Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441568

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441568

Virtual Reality in Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 111 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

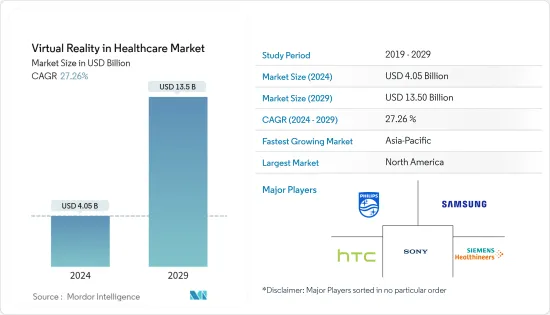

The Virtual Reality in Healthcare Market size is estimated at USD 4.05 billion in 2024, and is expected to reach USD 13.5 billion by 2029, growing at a CAGR of 27.26% during the forecast period (2024-2029).

Key Highlights

- During the COVID-19 pandemic, the need for virtual reality technologies in the healthcare business increased. The use of virtual reality in healthcare allowed medical personnel to better comprehend and study the impact of the new strain. Medical practitioners were aided by technology, which provided real-time radiographic insights into the disease's impact on a patient's body. For instance, as per the study published in August 2020 by Elsevier Public Health Emergency Collection, VR technology develops a platform to reduce the face-to-face interaction of doctors with infected COVID-19 patients. Through live video streaming, it helps to improve surveillance systems in the ongoing situation.

- The market is expected to see a surge even after the pandemic due to increased usage of technology in the healthcare market. Thus, COVID-19 has had a significant impact on the growth of the studied market throughout the pandemic phase and even after the pandemic.

- Technological advancements and digitalization in healthcare, increasing application of virtual reality in patient treatment, and rising healthcare expenditure and medical training are some of the fundamental factors anticipated to boost the growth and adoption of augmented reality (AR) technologies in the healthcare industry. These technologies have wide applications in healthcare, including surgeries, diagnostics, rehabilitation, training, and education.

- Virtual reality is being used by healthcare practitioners to increase patient treatment capacity. Professionals can quickly identify, diagnose, teach and treat health conditions. For instance, in October 2021, the US FDA approved a new method of treating children with amblyopia (lazy eye) that replaces eye patches and blurring eye drops with a VR headset.

- According to an article published in May 2022 by Smithsonian Magazine, medical professionals are embracing technology to help patients deal with post-traumatic stress disorder (PTSD), anxiety disorders, and more. Thus, the increasing applications in the treatment of patients are expected to increase the demand for virtual reality in healthcare during the forecast period.

- Furthermore, initiatives taken by the governments of various nations to promote digital health are also contributing to the growth of the market. For instance, in September 2021, Indian Prime Minister Narendra Modi rolled out the Pradhan Mantri Digital Health Mission. It is aimed at digitalizing healthcare practices across the nation, creating a country-wide digital health ecosystem that will enable patients to store, access, and consent to share health records.

- The increasing launches and investments by manufacturers to meet the growing demand for innovative products are expected to drive market growth. For instance, in March 2021, AppliedVR raised a total of USD 35 million in Series A funding that will be used to continue the development of software for an immersive headset to help patients with chronic pain. Such initiatives are expected to boost the growth of the market over the forecast period.

- However, technical shortcomings, such as computer specifications and the available resolution, are restraining the market's growth.

Virtual Reality (VR) in Healthcare Market Trends

Pain Management Segment is Expected to Grow at a High Pace Over the Forecast Period

- Virtual reality (VR) has been used to manage pain and distress associated with a wide variety of known painful medical procedures. In clinical settings and experimental studies, participants immersed in VR experienced reduced pain levels and general distress/unpleasantness and reported a desire to use VR again during painful medical procedures. VR acts as a nonpharmacologic form of analgesia by exerting an array of emotional affective, emotion-based cognitive, and attentional processes on the body's intricate pain modulation system.

- The study published in the Journal of Medical Internet Research in September 2021 found that virtual reality can be a useful, scalable, and appealing alternative to existing pain management approaches. Thus, the increasing research and development for virtual reality in pain management are expected to boost the market's growth over the forecast period.

- Moreover, in November of 2021, the US FDA authorized the marketing of a prescription home-use VR device to help reduce chronic low back pain. As per an article published in April 2022 by Harward Medical School, Harvard-affiliated Spaulding Rehabilitation Hospital has been studying VR for a few years to see if the approach has the potential to manage any type of chronic pain. Such instances are expected to boost the growth of the market over the forecast period.

North America is Expected to Continue Dominating the Market

- North America, being a developed region, is currently dominating the virtual reality in the healthcare market. It is expected to hold a significant market share for a few more years. The major factors responsible for the region's largest market share are the well-established healthcare industry and the early adoption of IT services across healthcare settings.

- The United States holds the majority of the market in the North American region. This is due to the higher adoption of digital healthcare in the country, along with the high concentration of key market players and increased government funding for healthcare services and infrastructure.

- As per the report published by the US HHS in February 2022, HHS awarded around USD 55 million to increase virtual healthcare access and quality through community healthcare centers. The funding will help the health centers adopt the latest innovations and technologies to expand facilities for primary care for underserved communities.

- In February 2022, XRHealth raised USD 10 million in funding to expand virtual healthcare treatment in the Metaverse. The funding was backed by HTC, Bridges Israel impact investment fund, AARP, and crowdfunding on StartEngine.com and existing investors. Such factors are anticipated to propel the market's growth in the United States over the forecast period.

- Moreover, in November 2021, the US FDA authorized the marketing of EaseVRx, a prescription-use immersive VR system that uses cognitive behavioral therapy and other behavioral methods to help with pain reduction in patients 18 years of age and older with diagnosed chronic lower back pain. Team members across the health system, which serves locations in North Carolina, South Carolina, and Georgia, will also immerse themselves in a lifelike environment that uses natural language processing to practice difficult workplace discussions - and ultimately address unconscious bias - in a supportive, non-threatening environment.

- Thus, the increasing product approval by the regulatory authorities is expected to boost the growth of the market in the region over the forecast period. A well-established healthcare industry and the early adoption of IT services across healthcare settings are also projected to drive the market.

Virtual Reality (VR) in Healthcare Industry Overview

The virtual reality in helathcare market is competitive and consists of several major players. Companies like Koninklijke Philips NV, Samsung Electronics Co. Ltd, HTC Corporation, Sony Corporation, and Siemens Healthineers, among others, hold a substantial market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93222

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Advancements and Digitalization in Healthcare

- 4.2.2 Increasing Application of Virtual Reality in Patient Treatment

- 4.2.3 Rising Healthcare Expenditure

- 4.3 Market Restraints

- 4.3.1 Technical Shortcomings, such as Computer Specifications and the Available Resolution

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Value By Size - USD million)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Application

- 5.2.1 Pain Management

- 5.2.2 Education and Training

- 5.2.3 Surgery

- 5.2.4 Patient Care Management

- 5.2.5 Rehabilitation and Therapy Procedures

- 5.2.6 Other Applications

- 5.3 By End Use

- 5.3.1 Hospitals and Clinics

- 5.3.2 Research Organizations and Pharma Companies

- 5.3.3 Other End Uses

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Koninklijke Philips NV

- 6.1.2 Samsung Electronics Co. Ltd

- 6.1.3 EON Reality

- 6.1.4 CAE Healthcare

- 6.1.5 Oculus Rift

- 6.1.6 Medical Realities Ltd

- 6.1.7 XRHealth USA Inc.

- 6.1.8 Amelia Virtual Care

- 6.1.9 HTC Corporation

- 6.1.10 Sony Corporation

- 6.1.11 GE Healthcare

- 6.1.12 Intuitive Surgical

- 6.1.13 Siemens Healthineers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.