PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910724

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910724

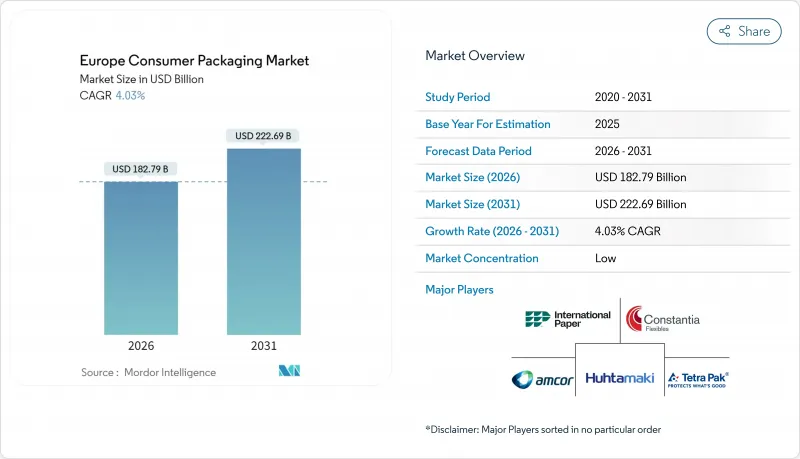

Europe Consumer Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe consumer packaging market was valued at USD 175.71 billion in 2025 and estimated to grow from USD 182.79 billion in 2026 to reach USD 222.69 billion by 2031, at a CAGR of 4.03% during the forecast period (2026-2031).

Growth is steered by the EU Packaging and Packaging Waste Regulation, accelerating brand commitments to closed-loop systems, and sustained momentum in e-commerce fulfillment. Material substitution toward fiber, mono-PET, and lightweight metal formats is reshaping capital allocation, while energy-price shocks force converters to reassess operating footprints. The competitive field is further altered by digital printing, which shortens design-to-launch cycles and supports SKU fragmentation, and by deposit-return infrastructure that channels recycled feedstock into high-value beverage applications.

Europe Consumer Packaging Market Trends and Insights

Convenience-driven demand for flexible plastic packs

Flexible formats continue to migrate volume from glass and metal as on-the-go consumption rebounds across urban corridors. Portion-controlled pouches with easy-open reclosable features meet the mobile lifestyle of 25- to 45-year-olds who prize portability and freshness. Price movements remain modest. 7-micron aluminum foil rose 4% in late 2024, but converters offset cost upticks through barrier-coated lightweight films that extend shelf life without adding bulk. Functionality now outweighs format loyalty, drawing liquid applications such as sauces and baby food toward spouted pouches and away from heavier rigid alternatives. The result is sustained share capture for flexibles in both food and personal-care aisles.

E-commerce boom creating last-mile packaging needs

Direct-to-consumer fulfillment adds multiple touchpoints where packs must survive conveyor drops, temperature shifts, and doorstep scrutiny. The PPWR mandates 40% reusable transport and sales packaging by 2030, pressuring retailers to harmonize automation with sustainability. Demand is surging for molded-fiber inserts and precision-engineered corrugated boxes that balance cushioning with dimensional efficiency. Poland and Spain show the steepest e-commerce penetration curves, widening the regional growth gap within the European consumer packaging market. Brand owners also leverage digital print to transform each parcel into a marketing canvas, elevating unboxing to a revenue lever rather than a cost center.

Volatile polymer and paper pulp prices

Feedstock swings erode converter margins and disrupt pricing contracts fixed on quarterly indices. Polyethylene values softened in early 2024 amid weak downstream demand, yet PET tightened when Asian supply lines faltered, demonstrating the difficulty of forecasting input trajectories. On the fiber side, coated paper spiked nearly 10% in Q2 2024 before easing, driven by mill maintenance outages and logistics bottlenecks. Vertical integration into recycling or pulp assets is gaining favor, but it locks capital that could fund innovation or geographic expansion.

Other drivers and restraints analyzed in the detailed report include:

- Shift toward lightweighting and easy-open formats

- EU Single-Use Plastics Directive spurring mono-material R&D

- Expanding EU bans on difficult-to-recycle formats

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper and board defended 35.22% of 2025 revenue on the strength of e-commerce shippers and foodservice disposables. The Europe consumer packaging market size for paper-based solutions is projected to expand modestly as regulatory goodwill and consumer perception remain supportive. However, PET's 5.74% CAGR underscores a decisive momentum swing driven by deposit-return economics and brand pledges for food-grade recycled content. Europe consumer packaging market share gains accrue to mono-PET beverage bottles that averaged 24% recycled resin in 2024, validating closed-loop viability. In contrast, PE and PP navigate headwinds from single-use caps, cutlery, and thin grocery bags disappearing under new bans.

The PET narrative is reinforced by mechanical recycling yields that reach 75% in optimized plants, narrowing the carbon delta versus fiber-based cartons. Meanwhile, glass lobbies are campaigning for EUR 20 billion in furnace electrification, but elevated electricity tariffs cloud competitiveness. Aluminum retains a strong circularity story, yet the liquidity of post-consumer can sheet fluctuates with regional redemption rates. Specialty polymers hold pockets of growth in pharma blister packs and personal-care pump components, where performance trumps uniform recyclability mandates.

The Europe Consumer Packaging Market Report is Segmented by Material (Plastic (PE, PP, PET, and More), Paper and Board (Cartonboard, Molded Fiber, and More), Glass, and Metal (Cans, Caps and Closures, Tubes, and More)), Packaging Format (Rigid, Flexible, and Semi-Rigid), End-User Industry (Food, Beverage, Pharmaceutical and Healthcare, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor PLC

- Huhtamaki Oyj

- Mondi PLC

- International Paper Company

- Tetra Pak International SA

- Ardagh Group S.A.

- Crown Holdings, Inc.

- Constantia Flexibles Holding GmbH

- Sealed Air Corporation

- Sonoco Products Company

- Stora Enso Oyj

- Smurfit Kappa Group Limited

- Ball Corporation

- Berry Global, Inc.

- Greiner Packaging International GmbH

- Albea Group S.A.S.

- Gerresheimer AG

- Vetropack Holding AG

- Massilly Holding

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convenience-driven demand for flexible plastic packs

- 4.2.2 E-commerce boom creating last-mile packaging needs

- 4.2.3 Shift toward lightweighting and easy-open formats

- 4.2.4 EU Single-Use Plastics Directive spurring mono-material R&D

- 4.2.5 Deposit-return schemes scaling rPET demand

- 4.2.6 Digital printing enabling SKU proliferation and short-runs

- 4.3 Market Restraints

- 4.3.1 Volatile polymer and paper pulp prices

- 4.3.2 Expanding EU bans on difficult-to-recycle formats

- 4.3.3 Recycling gaps for multilayer flexibles

- 4.3.4 Energy-price shocks inflating glass and metal costs

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.1.1 PE (Polyethylene)

- 5.1.1.2 PP (Polypropylene)

- 5.1.1.3 PET (Polyethylene Terephthalate)

- 5.1.1.4 PVC (Polyvinyl Chloride)

- 5.1.1.5 Other Plastics

- 5.1.2 Paper and Board

- 5.1.2.1 Cartonboard

- 5.1.2.2 Containerboard and Linerboard

- 5.1.2.3 Molded Fiber

- 5.1.3 Glass

- 5.1.4 Metal

- 5.1.4.1 Cans

- 5.1.4.2 Caps and Closures

- 5.1.4.3 Tubes

- 5.1.4.4 Other Metals

- 5.1.1 Plastic

- 5.2 By Packaging Format

- 5.2.1 Rigid

- 5.2.2 Flexible

- 5.2.3 Semi-rigid

- 5.3 By End-user Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Pharmaceutical and Healthcare

- 5.3.4 Cosmetics, Personal and Home Care

- 5.3.5 Other End-user Industry

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Poland

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 Huhtamaki Oyj

- 6.4.3 Mondi PLC

- 6.4.4 International Paper Company

- 6.4.5 Tetra Pak International SA

- 6.4.6 Ardagh Group S.A.

- 6.4.7 Crown Holdings, Inc.

- 6.4.8 Constantia Flexibles Holding GmbH

- 6.4.9 Sealed Air Corporation

- 6.4.10 Sonoco Products Company

- 6.4.11 Stora Enso Oyj

- 6.4.12 Smurfit Kappa Group Limited

- 6.4.13 Ball Corporation

- 6.4.14 Berry Global, Inc.

- 6.4.15 Greiner Packaging International GmbH

- 6.4.16 Albea Group S.A.S.

- 6.4.17 Gerresheimer AG

- 6.4.18 Vetropack Holding AG

- 6.4.19 Massilly Holding

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment