PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640342

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640342

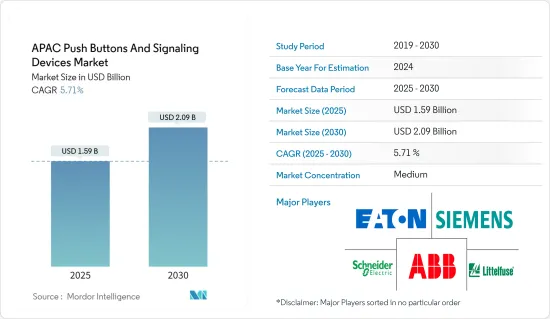

APAC Push Buttons And Signaling Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The APAC Push Buttons And Signaling Devices Market size is estimated at USD 1.59 billion in 2025, and is expected to reach USD 2.09 billion by 2030, at a CAGR of 5.71% during the forecast period (2025-2030).

A push button is a mechanical switch that opens or closes one or more circuits to control an aspect of a machine or process. The push button is usually used to start or stop a process, with switches ordinarily open or closed. The most common method of resetting an emergency stop in Asian countries is the pull-to-release mechanism.

Key Highlights

- Push buttons and signaling devices control some aspects of the processing equipment installed in industrial areas. Press buttons are shaped to be used by a person's finger or arm, and most of the hard material is plastic or metal. Most signal devices are used for alarm purposes, indicating the warning. An alarm may also be visible or audible depending on the requirement, application, or environment.

- Pilot devices such as push buttons and signaling devices control and monitor industrial equipment and machinery. These devices include several push buttons, indicating lights, and audible-visual signaling devices. These devices can be used as indicators to spot malfunctions and material shortages across facilities and alert operators to any hazard or fatality in the facility, reducing process downtime. The market for push buttons and signaling devices has expanded as industrial safety standards for food and beverages, chemicals, and pharmaceuticals and the oil and gas industries have become more stringent.

- Push buttons are preferred in industrial applications due to the functionality afforded over other switches. Unlike a standard controller that provides one particular function, push buttons can connect to other mechanical applications through linkages. This flexibility in industrial applications helps the employees control multiple aspects of a machine by pushing a button. The automotive industry extensively uses these devices in commercial vehicles.

- Signaling devices and systems convey simple messages concerning machinery, manufacturing lines, or individual industrial equipment operations. Imagining a properly functioning industrial plant without appropriate low-level optical and audible signaling devices is difficult.

APAC Push Buttons And Signaling Devices Market Trends

The Automotive Segment is Expected to Hold a Significant Market Share

- The automotive segment is going through a considerable transformation to curb its carbon footprint. The EV market witnessed significant investments; the implementation of push buttons also increased for auto-start functions and other automated vehicle mechanisms.

- Push buttons have been used to implement keyless access in vehicles. Many automobile companies widely adopt push-button ignition due to its comfort and reliability.

- With the increasing number of road accidents and internal vehicle damage, automotive manufacturers focus on improving vehicular safety. For instance, push buttons can be used to indicate if the vehicle is required to pass through a cross-section. This majorly provides ease of use while improving passenger safety.

- Panel lights and horns are vehicles' most commonly used signaling devices. Automotive manufacturers also focus on providing additional features, such as video surveillance and strobes. Emergency lighting is also included in all the newly manufactured vehicles. This is also anticipated to drive the market's growth during the forecast period.

- According to the ASEAN Automotive Federation, in 2023, Indonesia accounted for the most motor vehicle sales across Southeast Asia, with over one million sales generated.

- Across the region, the repercussions of the pandemic crisis have been immense and unprecedented, as many auto-retail stores remained closed for a month or more, resulting in a decline in profit by the automotive manufacturer compared to the previous two years. It may take years to recover from this plunge in profitability.

India Holds The Majority Market Share

- Push buttons have been used to implement keyless access in vehicles. Many automobile companies widely adopt push-button ignition due to its comfort and reliability in the country. According to SIAM India, the sales volume for light commercial vehicles across India was around 604 thousand units in FY 2023, an increase from the previous year.

- Panel lights and horns are the most commonly used signaling devices by vehicles. Automotive manufacturers also focus on providing additional features, such as video surveillance and strobes. Emergency lighting is also included in all the newly manufactured vehicles. This is also anticipated to drive the market's growth during the forecast period.

- Large-scale industries prefer and opt for automation of push-button and signaling devices, primarily to avoid the human error factor. The emergence of industrial control systems, such as SCADA, PLC, and IT control, aided the market growth. The primary factors that drive demand in the country are the flexibility in management and functionality that devices offer in the industrial space and the enhancement of a safe work environment on industry floors.

- In the long run, the demand for renewable energy across India, accelerated by the pandemic, is also expected to boost the market's growth. However, the uncertainty in the supply chain and demand brought by the short-term repercussions is expected to stall the market's growth as the pandemic impacted all end-user industries.

APAC Push Buttons And Signaling Devices Industry Overview

The Asia-Pacific push button and signaling device market is semi-consolidated. An increasing number of players are increasing their share percentage through strategic mergers and acquisitions and partnerships with several small players. Some of the key players in the market include ABB Ltd, Schneider Electric SE, Siemens AG, and Eaton Corporation.

- December 2023: Pepperl+Fuchs, a sensor device manufacturer, launched a new push button box that can be easily connected to IO-Link networks via an M12 connector without complex wiring.

- October 2023: SCHURTER launched the next generation of MSM push button switches. The foundation of MSM's decades of success is its elegant design and a vast selection of highly accurate push buttons and switches. Subminiature microswitches, which allow installation in units with a small mounting depth, were made available for stainless steel enclosures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Use of Fire Alarm Management Systems and Safety Systems

- 4.2.2 Favorable Government Regulations for Industrial Safety

- 4.3 Market Restraints

- 4.3.1 High Initial Investment in Creating Supporting Infrastructure and Automation

- 4.4 Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Round or Square Body Type

- 5.1.2 Non-lighted Push Button

- 5.1.3 Other Products

- 5.2 By Type

- 5.2.1 Audible

- 5.2.2 Visible

- 5.2.3 Other Types

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Energy and Power

- 5.3.3 Manufacturing

- 5.3.4 Food and Beverage

- 5.3.5 Transportation

- 5.3.6 Other End-user Industries

- 5.4 By Country

- 5.4.1 India

- 5.4.2 China

- 5.4.3 Japan

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Siemens AG

- 6.1.2 Eaton Corporation

- 6.1.3 ABB Ltd

- 6.1.4 Schneider Electric

- 6.1.5 Littelfuse

- 6.1.6 Carling Technologies

- 6.1.7 Omron Industrial Automation (Omron Corporation)

- 6.1.8 NKK Switches

- 6.1.9 Panasonic

- 6.1.10 ITW Switches

- 6.1.11 Wurth Electronics

- 6.1.12 Nihon Kaiheiki

- 6.1.13 Marquardt Mechatronik

- 6.1.14 Kaihua Electronics

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET