Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690876

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690876

Remote Sensing Satellites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 203 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

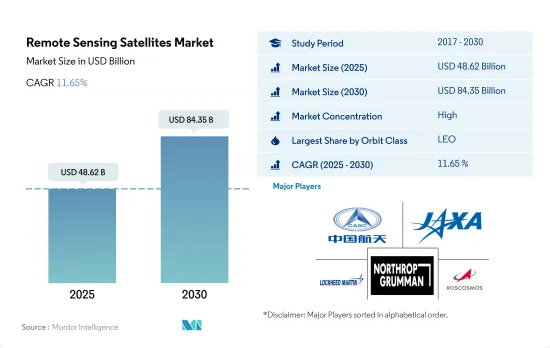

The Remote Sensing Satellites Market size is estimated at 48.62 billion USD in 2025, and is expected to reach 84.35 billion USD by 2030, growing at a CAGR of 11.65% during the forecast period (2025-2030).

Demand for LEO satellites is driving the market and registers a share of 79.5% in 2029

- Various remote sensing satellites orbit the Earth at varying distances depending on their design and primary purpose. These satellites are launched or placed into different orbits according to their purposes/applications. Each satellite deployed into orbit has its own benefits and challenges, which include increased coverage and decreased energy efficiency.

- Around 90% of the remote sensing satellites launched between 2017 and 2022* were placed in low Earth orbit for Earth observation and science, among other applications. This is because of the close proximity of this orbit to the Earth, which helps send spatial high-resolution images without any latency. Therefore, with the increased benefits of this orbit, the demand for these satellites to be deployed in the LEO orbit is expected to rise during the forecast period. Similarly, during 2017-2022, of the 56 satellites launched in the MEO orbit, 46 were built for Navigation/Global Positioning purposes. Of the 147 satellites in the GEO orbit, 105 satellites have been deployed for communication applications.

- The increasing use of remote sensing satellites for purposes such as electronic intelligence, Earth science/meteorology, laser imaging, optical imaging, and meteorology is expected to drive the demand for the remote sensing satellites market during the forecast period.

Asia-Pacific is expected to witness highest growth during the forecast period

- The global remote sensing satellite market is expected to grow significantly over the coming years, driven by increasing demand for high-speed internet, communication services, and data transfer across different industries. North America, Europe, and Asia-Pacific are the major regions in terms of market share and revenue generation. During 2017-2022, a total of 147 remote sensing satellites were manufactured and launched.

- North America is expected to dominate the global remote sensing satellite market due to the presence of several leading market players, such as Boeing, Lockheed Martin, and Northrop Grumman, in the region. The US government is also investing heavily in the development of advanced satellite technology, which is expected to drive the growth of the market in North America. During 2017-2022, the region accounted for 30% of the total remote sensing satellites manufactured.

- The remote sensing satellite market in Europe is expected to grow significantly due to the increasing demand for high-speed internet and communication services. The European Space Agency (ESA) has been investing heavily in the development of advanced satellite technology, which is expected to drive the growth of the market in the region. During 2017-2022, the region accounted for 11% of the total remote sensing satellites manufactured.

- Asia-Pacific is expected to witness significant growth in the remote sensing satellite market due to the increasing demand for satellite-based communication services and navigation systems in countries such as China, India, and Japan. During 2017-2022, the region accounted for 59% of the total remote sensing satellites manufactured.

Global Remote Sensing Satellites Market Trends

Rising demand for satellite miniaturization across all regions is driving the market

- The ability of small satellites to perform nearly all the functions of traditional satellites at a fraction of their cost has increased the viability of building, launching, and operating small satellite constellations. The demand from North America is primarily driven by the United States, which manufactures the largest number of small satellites each year. In North America, during 2017-2022, a total of 596 nanosatellites were placed into orbit by various regional players. NASA is also currently involved in several projects aimed at developing these satellites.

- The demand from Europe is primarily driven by Germany, France, Russia, and the United Kingdom, which manufacture the largest number of small satellites each year. During 2017-2022, more than 50 nano and microsatellites were placed into orbit by various regional players. The miniaturization and commercialization of electronic components and systems have driven market participation, resulting in the emergence of new market players who aim to capitalize on and enhance the current market scenario. For instance, UK-based startup Open Cosmos partnered with ESA to provide commercial nanosatellite launch services to end users while ensuring competitive cost savings of around 90%.

- The demand from Asia-Pacific is primarily driven by China, Japan, and India, which manufacture the largest number of small satellites annually. During 2017-2022, more than 190 nano and microsatellites were placed into orbit by various regional players. China is investing significant resources toward augmenting its space-based capabilities. The country has launched the most significant number of nano and microsatellites in Asia-Pacific to date.

Investment opportunities in satellite manufacturing is driving the market

- In North America, global government expenditure for space programs reached a record of approximately USD 103 billion in 2021. The region is the epicenter of space innovation and research, with the presence of the world's biggest space agency, NASA. In 2022, the US government spent nearly USD 62 billion on its space programs, making it the highest spender on space programs in the world. In the United States, federal agencies receive funding from Congress every year worth USD 32.33 billion for their subsidiaries.

- European countries are recognizing the importance of various investments in the space domain and are increasing their spending on innovative activities to remain competitive in the global space industry. In November 2022, ESA announced that it had proposed a 25% boost in space funding over the next three years designed to maintain Europe's lead in Earth observation, expand navigation services, and remain a partner in space exploration with the United States. The European Space Agency (ESA) is asking its 22 nations to back a budget of some EUR 18.5 billion for 2023-2025. Germany, France, and Italy are the major contributors.

- In line with the increase in space-related activities in the Asia-Pacific region, in 2022, Japan's draft budget registered a rise in its space budget, which amounted to over USD 1.4 billion. It included the development of the H3 rocket, Engineering Test Satellite-9, and the nation's Information Gathering Satellite (IGS) program. Similarly, the proposed budget for India's space programs for FY22 was USD 1.83 billion. In 2022, the South Korean Ministry of Science and ICT announced a space budget of USD 619 million for manufacturing satellites, rockets, and other key space equipment.

Remote Sensing Satellites Industry Overview

The Remote Sensing Satellites Market is fairly consolidated, with the top five companies occupying 85.94%. The major players in this market are China Aerospace Science and Technology Corporation (CASC), Japan Aerospace Exploration Agency (JAXA), Lockheed Martin Corporation, Northrop Grumman Corporation and ROSCOSMOS (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 72226

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Mass

- 4.2 Satellite Miniaturization

- 4.3 Spending On Space Programs

- 4.4 Regulatory Framework

- 4.4.1 Global

- 4.4.2 Australia

- 4.4.3 Brazil

- 4.4.4 Canada

- 4.4.5 China

- 4.4.6 France

- 4.4.7 Germany

- 4.4.8 India

- 4.4.9 Iran

- 4.4.10 Japan

- 4.4.11 New Zealand

- 4.4.12 Russia

- 4.4.13 Singapore

- 4.4.14 South Korea

- 4.4.15 United Arab Emirates

- 4.4.16 United Kingdom

- 4.4.17 United States

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Satellite Mass

- 5.1.1 10-100kg

- 5.1.2 100-500kg

- 5.1.3 500-1000kg

- 5.1.4 Below 10 Kg

- 5.1.5 above 1000kg

- 5.2 Orbit Class

- 5.2.1 GEO

- 5.2.2 LEO

- 5.2.3 MEO

- 5.3 Satellite Subsystem

- 5.3.1 Propulsion Hardware and Propellant

- 5.3.2 Satellite Bus & Subsystems

- 5.3.3 Solar Array & Power Hardware

- 5.3.4 Structures, Harness & Mechanisms

- 5.4 End User

- 5.4.1 Commercial

- 5.4.2 Military & Government

- 5.4.3 Other

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Airbus SE

- 6.4.2 Ball Corporation

- 6.4.3 China Aerospace Science and Technology Corporation (CASC)

- 6.4.4 ESRI

- 6.4.5 GomSpaceApS

- 6.4.6 IHI Corporation

- 6.4.7 Indian Space Research Organisation (ISRO)

- 6.4.8 Japan Aerospace Exploration Agency (JAXA)

- 6.4.9 Lockheed Martin Corporation

- 6.4.10 Maxar Technologies Inc.

- 6.4.11 Northrop Grumman Corporation

- 6.4.12 Planet Labs Inc.

- 6.4.13 ROSCOSMOS

- 6.4.14 Spire Global, Inc.

- 6.4.15 Thales

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.