PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851172

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851172

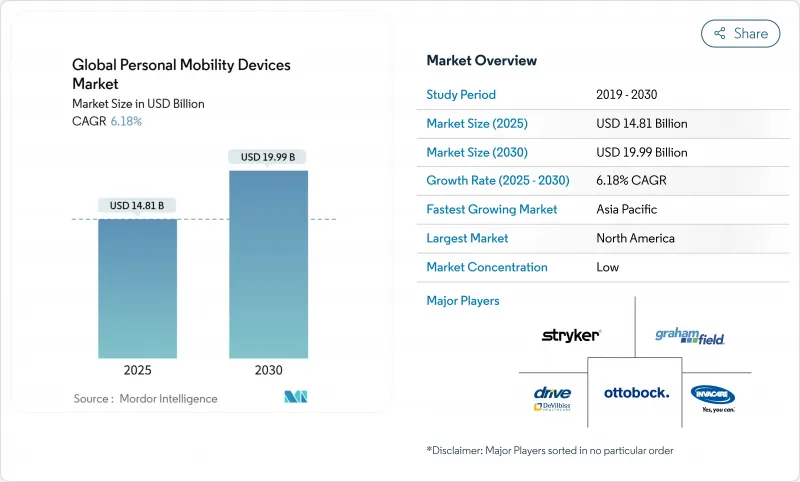

Global Personal Mobility Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The personal mobility devices market is valued at USD 14.81 billion in 2025 and is projected to touch USD 19.99 billion by 2030, advancing at a 6.18% CAGR.

Demand accelerates as home-care reimbursement expands, AI-driven wheelchairs reach mainstream price levels, and battery density improvements extend powered-device range. Wheelchairs remain the volume backbone, while mobility scooters gain traction among seniors who want independence outdoors. Manual devices still outsell powered units, yet power-assist technologies narrow the affordability gap and tempt first-time buyers. North America retains leadership thanks to established coverage rules, but the personal mobility devices market in Asia-Pacific grows fastest as its elderly population swells and consumer spending power rises.

Global Personal Mobility Devices Market Trends and Insights

Aging-in-Place Preference & Home-Care Reimbursement Expansion

Medicare's 2025 Home Health Prospective Payment System now reimburses 80% of approved mobility device costs, aligning coverage with community-based care goals. U.S. private insurers mirror this structure, guaranteeing continuity across commercial plans. Streamlined telehealth evaluations further reduce administrative friction, which brings purchasing decisions earlier in the disability journey. European payers adjust in parallel, adding personal mobility devices to home-adaptation budgets. As reimbursement spreads across Asia-Pacific, independent living purchases become integral to retirement planning.

Surge in Robotic & AI-Driven Wheelchairs Reaching Commercial Price Points

WHILL's autonomous chairs already ferry travelers across major U.S. airports, proving that lidar, depth cameras, and drive-by-wire systems meet safety and cost targets. Japanese nursing homes deploy similar fleets to ease staff workloads. Component price declines invite midsize manufacturers to license navigation stacks rather than build them from scratch. Insurers have begun covering autonomous options when they remove the need for human attendants, suggesting a virtuous cycle of data collection and actuarial validation.

High Out-of-Pocket Cost Amid Limited Insurance Coverage Outside Tier-1 Markets

In the United States a beneficiary still pays 20% of an approved device, which may equate to several months of Social Security income. Coverage gaps are wider in Latin America and parts of Southeast Asia where national plans exclude durable medical equipment. Private insurers demand clinical validation, adding evaluation charges that push total expense beyond household budgets. Rural patients face added travel costs for fitting sessions, reinforcing inequity between urban and remote populations.

Other drivers and restraints analyzed in the detailed report include:

- Mini-Mobility Regulation Easing for Scooters & E-Kick Devices in OECD Cities

- Growing Geriatric Population & Chronic Disease Prevalence

- Safety Recalls & Rising Litigation on Lithium-Ion Fire Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wheelchairs captured 45.21% of 2024 revenue, underscoring their foundational role in the personal mobility devices market. Manual variants remain the first choice for hospitals and budget-constrained buyers, while powered models appeal to users seeking independence over longer distances. WHILL's joystick-free mid-wheel platform exemplifies a design pivot toward intuitive control. Mobility scooters follow with a 6.66% CAGR forecast to 2030, fueled by retirees who need a stable outdoor solution for shopping and leisure. Stair and platform lifts create household vertical access, gaining share as multi-story homes retrofit for aging residents. Competition now centers on out-of-box connectivity, seat ergonomics, and transportability rather than simple speed specifications.

Growth drivers vary by sub-segment. Manual chair sales rely on consistent reimbursement and refurbishment programs that place second-life units in emerging economies. Powered chair demand tracks battery breakthroughs that reduce weight without sacrificing torque. Scooters benefit from liberalized sidewalk rules in many OECD cities. Lift installations correlate with real-estate trends toward multi-level living spaces. Manufacturers that serve each niche through modular platforms can cross-sell accessories and lock in service revenue.

Manual designs held 50.45% market share in 2024 due to low price, simple maintenance, and universal insurance recognition. Lightweight aluminum frames and quick-release wheels keep the category competitive for active users. Powered systems, however, should grow at 6.54% CAGR on the back of denser batteries and falling electronics costs. Power-assist kits such as Sunrise Medical's Empulse line transform a standard chair into a hybrid, providing a bridge for consumers hesitant about full electrification. Research into cobalt-free lithium-ion chemistries promises lower materials risk and extended cycle life.

Future design language blends energy-harvesting hubs, smartphone-based controls, and over-the-air diagnostics. As weight and price converge, insurers may eventually grade benefit levels on functionality rather than drive system. Suppliers who integrate open APIs for remote monitoring position themselves for value-based care contracts that reimburse on mobility outcomes rather than device acquisition alone.

The Personal Mobility Devices Market is Segmented by Product (Wheelchair[Manual Wheelchairs, Powered Wheelchairs, and More], Walking Aids, and More), Technology(manual, Powered, and More), End User (Hospitals and Clinics, Home Care Settings, and More), Distribution Channel(Offline and E-Commerce) and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 38.68% share in 2024 as Medicare coverage and ADA regulations created predictable volumes for suppliers. The personal mobility devices market benefits from an aging Baby Boomer cohort that prioritizes active lifestyles. Autonomous chair pilots at Los Angeles International Airport and Miami International Airport highlight early adoption appetite. Canada supports growth via provincial equipment loan programs, and Mexico expands public-insurance formularies, though price sensitivity is greater south of the border.

Asia-Pacific delivers the fastest CAGR at 6.82% through 2030. China's middle class purchases powered scooters for suburban travel, while Japan pioneers robotic chairs to cope with caregiver shortages. India's public-private partnerships scale low-cost manual chairs nationwide, yet premium demand rises in metro hospitals. Government initiatives fund domestic battery cell factories, aiming to cut import dependency and stabilize the personal mobility devices market supply chain. Southeast Asian nations revise import tariffs on medical devices, broadening market access for global brands.

Europe holds a sizeable yet slower-growing base. Universal healthcare plans reimburse most mobility aids, but refurbished equipment prolongs replacement cycles. The European Commission's 2024 guidance on light electric vehicle standards harmonizes cross-border product certification, easing pan-EU distribution. Middle East and Africa show early-stage adoption tied to hospital construction booms and newly introduced mandatory health insurance in Gulf Cooperation Council states. South America progresses steadily as Brazil expands long-term care benefits and Argentina subsidizes domestic wheelchair production.

- Pride Mobility Products

- Invacare

- Drive DeVilbiss Healthcare

- Sunrise Medical

- Permobil AB

- GF Health Products

- Stryker

- Ottobock

- Medline Industries

- Arjo AB

- Kaye Products

- Rollz International

- Performance Health

- WHILL Inc.

- Golden Technologies

- Amigo Mobility International

- Afikim Electric Vehicles

- Permobil Group (ROHO)

- TOPRO AS

- Yadea Technology Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging-in-place Preference & Home-care Reimbursement Expansion

- 4.2.2 Surge in Robotic & AI-driven Wheelchairs Reaching Commercial Price Points

- 4.2.3 Mini-mobility Regulation Easing for Scooters & E-kick Devices in OECD Cities

- 4.2.4 Growing Geriatric Population & Chronic Disease Prevalence

- 4.2.5 Battery Density Breakthroughs Lifting Range & Payload of Powered Devices

- 4.2.6 Rapid E-commerce Penetration in DME (Durable Medical Equipment) Retail

- 4.3 Market Restraints

- 4.3.1 High Out-of-pocket Cost Amid Limited Insurance Coverage Outside Tier-1 Markets

- 4.3.2 Safety Recalls & Rising Litigation on Lithium-ion Fire Risk

- 4.3.3 Re-use / Refurbished Equipment Suppressing New Unit Sales in OECD

- 4.3.4 Supply-chain Exposure to Rare-earth Motor Magnets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter?s Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Wheelchairs

- 5.1.1.1 Manual Wheelchairs

- 5.1.1.2 Powered Wheelchairs

- 5.1.1.3 Robotic/Autonomous Wheelchairs

- 5.1.2 Walking Aids

- 5.1.2.1 Canes & Crutches

- 5.1.2.2 Walkers & Rollators

- 5.1.3 Mobility Scooters

- 5.1.3.1 3-Wheel

- 5.1.3.2 4-Wheel

- 5.1.4 Stair Lifts & Platform Lifts

- 5.1.1 Wheelchairs

- 5.2 By Technology

- 5.2.1 Manual

- 5.2.2 Powered

- 5.2.3 Hybrid / Power-assist

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Home-care Settings

- 5.3.3 Rehabilitation & Long-term Care Centers

- 5.4 By Distribution Channel

- 5.4.1 Offline

- 5.4.2 E-commerce

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Pride Mobility Products Corp.

- 6.3.2 Invacare Corporation

- 6.3.3 Drive DeVilbiss Healthcare

- 6.3.4 Sunrise Medical LLC

- 6.3.5 Permobil AB

- 6.3.6 GF Health Products Inc.

- 6.3.7 Stryker Corporation

- 6.3.8 Ottobock SE & Co. KGaA

- 6.3.9 Medline Industries LP

- 6.3.10 Arjo AB

- 6.3.11 Kaye Products Inc.

- 6.3.12 Rollz International

- 6.3.13 Performance Health

- 6.3.14 WHILL Inc.

- 6.3.15 Golden Technologies

- 6.3.16 Amigo Mobility International

- 6.3.17 Afikim Electric Vehicles

- 6.3.18 Permobil Group (ROHO)

- 6.3.19 TOPRO AS

- 6.3.20 Yadea Technology Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment