PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693574

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693574

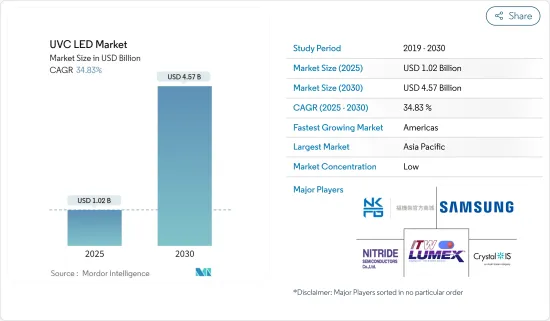

UVC LED - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UVC LED Market size is estimated at USD 1.02 billion in 2025, and is expected to reach USD 4.57 billion by 2030, at a CAGR of 34.83% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 0.22 billion units in 2025 to 1.04 billion units by 2030, at a CAGR of 36.93% during the forecast period (2025-2030).

UV-C LEDs produce UV photons through the electroluminescence of a semiconductor crystal; these semiconductor crystals are typically made of AlGaN compounds grown on sapphire or AlN substrates. These solid-state devices contain no mercury and do not rely on other substances that are subject to environmental restrictions; as a result, they may provide a regulatory-proof alternative to traditional mercury-containing UV lamps.

Key Highlights

- UV-C LEDs are germicidal, which treats microorganisms and prevents them from becoming resistant to chemical disinfectants. As a result, microorganisms do not develop resistance to UV radiation. UV-C LEDs have a wide range of applications, including air, food, and water purification. UV-C is weak at the Earth's surface because the atmosphere's ozone layer blocks it.

- UV-C LED disinfection is a new technology that uses light to damage the DNA of pathogens. This technology offers a variety of unique benefits when compared to conventional UV purification. The UV-C LEDs are expected to have a lasting effect on disinfecting water, surfaces, and air, like the effect of visible LEDs in the display market.

- UV-C LED technology is progressing quickly and receiving considerable interest across various industries. Due to increasing environmental concerns regarding traditional disinfection methods, UV-C LEDs offer an eco-friendlier option. Unlike traditional UV-C lamps, UV-C LEDs do not contain mercury, eliminating the necessity for special disposal methods and decreasing the risk of environmental pollution.

- Additionally, the energy efficiency and extended lifespan of UV-C LEDs contribute to reduced energy usage and waste production. These factors are expected to drive growth in the UV-C LED market in the foreseeable future.

- Additionally, UV-C LEDs can generate UV-C light in systems that circulate air or water. Some key factors advancing the growth of UV-C LEDs include the rapid expansion of the use of environment-safe LEDs and the growth in the application of UV curing systems.

- Since UV-C LED is very effective at disinfection, a surge in the adoption of water purification is a significant factor driving the growth of the global UV-C LED industry. However, the thermal management of UV-C LEDs is considered a significant issue with the technology and restraint to the growth of the market studied.

- The COVID-19 outbreak affected the expansion of the UV-C LED market. The development of COVID-19 has sparked a meteoric rise in interest in germicidal ultraviolet (UV) technology. SARS-CoV-2 and other pathogens can be rendered inactive on surfaces, in the air, and water by UV-C band radiation (100-280 nm) produced by conventional or LED sources. Around the world, numerous universities and laboratories are creating UV-C LED-based products to stop the spread of infections. As a result, the COVID-19 pandemic's introduction has led to a significant increase in the UV-C LED market.

UVC LED Market Trends

Water Disinfection Application Segment is Expected to Hold Significant Market Share

- UV-C LEDs have become increasingly popular for their effectiveness in disinfecting and sanitizing surfaces, which is vital in addressing hygiene concerns, particularly during the COVID-19 pandemic.

- UV-C LEDs provide a safe, efficient method of treating water without using risky chemicals that contaminate rivers, oceans, and other bodies of water. UVC-LEDs are used to efficiently purify water in applications such as water reclamation, wastewater treatment, drinking water, industrial and commercial process water, pools and spas, aquaculture, and life sciences.

- UV-C LEDs can be added to on-demand POU water purification systems to safeguard households against common pathogenic causes of waterborne illnesses. UV-C LEDs are used in these systems to protect against microbial contaminants, which include parasites, viruses, and bacteria like E. coli, Pseudomonas, and Legionella.

- There are two types of water disinfection: single-pass and water storage. A single-pass type, such as a household water purification system, irradiates ultraviolet to disinfect running water. A water storage type irradiates and disinfects water inside a tank, such as a humidifier.

- Drinking water is sanitized with UV-C LEDs at various stages of the treatment process, from the source to consumption. With the new technology, LEDs can be positioned at different points to ensure decontamination. In a UV-C model, the water can take a few seconds to become clean. It initially disinfects the water by exposing a reservoir to several powerful LEDs. They release potent UV-C photons between 200 nm and 280 nm, which travel through the water and prevent aquatic bacteria from being able to procreate.

Asia-Pacific is Expected to Hold Significant Market Share

- The UV-C LED market in Asia-Pacific is expected to hold the most prominent market share during the forecast period because the main UV-C LED suppliers are in South Korea and Japan. Moreover, the region is also experiencing a rising demand for UV-C LEDs for scientific research. Several South Korean LED companies are expected to launch a new series of UV-C LED products, contributing to the expansion of South Korean suppliers' revenue.

- Increasing cases of waterborne diseases, primarily in emerging countries across Asia, are poised to augment demand as UV radiation holds a strong germicidal ability to disinfect water with protozoans, bacteria, and viruses. The market growth is stimulated by the increasing adoption of advanced technologies to treat industrial liquid waste and wastewater.

- Leading companies offer high-performance solutions for large-volume applications like industrial water treatment and municipal drinking water. In addition, factors such as government policies, rapid industrialization, and a strong focus on efficient water & wastewater treatment are poised to expedite the market's growth.

- The increasing adoption of UV-C LED-based equipment in the healthcare industry also favors market growth. These devices can be effectively designed and customized for patient wards, operating rooms, and other areas for efficient disinfection and mitigating the risk of hospital-acquired infections.

- Moreover, the water and wastewater treatment segment is growing owing to increased acceptance of both municipal and household drinking water treatment systems across Asian countries such as Nepal, Bhutan, Bangladesh, and India. The water treatment segment, which includes municipal, commercial, and residential applications, dominates the UV disinfection equipment market.

- Governments in the Asia-Pacific region have been promoting the adoption of UV-C LED technology. They have recognized its potential in addressing public health concerns, such as disinfection and sterilization, especially in densely populated areas. Additionally, regulatory measures and standards are being developed to ensure the safety and efficacy of UV-C LED products, further driving their adoption.

UVC LED Market Overview

The UV-C LED market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are NKFG Corporation, Nitride Semiconductor Co. Ltd, Samsung Electronics Co. Ltd, Lumex Inc. (ITW Inc.), and Crystal IS Inc. (Asahi Kasei Group). Players in the market are adopting partnership and acquisition strategies to enhance their product offerings and gain sustainable competitive advantage.

- December 2023 - Luminus announced the official launch of its Gen2 XBT-3535 series, an addition to its extensive UV-C LED portfolio. This release ensures Luminus is a prominent player with one of the most comprehensive portfolios in the industry by offering multiple wavelength options, including 265 nm, 275 nm, 285 nm, 308 nm, and 340 nm.

- November 2023 - Crystal IS Inc. announced that Amway has chosen its UVC LED technology for its eSpring home water treatment system. With a unique combination of UV LEDs and eSpring e3 carbon filter, the new eSpring water purifier is 99.9999% effective at killing bacteria, Viruses up to 99.99%, and cysts up to 99.9%. UV C LEDs also make the new eSpring water purifier a more environmentally friendly product, as the new device consumes 25 less energy during active use compared to the previous model.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 and Macroeconomic Factors on the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Pricing Analysis

- 4.5 Overall UV Lamp Analysis

- 4.6 UV-C LED Technology - Manufacturing Process

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 UV-C LED is Highly Effective for Disinfection

- 5.1.2 Surge in Adoption of Water Purification

- 5.2 Market Restraints

- 5.2.1 Thermal Management of UV-C LED is a Concern

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Surface Disinfection

- 6.1.2 Air Disinfection

- 6.1.3 Water Disinfection

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.2 Asia

- 6.2.3 Australia and New Zealand

- 6.2.4 Europe, Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NKFG Corporation

- 7.1.2 Nitride Semiconductor Co. Ltd

- 7.1.3 Samsung Electronics Co. Ltd

- 7.1.4 Lumex Inc. (ITW Inc.)

- 7.1.5 Crystal IS Inc. (Asahi Kasei Group)

- 7.1.6 Seoul Viosys Co. Ltd

- 7.1.7 Hongli Zhihui Group

- 7.1.8 LiteOn Technology Corporation

- 7.1.9 Luminus Inc.

- 7.1.10 AMS-Osram AG

- 7.1.11 International Light Technologies Inc.

- 7.1.12 Nichia Corporation

8 VENDOR MARKET SHARE ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET