Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693572

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693572

ASEAN Freight and Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 382 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

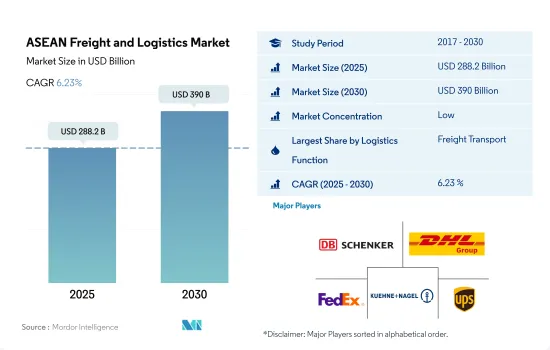

The ASEAN Freight and Logistics Market size is estimated at 288.2 billion USD in 2025, and is expected to reach 390 billion USD by 2030, growing at a CAGR of 6.23% during the forecast period (2025-2030).

Rising GDP contributions from ASEAN countries in the logistics sector leading to sector development

- Malaysia's focus on clean energy transition is driving its infrastructure development, with both local companies and government-owned entities spearheading technological advancements. These initiatives span various sectors, including rooftop and floating solar, battery storage, and hydrogen. A notable example is the RM 38 million (USD 8.61 million) contract awarded by Masama Sdn Bhd to Sarawak Consolidated Industries Bhd (SCIB) in May 2022. The contract, encompassing engineering, procurement, construction, and commissioning, was for a road project connecting multiple locations in Sarawak, Malaysia, and was successfully completed in March 2023.

- Vietnam, with its extensive coastline of 3,260 km and a network of rivers, presents significant opportunities in maritime freight transportation. The Vietnamese government has set ambitious targets, aiming to position the nation as a leading maritime power by 2030. These goals include elevating the maritime sector's GDP contribution to 10% and amplifying the economic significance of its 28 coastal cities and provinces, targeting a 65% to 70% share of the overall Vietnamese GDP.

Rising e-commerce trends and initiatives imposed by the government are driving the market's growth

- Vietnam's Ministry of Transport plans to break ground on 14 infrastructure projects and complete 50 more by 2025, including key parts of the North-South Expressway. This is part of the goal to expand the country's expressways to 3,000 km by 2025, up from the current 2,021 km. Additionally, the Long Thanh International Airport, a USD 14.12 billion project in Dong Nai province, is on track to finish in 2025. Once completed, it will be the country's largest airport, easing congestion at Tan Son Nhat in Ho Chi Minh City.

- In November 2023, BBN Airlines Indonesia expanded its fleet by adding a third freighter, underscoring the robust growth of the nation's all-cargo market. The ACMI carrier, a subsidiary of Avia Solutions Group, announced the acquisition of a Boeing 737-400SF, enhancing its current fleet of two 737-800Fs. The aircraft, began commercial operations in 2024. Given Indonesia's vast archipelago, which spans 17,000 islands over 5,150 km, air transportation is crucial. The International Air Transport Association (IATA) forecasts that by 2034, Indonesia will rank as the world's sixth-largest air transport market.

ASEAN Freight and Logistics Market Trends

Rising FDI in ASEAN countries supported by infrastructure construction projects by country governments driving economic growth

- In May 2024, the Japanese government announced a loan of about JPY140.7 billion (USD 900 million) to build a high-speed rail line in Jakarta, Indonesia. The East-West rail project will cover 84.1 km and be completed in two phases, starting in 2026 and finishing by 2031. The new rail line will feature Japanese technology for trains and signaling systems. Such initiatives are expected to boost GDP contribution from transport and storage sector.

- In February 2024, the Transport Ministry announced plans to invest USD 18.83 billion in around 150 transport projects by the end of 2025 to enhance Thailand's infrastructure. In 2024, 64 projects will commence, with an additional 31 projects valued at USD 11.23 billion in the pipeline. For 2025, there are 57 new projects planned, totaling USD 7.59 billion. These initiatives include 18 motorway projects, 9 railway projects, and plans for regional port development, all aimed at bolstering the transport and storage sector's contribution to GDP in the future.

Impact of the Iran-Israel conflict and Ukraine-Russia war on ASEAN countries led to increased fuel prices and supply chain disruptions

- Indonesia expects a 29% increase in oil and gas sector investments in 2024 to boost drilling and exploration after Shell and Chevron's recent exits. This push is vital for Indonesia to counter a long-term decline in output amid rising financing challenges for fossil fuel projects. Foreign companies like Eni, Exxon Mobil, and BP will contribute 40% of 2024's planned investments. Also, in early 2024, the Ministry of Oil and Gas announced that fuel prices at gas stations will stay stable until at least June 2024, despite the Iran-Israel conflict potentially raising oil prices to USD 100 per barrel.

- Diesel prices in Malaysia surged by over 50% in June 2024 as part of Prime Minister Anwar Ibrahim's efforts to reform the country's long-standing fuel subsidy system. The restructuring aimed to alleviate pressure on national finances by eliminating universal energy subsidies and focusing assistance on those most in need. This move also aims to address issues like the smuggling of subsidized diesel to neighboring countries, where it fetches higher prices.

ASEAN Freight and Logistics Industry Overview

The ASEAN Freight and Logistics Market is fragmented, with the major five players in this market being Deutsche Bahn AG (including DB Schenker), DHL Group, FedEx, Kuehne+Nagel and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92671

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 Indonesia

- 4.21.2 Malaysia

- 4.21.3 Thailand

- 4.21.4 Vietnam

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 Indonesia

- 4.22.2 Malaysia

- 4.22.3 Thailand

- 4.22.4 Vietnam

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.3 Country

- 5.3.1 Indonesia

- 5.3.2 Malaysia

- 5.3.3 Thailand

- 5.3.4 Vietnam

- 5.3.5 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Alps Logistics

- 6.4.2 Deutsche Bahn AG (including DB Schenker)

- 6.4.3 DHL Group

- 6.4.4 DP World

- 6.4.5 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.6 FedEx

- 6.4.7 JWD Group

- 6.4.8 Kuehne+Nagel

- 6.4.9 NYK (Nippon Yusen Kaisha) Line

- 6.4.10 Tiong Nam Logistics Holdings Bhd

- 6.4.11 United Parcel Service of America, Inc. (UPS)

- 6.4.12 YCH Group

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.