PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851096

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851096

China Commercial Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

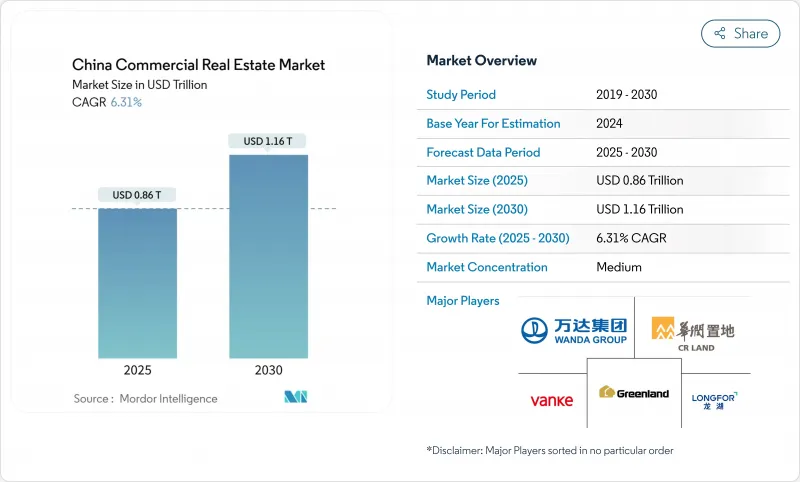

The China commercial real estate market stood at USD 0.86 trillion in 2025 and is forecast to reach USD 1.16 trillion by 2030, expanding at a 6.31% CAGR.

Momentum stems from a USD 563.4 billion public-funding push for housing and urban projects, the rollout of infrastructure real-estate investment trusts (C-REITs), and a policy tilt that favors asset upgrades over green-field additions. Occupier needs keep shifting toward modern logistics space, Grade-A offices, and data-driven campuses, while institutional investors intensify their hunt for stabilized yields in a volatile financing climate. At the same time, legacy stock oversupply, high private-developer borrowing costs, and the slow absorption of secondary malls curb headline growth. Competitive advantage is drifting away from scale-oriented developers toward asset-light operators able to combine patient capital with technology-enabled property management.

China Commercial Real Estate Market Trends and Insights

Resilient Logistics Demand from E-commerce & "Dual-Circulation" Policy

China's dual-circulation blueprint emphasizes domestic consumption alongside external trade, which lifts the logistics backbone of the China commercial real estate market. Average warehouse occupancy already exceeds 90% in Greater Beijing and Shanghai, while prime rents in Beijing have risen 90% since 2008. E-commerce giants accelerate investments in automated distribution and last-mile nodes that meet tight delivery promises to consumers. Government guidelines for supply-chain modernization dovetail with private capital inflows to class-A logistics parks, driving sustained absorption even as export growth moderates. The resulting logistics pipeline is capital-intensive, favoring long-lease assets that appeal to pension funds and insurance firms. Stable rental escalations reinforce the segment's perception as quasi-infrastructure within the China commercial real estate market.

State-Led Urban-Renewal Stimulus for Grade-A Office Upgrades in Tier-1 Cities

Central and municipal authorities earmarked USD 197.2 billion for 5,392 urban-renewal projects by August 2024, targeting stock optimization rather than new supply. Within Shanghai, Beijing, Shenzhen, and Guangzhou, redevelopment priorities include smarter HVAC systems, flexible floorplates, and carbon-reduction retrofits to satisfy hybrid-work tenants. Public policy banks have been instructed to prioritize renewal loans, lowering execution risk for qualified schemes. The focus on quality lifts demand for Grade-A space, even as secondary offices struggle with high vacancy. Developers able to reposition older assets can capture rental premiums while easing the structural oversupply that weighs on the broader China commercial real estate market.

Structural Oversupply of Legacy Office Stock Post-Hybrid Adoption

Hybrid work has trimmed aggregate office-space needs, exposing functional deficiencies in pre-2010 towers lacking flexible layouts or modern ventilation. Research shows that each unit rise in pandemic-related sentiment pushed rents down 8% in high-vacancy cities. Grade-A conversions benefit from renewal subsidies, yet the scale of non-core stock dwarfs renovation capacity. As tenants gravitate to quality, landlords of secondary offices resort to rent cuts or co-working conversions, suppressing returns within the China commercial real estate market. Vacancy drag is most acute in decentralized submarkets where commuting friction further cools demand.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated C-REIT Program Unlocking Institutional Capital for Infrastructure-type CRE

- "New Quality Productive Forces" Agenda Spurring Data-Center & Life-Science Campuses

- High Financing Costs for Private Developers amid Sector De-leveraging

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Office real estate captured 34.0% of China commercial real estate market share in 2024, reflecting entrenched demand from finance, technology, and professional-services tenants clustered in tier-1 districts. Grade-A towers cater to multinationals that value ESG-ready buildings and smart-workspace amenities, keeping prime vacancy in single digits despite hybrid adoption. Yet secondary offices see double-digit vacancy as occupiers upgrade at minimal rent premiums. Counterbalancing the office crown, logistics stock is expanding at a 7.72% CAGR to 2030, outstripping every other asset class on the back of e-commerce penetration and domestic circulation goals. Occupier pre-leasing in large-scale industrial parks anchors development risk and ensures quick rent commencements, enhancing the income depth of the China commercial real estate market size attached to warehousing assets.

High-spec warehouses now integrate automation, high-pallet racking, and cold-chain bays, commanding premium rents that dilute location cost sensitivity. Institutional managers chase city-adjacent logistics clusters near Shanghai's Lingang or Shenzhen's Qianhai zone on long leases that hedge inflation. By contrast, retail-mall performance bifurcates: luxury-tier venues post robust sales, whereas mid-market centers in lower-tier cities wrestle with double-digit vacancy. Data-center shells and bio-manufacturing parks, although small in volume, record outsized yields and long lease terms, carving a high-margin niche in the wider China commercial real estate market. Developers able to straddle office refurbishments and last-mile facilities diversify cash flow and mitigate cyclical shocks.

The China Commercial Real Estate Market is Segmented by Property Type (Offices, Retail, Logistics, Others (industrial Real Estate, Hospitality Real Estate)), by Business Model (Sales and Rental), by End-User (Individuals / Households, Corporates & SMEs, Others) and by Cities (Shanghai, Beijing, Shenzhen and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD)

List of Companies Covered in this Report:

- Wanda Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Commercial Real Estate Buying Trends - Socio-economic & Demographic Insights

- 4.3 Rental Yield Analysis

- 4.4 Capital-Market Penetration & REIT Presence

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Insights into Real Estate Tech and Startups Active in the Real Estate Segment

- 4.8 Insights into Existing and Upcoming Projects

- 4.9 Market Drivers

- 4.9.1 Resilient Logistics Demand from E-commerce & "Dual-Circulation" Policy

- 4.9.2 State-led Urban-Renewal Stimulus for Grade-A Office Upgrades in Tier-1 Cities

- 4.9.3 Accelerated C-REIT Program Unlocking Institutional Capital for Infrastructure-type CRE

- 4.9.4 "New Quality Productive Forces" Agenda Spurring Data-Centre & Life-science Campuses

- 4.9.5 Transport-Hub Build-out (14th FYP) Catalysing Last-mile Retail Warehousing Nodes

- 4.9.6 Net-Zero & 3-Star Green Building Mandates Driving Retrofit Wave

- 4.10 Market Restraints

- 4.10.1 Structural Oversupply of Legacy Office Stock Post-Hybrid Adoption

- 4.10.2 High Financing Costs for Private Developers amid Sector De-leveraging

- 4.10.3 Elevated Vacancy in Lower-tier Malls from Consumption Polarisation

- 4.10.4 Land-sale Revenue Caps Constraining New-build Pipelines

- 4.11 Value / Supply-Chain Analysis

- 4.11.1 Overview

- 4.11.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.11.3 Real Estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.11.4 Property Management Companies - Key Quantitative and Qualitative Insights

- 4.11.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.11.6 State of the Building Materials Industry and Partnerships with Key Developers

- 4.11.7 Insights on Key Strategic Real Estate Investors/Buyers in the Market

- 4.12 Porters Five Forces

- 4.12.1 Bargaining Power of Suppliers

- 4.12.2 Bargaining Power of Buyers

- 4.12.3 Threat of New Entrants

- 4.12.4 Threat of Substitutes

- 4.12.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Offices

- 5.1.2 Retail

- 5.1.3 Logistics

- 5.1.4 Others (industrial, hospitality, data-centre, life-science, mixed-use)

- 5.2 By Business Model

- 5.2.1 Sales

- 5.2.2 Rental

- 5.3 By End-user

- 5.3.1 Individuals / Households

- 5.3.2 Corporates & SMEs

- 5.3.3 Others (institutions, governments, NGOs)

- 5.4 By Cities

- 5.4.1 Shanghai

- 5.4.2 Beijing

- 5.4.3 Shenzhen

- 5.4.4 Guangzhou

- 5.4.5 Chengdu

- 5.4.6 Rest of China

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)}

- 6.3.1 Wanda Group

- 6.3.1.1 China Resources Land Ltd

- 6.3.1.2 Greenland Group

- 6.3.1.3 Longfor Group

- 6.3.1.4 China Vanke Co.

- 6.3.1.5 Seazen Holdings

- 6.3.1.6 China Overseas Land & Investment

- 6.3.1.7 CapitaLand China

- 6.3.1.8 Sino-Ocean Group

- 6.3.1.9 Sun Hung Kai Properties

- 6.3.1.10 Henderson Land Development

- 6.3.1.11 Wharf REIC

- 6.3.1.12 Prologis China

- 6.3.1.13 GLP China

- 6.3.1.14 Goodman China

- 6.3.1.15 JD Property

- 6.3.1.16 Cainiao Smart Logistics

- 6.3.1.17 GDS Holdings

- 6.3.1.18 Keppel Land China

- 6.3.1.19 Brookfield China Logistics

- 6.3.1 Wanda Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment