PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444684

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444684

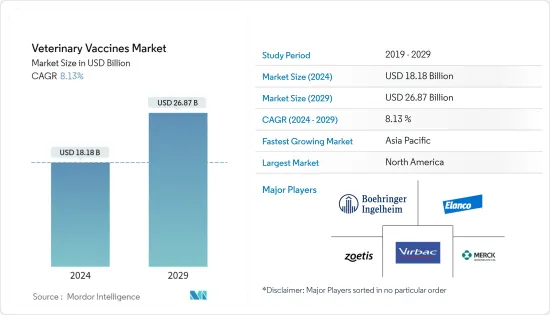

Veterinary Vaccines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Veterinary Vaccines Market size is estimated at USD 18.18 billion in 2024, and is expected to reach USD 26.87 billion by 2029, growing at a CAGR of 8.13% during the forecast period (2024-2029).

COVID-19 has impacted the veterinary vaccines market owing to the increased need for the development of COVID-19 vaccines for animals during the pandemic. Various market players and healthcare organizations developed vaccines for animals. For instance, in June 2022, the Union Minister of Agriculture & Farmers' Welfare of India launched Animal Vaccine developed by the ICAR-National Research Centre on Equines, Hisar, Haryana. The Ancovax Equines Vaccine is an inactivated SARS-CoV-2 Delta (COVID-19) Animal Vaccine. Ancovax-induced immunity neutralizes both the Delta and Omicron variants of SARS-CoV-2. Therefore, the market was significantly impacted by COVID-19. Moreover, with the emergence of new variants of COVID-19 strains, various market players are continuing their research and development for the development of innovative veterinary vaccines which is expected to propel the market growth during the forecast period.

Furthermore, an increase in pet adoption during recent years worldwide is boosting companion animal vaccine growth during the forecast period. For instance, according to the People's Dispensary for Sick Animals (PDSA), animal wellbeing June 2021 report, 2 million people in the United Kingdom adopted a pet in 2021. Out of these pets, 10% were dogs, 8% were cats and 13% were rabbits. Such a high rate of pet adoption in the country has increased the focus on the healthcare of animals, thus increasing the demand for appropriate pet vaccines, thereby boosting the market.

Additionally, the rising burden of zoonotic diseases is expected to propel the demand for vaccines for animals, thereby boosting market growth during the forecast period. For instance, the increasing number of cases of rabies across the globe is one of the major factors driving the market's growth over the forecast period. Dogs are the leading cause of human rabies mortality and account for up to 99.0% of all human rabies transmissions as of May 2021, according to the World Health Organization (WHO).

The strategic initiatives by the government worldwide for the vaccination of animals are expected to propel market growth. For instance, in June 2022, Indonesia launched a nationwide livestock vaccination program as the number of cattle infected with foot and mouth disease surged to more than 151 thousand. These initiatives create opportunities for market players for developing innovative and effective veterinary vaccines, thereby propelling market growth.

Therefore, owing to the factors such as the high burden of zoonotic diseases, rising pet adoption and vaccination programs, and launches by market players, the studied market is anticipated to witness growth over the analysis period. However, the high storage costs for vaccines and the shortage of veterinarians and skilled farm workers are estimated to restrain the market growth.

Veterinary Vaccines Market Trends

The Canine Vaccines Segment is Expected to Hold a Significant Market Share Over the Forecast Period

The canine vaccine is expected to increase rapidly because of the increasing number of pet dogs globally and the rising launches of canine vaccines by market players during the forecast period.

An article published in Acta Scientific Veterinary Sciences in March 2022 stated that India has approximately 6.2 crores of community dog population and it is estimated that the population of pet dogs is likely to reach around 31 million by the end of the year 2023. In spite of India's huge dog population, awareness regarding the zoonoses transmissible from dogs to humans is highly lacking. Additionally, India's climate is particularly favorable for a wide range of zoonotic diseases, and for the majority of them, canines including both community and companion dogs serve as the reservoir host. The large canine population worldwide and the zoonotic diseases associated with them are expected to propel the canine vaccine development and launches during the forecast period.

The activities of market players for the launch, approvals, and partnerships to expand vaccines are expected to boost the segment's growth over the forecast period. For instance, in March 2022, Alv B AS announced the new developments in their feline and canine vaccine, Alvacan. It is the product line of therapeutic cancer vaccines that combines the best of classical cellular immunotherapy with recombinant DNA/RNA technology.

Additionally, in September 2022, Ministry of animal husbandry and dairy development announced all stray dogs will be vaccinated and steps have been initiated to identify hotspots of dog bites. Also, in April 2022, Gujarat-based Cadila Pharmaceuticals launched one of the world's first three-dose anti-rabies vaccines, ThRabis. Therefore, the rising launches of canine vaccines are anticipated to augment the segment's growth during the forecast period.

North America is Expected to Hold a Significant Market Share Over The Forecast Period

The rising number of pet insurance in the region is expected to increase the market growth. For instance, according to the 2022 statistics published by the Insurance Information Institute, in the United States, 3.9 million pets were insured in 2021, with an increase of 20% compared to the previous year. Also, in Canada, 432.5 thousand pets were insured in 2021, with an increase of 22.7% as compared to the previous year. The rising number of pet insurance in the region is expected to create opportunities for the development and availability of advanced veterinary vaccines for the treatment of animals, which is anticipated to fuel market growth over the forecast period.

Additionally, the strategic initiatives by market players are expected to propel the market growth in the region during the forecast period. For instance, in September 2022, Merck Animal Health donated more than five million doses of its NOBIVAC rabies vaccine to help eliminate canine-mediated rabies.

Also, in May 2022, Ceva Sante Animale (Ceva) acquired the Canadian oral rabies vaccine manufacturer Artemis Technologies, Inc. With this acquisition, Ceva will expand its presence in the segment to North America.

Therefore, owing to the above-mentioned factors such as the rising pet insurance and spending on animal healthcare, and product approvals and launches by market players, the growth of the studied market is anticipated in the North America region.

Veterinary Vaccines Industry Overview

The veterinary vaccines market is fairly competitive and consists of several major players. Most of these major players enjoy a global presence, and they are facing intense competition in emerging economies. Emerging countries are becoming hotspots for significant competition due to the rapidly expanding market, fueled by rising concerns over food safety and the increasing adoption of companion animals. Some market players are Zoetis Inc., Merck & Co. Inc., Virbac, Boehringer Ingelheim International GmbH, Elanco Animal Health, HIPRA, Ceva Sante Animale, and Phibro Animal Health Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidence of Livestock Diseases

- 4.2.2 Increasing Pet Adoption Globally

- 4.2.3 Initiatives by Government Agencies, Animal Associations, and Leading Players

- 4.3 Market Restraints

- 4.3.1 High Storage Costs for Vaccines

- 4.3.2 Shortage of Veterinarians and Skilled Farm Workers

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Vaccine Type

- 5.1.1 Livestock Vaccines

- 5.1.1.1 Bovine Vaccines

- 5.1.1.2 Poultry Vaccines

- 5.1.1.3 Porcine Vaccines

- 5.1.1.4 Other Livestock Vaccines

- 5.1.2 Companion Animal Vaccines

- 5.1.2.1 Canine Vaccines

- 5.1.2.2 Feline Vaccines

- 5.1.2.3 Equine Vaccines

- 5.1.1 Livestock Vaccines

- 5.2 By Technology

- 5.2.1 Live Attenuated Vaccines

- 5.2.2 Inactivated Vaccines

- 5.2.3 Toxoid Vaccines

- 5.2.4 Recombinant Vaccines

- 5.2.5 Other Technologies

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Zoetis Inc.

- 6.1.2 Merck & Co. Inc.

- 6.1.3 Virbac

- 6.1.4 Hester Biosciences Limited

- 6.1.5 Elanco Animal Health

- 6.1.6 Boehringer Ingelheim International GmbH

- 6.1.7 Ceva Sante Animale

- 6.1.8 Phibro Animal Health Corporation

- 6.1.9 HIPRA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS