufacturing clusters that link timber concessions, resin plants, and furniture exporters along efficient logistics corridors. Provincial governments in China continue to incentivize capacity relocation from coastal provinces to inland sites, aiming to align industrial growth with regional development policies. India, meanwhile, logs a 4.1% annual uptick in domestic particle board demand as modular kitchen penetration rises among middle-income households. Vietnam functions as a processing hub, importing 5.08 million m3 of raw panels and chips during January-November 2024 for re-export as fabricated furniture.

North America and Europe together account for 38.20% of global output but deliver subtler growth, averaging 1.5% CAGR through 2031. Regulatory strings attached to indoor-air-quality standards motivate mills to channel capex toward resin-emission abatement rather than new capacity, thereby constraining supply and supporting price stability even amid subdued housing starts. In the U.S., tariffs on Canadian softwood lumber shift some builders toward engineered panels, benefiting domestic mills that maintain CARB 2 compliance. European demand bifurcates between price-sensitive Eastern European buyers and Western European markets that prioritize sustainability credentials, stimulating uptake of panels with >=30% recycled wood content. The Middle East and Africa register the fastest regional expansion at 3.55% CAGR, albeit from a lower base of 5.55 million m3. Mega-projects tied to economic diversification-such as Saudi Arabia's NEOM-and widespread hotel pipeline growth ahead of global events channel steady demand for interior panels. Limited indigenous forest resources compel reliance on imports; however, joint ventures in Egypt and the Gulf are commissioning continuous-press lines using a blend of plantation wood and imported chips, signaling an embryonic shift toward local production.

- ARAUCO

- Associate Decor

- Boise Cascade Company

- Century Prowud

- Century Plyboards (India) Ltd

- EGGER

- Georgia-Pacific

- Kastamonu Entegre

- Krifour Industries Pvt. Ltd.

- Kronoplus Limited

- Roseburg Forest Products

- Siam Riso Wood Products Co., Ltd.

- Sonae Arauco

- SWISS KRONO Group

- Timber Products Company

- West Fraser Timber Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Global Flat-Pack and RTA Furniture Production

- 4.2.2 Rapid Urbanisation in Tier-2/3 Asian Cities Boosting Affordable Housing Interiors

- 4.2.3 Cost Advantage Vs. MDF and Plywood for Non-Load-Bearing Uses

- 4.2.4 Emission-Compliant Urea-Formaldehyde Resins Unlocking Import Demand in EU And NA

- 4.2.5 Sugar-Industry Decarbonisation Policy Freeing Up Bagasse Feedstock

- 4.3 Market Restraints

- 4.3.1 Competitive Threat from Ultra-Thin MDF in Ready-To-Assemble Furniture

- 4.3.2 Volatile Resin and Methanol Prices Squeezing Margins

- 4.3.3 Moisture-Related Swelling Limiting Exterior Applications

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Raw Material

- 5.1.1 Wood Residue

- 5.1.2 Bagasse

- 5.1.3 Other Raw Materials

- 5.2 By Application

- 5.2.1 Furniture

- 5.2.2 Construction

- 5.2.3 Infrastructure

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ARAUCO

- 6.4.2 Associate Decor

- 6.4.3 Boise Cascade Company

- 6.4.4 Century Prowud

- 6.4.5 Century Plyboards (India) Ltd

- 6.4.6 EGGER

- 6.4.7 Georgia-Pacific

- 6.4.8 Kastamonu Entegre

- 6.4.9 Krifour Industries Pvt. Ltd.

- 6.4.10 Kronoplus Limited

- 6.4.11 Roseburg Forest Products

- 6.4.12 Siam Riso Wood Products Co., Ltd.

- 6.4.13 Sonae Arauco

- 6.4.14 SWISS KRONO Group

- 6.4.15 Timber Products Company

- 6.4.16 West Fraser Timber Co.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment